Co Signer Mortgage Rates Today

Co Signer Mortgage Rates Today As a co signer, you stand in the primary applicant’s place during the approval process. you’ll need a minimum 580 median score for an fha or va loan. for a conventional loan, rocket mortgage ® requires a qualifying score of 620. for a jumbo loan, the minimum credit score required is 680, depending on the loan amount and the purpose of the. A cosigner won’t help if: you can’t get approved for a high enough loan amount. a cosigner’s income is added to yours, so it can give you a big leg up if you have a high debt to income ratio (dti). you have no credit. if you don’t have a credit score, the lender will use your cosigner’s credit score to qualify you.

Today S California Mortgage Rates Loan Officer Kevin O Connor A mortgage co signer is anyone willing to use their financial profile to help a borrower qualify for a mortgage and or access a lower interest rate. by co signing on a mortgage, you’re agreeing to repay the loan if the primary borrower is unable, which is why it’s important for co signers to have good credit, a steady income and low debts. Today’s interest rate for a 15 year fixed rate mortgage is 6.13%, which is 0.13 percentage points higher than yesterday. the monthly payment for a $250,000 mortgage with a 15 year term and a. Mike cox (nmls# 269700) is a loan officer and branch manager with gsf mortgage, where he has been a 10 time loan officer of the year. The current home equity loan rates are 7.7% for a 10 year term and 7.9% for a 15 year term. home equity is the difference between your home's market value and mortgage balance. according to experian, home equity balances surged by 17.6%, showing that more homeowners are using this resource. the average aprs for 15 year and 10 year home equity.

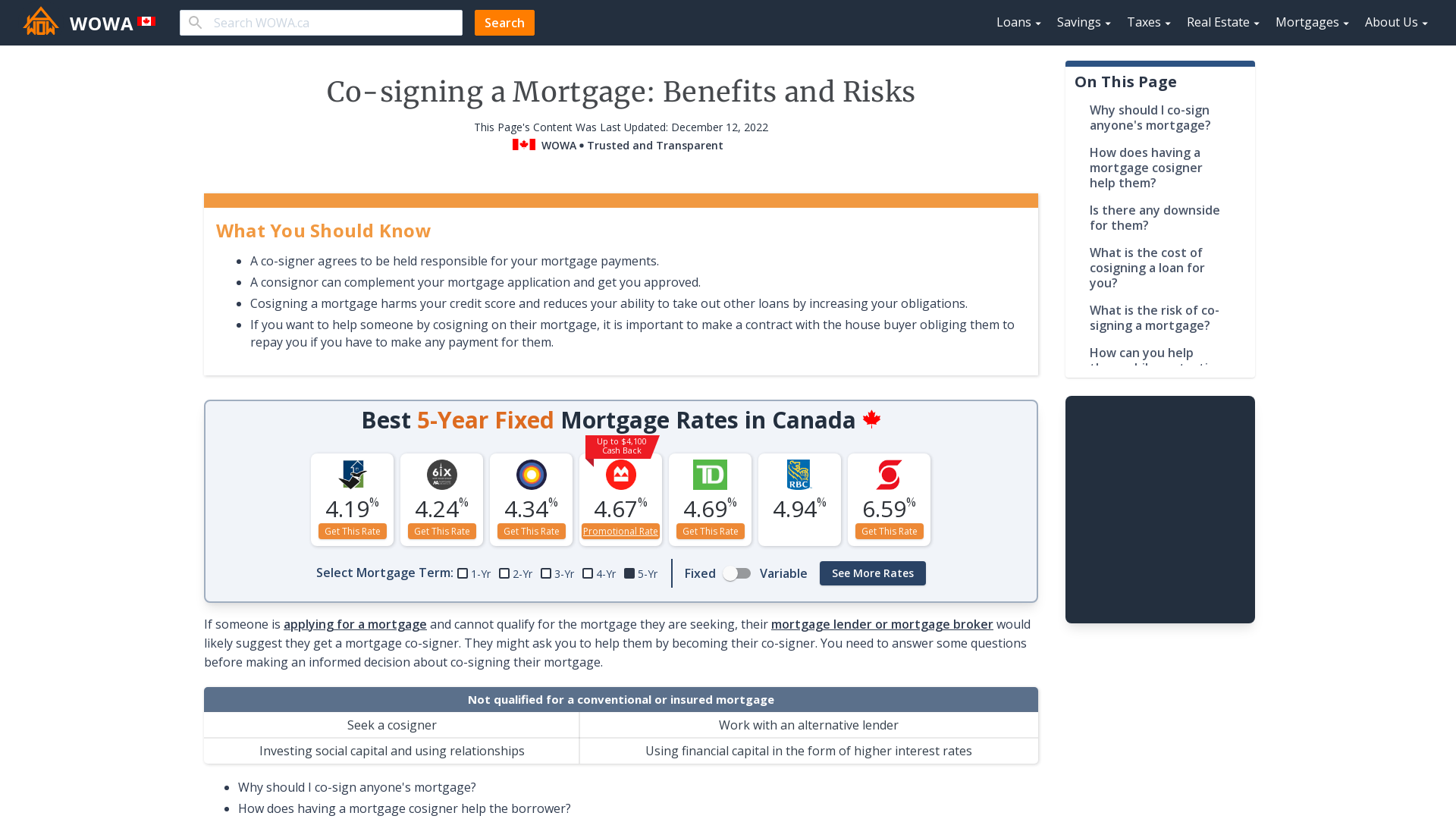

Co Signing A Mortgage Benefits And Risks Wowa Ca Mike cox (nmls# 269700) is a loan officer and branch manager with gsf mortgage, where he has been a 10 time loan officer of the year. The current home equity loan rates are 7.7% for a 10 year term and 7.9% for a 15 year term. home equity is the difference between your home's market value and mortgage balance. according to experian, home equity balances surged by 17.6%, showing that more homeowners are using this resource. the average aprs for 15 year and 10 year home equity. Today's average rate for the benchmark 30 year fixed mortgage is 6.89, the average rate you'll pay for a 15 year fixed mortgage is 6.13 percent, and the average 5 1 arm rate is 6.20 percent. Here are the average annual percentage rates today on 30 year, 15 year and 5 1 arm mortgages: today's mortgage rates today, the average apr for the benchmark 30 year fixed mortgage remained at 3.

Mortgage Rates Today August 24 2023 Adding A Co Signer Youtube Today's average rate for the benchmark 30 year fixed mortgage is 6.89, the average rate you'll pay for a 15 year fixed mortgage is 6.13 percent, and the average 5 1 arm rate is 6.20 percent. Here are the average annual percentage rates today on 30 year, 15 year and 5 1 arm mortgages: today's mortgage rates today, the average apr for the benchmark 30 year fixed mortgage remained at 3.

A Guide To Co Signing Mortgage And How It Works Thingscouplesdo

Co Signing A Mortgage Find Out The Benefits And The Risks Canadian

Comments are closed.