Co Signer On A Mortgage Loan How Does A Cosigner Help My Mortgage

Co Signer On A Mortgage Loan How Does A Cosigner Help My Mortgage Identification. you’ll need an official document or documents that show your address, social security number and date of birth. 2. financial records. to qualify as a cosigner, you’ll need to provide financial documentation with the same information needed when you apply for a loan. this may include: income verification. A mortgage co signer is anyone willing to use their financial profile to help a borrower qualify for a mortgage and or access a lower interest rate. by co signing on a mortgage, you’re agreeing to repay the loan if the primary borrower is unable, which is why it’s important for co signers to have good credit, a steady income and low debts.

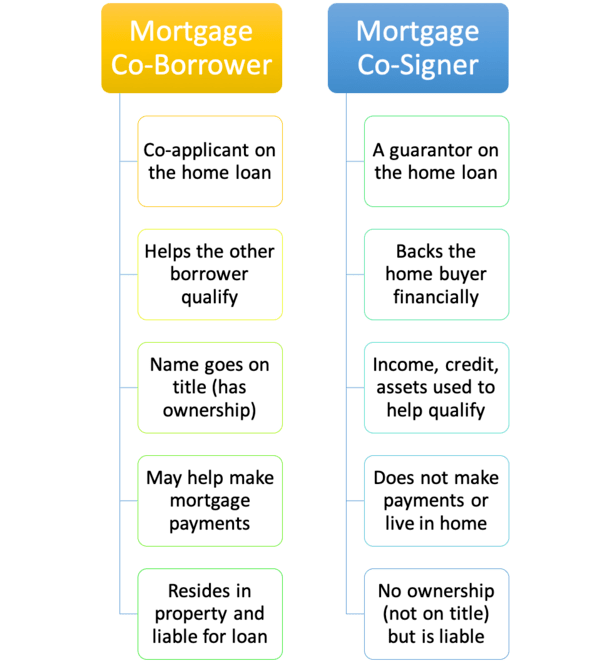

Mortgage Co Borrower Vs Co Signer The Truth About Mortgage Occupant co borrowers must have skin in the game when using a co signer, and lender rules vary based on loan type and down payment. below are common lender requirements for co signers. this list isn’t all inclusive, and conditions vary by borrower, so find a local lender to advise on your situation. for conforming loans (up to $417,000, and. As a co signer, you stand in the primary applicant’s place during the approval process. you’ll need a minimum 580 median score for an fha or va loan. for a conventional loan, rocket mortgage ® requires a qualifying score of 620. for a jumbo loan, the minimum credit score required is 680, depending on the loan amount and the purpose of the. When adding a co signer to a conventional mortgage, you can buy a 1 to 4 unit home with a 5% down payment. you and your co signer can buy a 1 unit property with an fha loan as little as 3.5% down. however, you'll need at least a 25% down payment to buy a multi unit, 2 to 4 unit property. A cosigner won’t help if: you can’t get approved for a high enough loan amount. a cosigner’s income is added to yours, so it can give you a big leg up if you have a high debt to income ratio (dti). you have no credit. if you don’t have a credit score, the lender will use your cosigner’s credit score to qualify you.

How A Mortgage Co Signer Can Help You Buy A Home When adding a co signer to a conventional mortgage, you can buy a 1 to 4 unit home with a 5% down payment. you and your co signer can buy a 1 unit property with an fha loan as little as 3.5% down. however, you'll need at least a 25% down payment to buy a multi unit, 2 to 4 unit property. A cosigner won’t help if: you can’t get approved for a high enough loan amount. a cosigner’s income is added to yours, so it can give you a big leg up if you have a high debt to income ratio (dti). you have no credit. if you don’t have a credit score, the lender will use your cosigner’s credit score to qualify you. When you co sign a mortgage, you're using your finances to help the primary borrower qualify. unlike co borrowers, co signers don't have any claim to the home the mortgage is attached to. co. Easier qualifications: a co signer carries as much weight on a mortgage loan application as a co borrower. so, having a co signer can likewise make it easier for you to qualify for a mortgage even if your finances aren’t perfect. the cons. here are a few of the downsides of using a co signer to help you qualify for a mortgage:.

How Does Cosigning A Loan Work Personal Finance 101 Youtube When you co sign a mortgage, you're using your finances to help the primary borrower qualify. unlike co borrowers, co signers don't have any claim to the home the mortgage is attached to. co. Easier qualifications: a co signer carries as much weight on a mortgage loan application as a co borrower. so, having a co signer can likewise make it easier for you to qualify for a mortgage even if your finances aren’t perfect. the cons. here are a few of the downsides of using a co signer to help you qualify for a mortgage:.

What Is A Co Signer On Mortgage How Does It Work Cc

Benefits Of A Co Signer On Your Mortgage Coldwell Banker Seaside Realty

Comments are closed.