Chexsystems Codes What Do They Mean For You

What Is Chexsystems And What Do You Need To Know About It Lexington Law Chexsystems codes provide banks with insights into a customer’s banking history, affecting their ability to open new accounts. understanding these codes and managing your chexsystems record is crucial for maintaining good financial health. being aware of your chexsystems report and actively managing it can help you avoid unexpected obstacles. Chexsystems assigns each person a consumer score based on how risky they are to open a bank account. the chexsystems score ranges from 100 to 899, with a higher score indicating lower risk. you.

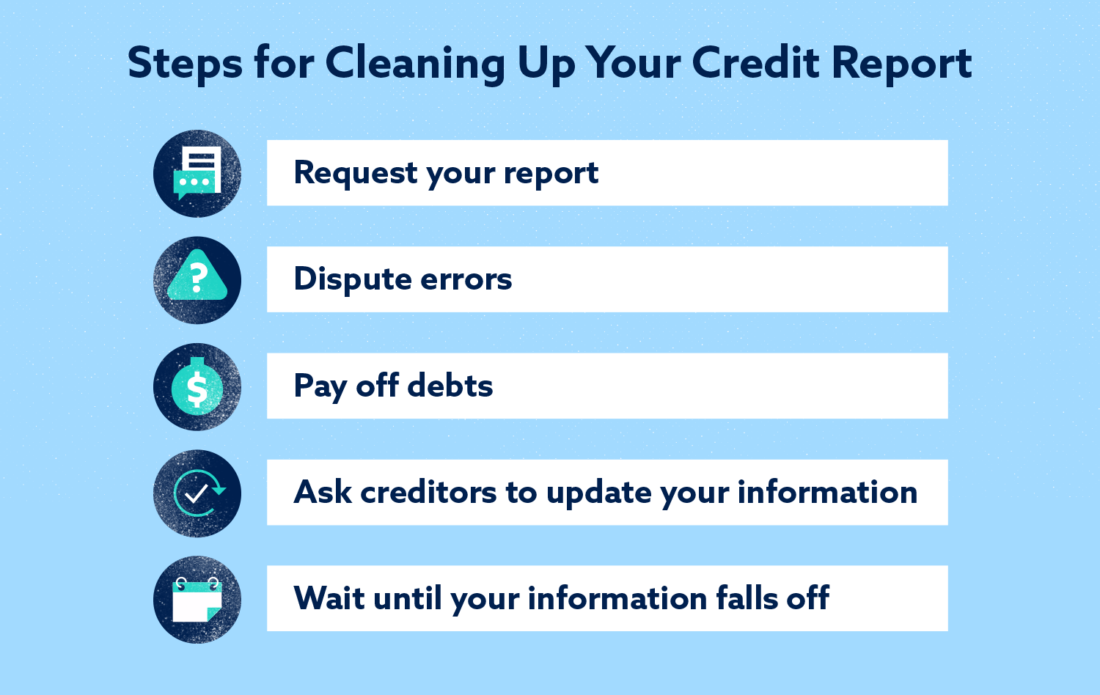

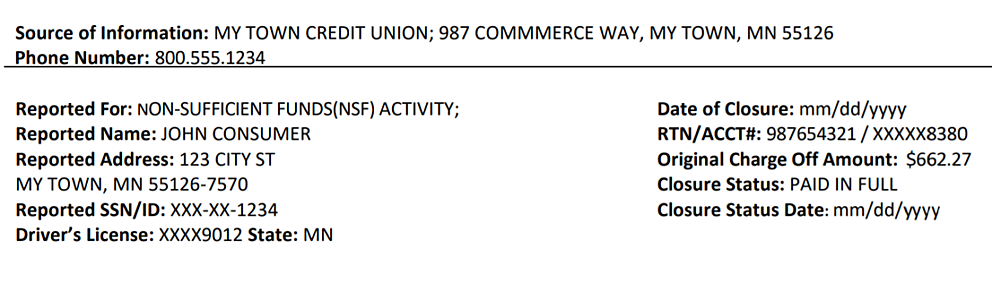

Chexsystems Codes What Do They Mean For You Download the form, fill it out and fax your request to (602) 659 2197. you will receive the report within five business days. a chexsystems score is also called a chexsystems consumer score or qualify score. also, you can find out your score if you applied for a checking account and got rejected. here is an example:. If you are visually impaired and would like to receive your chexsystems consumer disclosure report in braille, large print, or audio cd, call 855.472.2911. if you are hearing impaired, you can contact chexsystems through a tdd relay operator by calling 7 1 1 and referring the operator to 800.428.9623. There are multiple ways to request your report: call chexsystems directly at (800) 428 9623. submit a request online via the. chexsystems website. fax a chexsystems request form to (602) 659 2197. mail a request form to: chexsystems inc. attn: consumer relations 7805 hudson road, suite 100 woodbury, mn 55125. Chexsystems is a reporting agency that banks use to track people who have had issues with their bank account. chexsystems retains consumer records for up to five years. second chance checking.

What Is Chexsystems And What Do You Need To Know About It Lexington Law There are multiple ways to request your report: call chexsystems directly at (800) 428 9623. submit a request online via the. chexsystems website. fax a chexsystems request form to (602) 659 2197. mail a request form to: chexsystems inc. attn: consumer relations 7805 hudson road, suite 100 woodbury, mn 55125. Chexsystems is a reporting agency that banks use to track people who have had issues with their bank account. chexsystems retains consumer records for up to five years. second chance checking. Chexsystems is a national consumer reporting agency that keeps track of people with derogatory marks on their checking and savings accounts, including late fees, bounced checks, and fraudulent activity. when you apply for a new account, the bank or credit union will likely review your chexsystems report. Chexsystems is a consumer reporting agency that gathers information about problems you’ve had with checking accounts. chexsystems reports include, but aren’t limited to, account misuse or fraudulent activity that has occurred within the previous five years. save for free with credit karma money™ save start saving.

What Is Chexsystems Are You Blacklisted Unchex Chexsystems is a national consumer reporting agency that keeps track of people with derogatory marks on their checking and savings accounts, including late fees, bounced checks, and fraudulent activity. when you apply for a new account, the bank or credit union will likely review your chexsystems report. Chexsystems is a consumer reporting agency that gathers information about problems you’ve had with checking accounts. chexsystems reports include, but aren’t limited to, account misuse or fraudulent activity that has occurred within the previous five years. save for free with credit karma money™ save start saving.

Comments are closed.