Clinton Versus Trump How Their Tax Plans Will Affect You

Comparing Trump Clinton Tax Plans Facts And Impacts People S Pundit You may already have a general sense of how the two tax plans differ: trump’s tax plan calls for a fairly radical simplification of the tax code that would create 3 brackets: 12%, 25% and 33%. You can see the analysis of clinton’s full tax proposal here and trump’s full tax proposal here. to give you a snapshot of how your taxes might change, we’ve simplified the numbers for both plans and put them side by side. we used average salaries in each “bracket” to show the effect on american taxpayers at range of income levels.

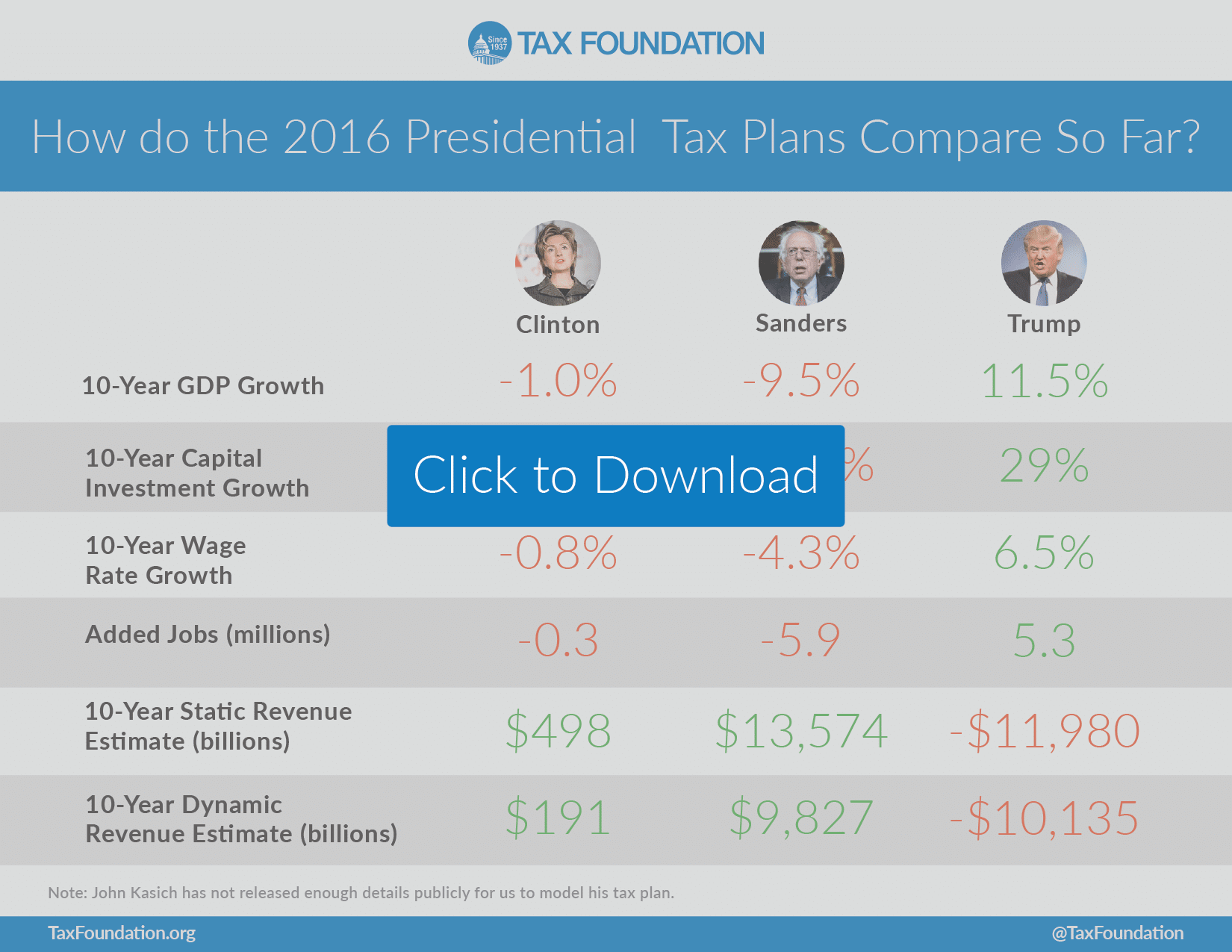

How Do Clinton And Trump S Tax Plans Compare Tax Foundation Both hillary clinton and donald trump have both introduced hillary clinton’s tax plan would increase federal revenue by about $1.4 trillion over the next decade. her plan would make the current taxa tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of […]. The tax foundation estimates that clinton's plan would lower after tax incomes of all taxpayers by at least 0.9%, and reduce gdp by 1% over the long term. the economic impact of tax plans proposed by hillary clinton and donald trump, as estimated by the tax foundation. critics have called clinton's profit sharing plan complex and gimmicky. The republican platform states that tax rates that penalize thrift or discourage investment must be lowered, and rules that discourage economic growth must be changed. the platform calls for. Trump supports his vice presidential pick j.d. vance's idea to give parents a higher child tax credit of $5,000 per child, a 250% increase from the current $2,000 per child tax credit. hospitality.

Two Very Different Paths On Taxes Clinton Vs Trump Tax Policy Center The republican platform states that tax rates that penalize thrift or discourage investment must be lowered, and rules that discourage economic growth must be changed. the platform calls for. Trump supports his vice presidential pick j.d. vance's idea to give parents a higher child tax credit of $5,000 per child, a 250% increase from the current $2,000 per child tax credit. hospitality. Big and small business owners. harris wants to bump up the corporate tax rate from 21% to 28%, while trump has proposed lowering it from 21% to 15% for firms that make their products in the us. Trump’s claim about clinton’s tax plan has become a regular feature in stump speeches and interviews. at all to their taxes under the proposals clinton has laid out so far, williams said.

2016 Race How Presidential Candidates Tax Plans Will Affect Your Big and small business owners. harris wants to bump up the corporate tax rate from 21% to 28%, while trump has proposed lowering it from 21% to 15% for firms that make their products in the us. Trump’s claim about clinton’s tax plan has become a regular feature in stump speeches and interviews. at all to their taxes under the proposals clinton has laid out so far, williams said.

Updated It S Clinton Versus Trump A Comparison Of The Final Two Tax

Comments are closed.