Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Cheat sheet of 100 legal tax deductions for real estate agents. real estate agents, who are by and large self employed, can relate to the importance of tax deductions. by reducing your taxable income, deductions naturally become your best friend during tax time. the problem, though, is determining what can be written off, and what can’t. Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction.

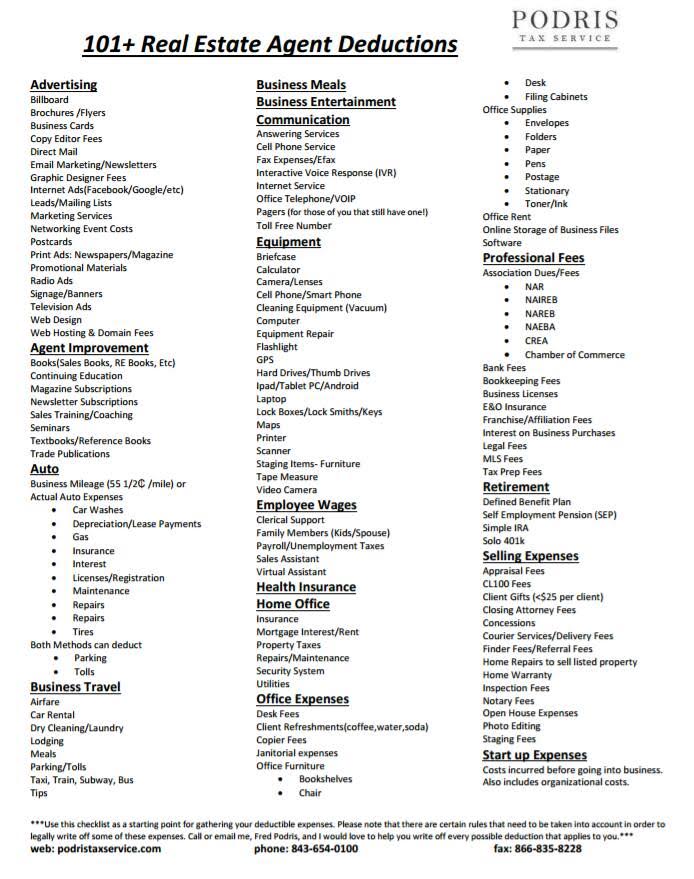

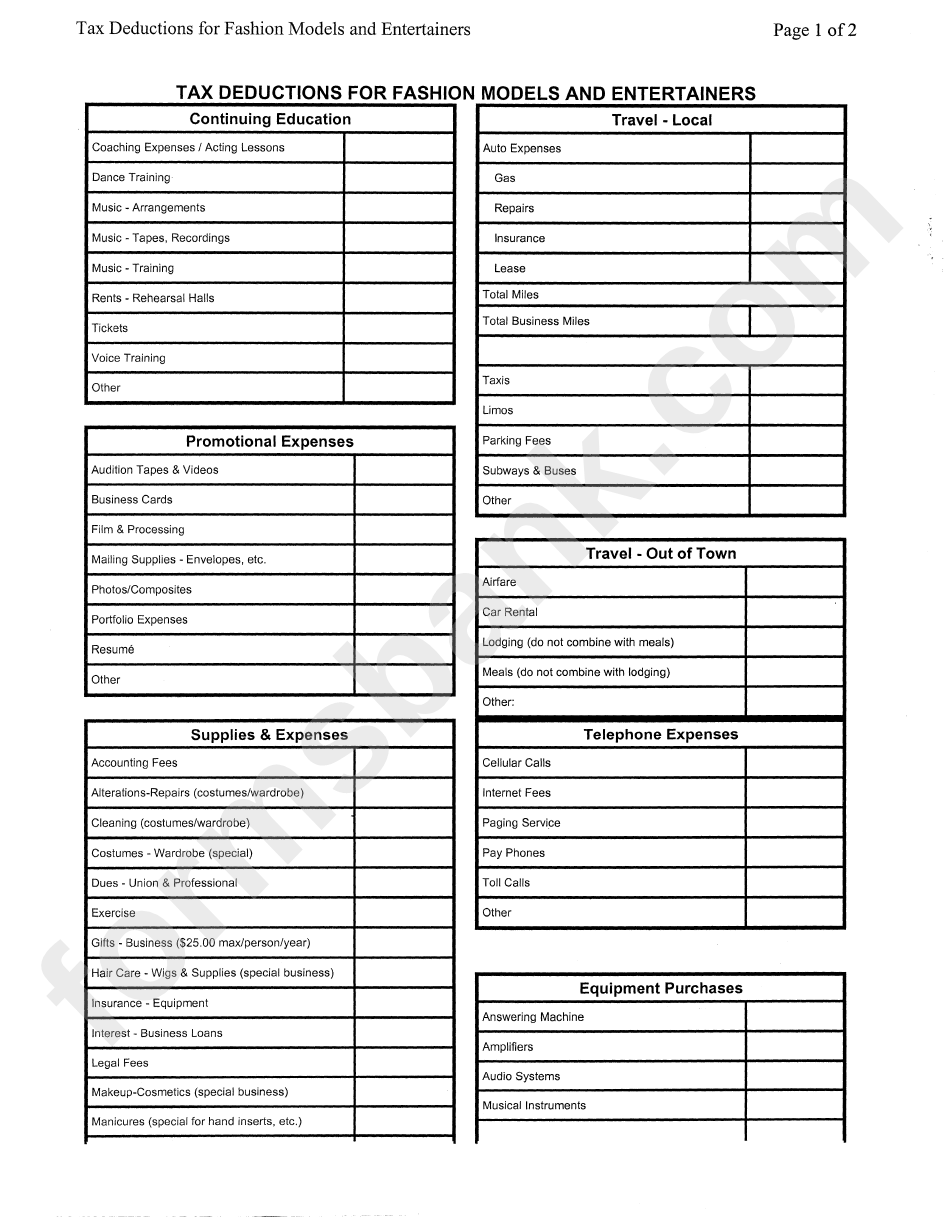

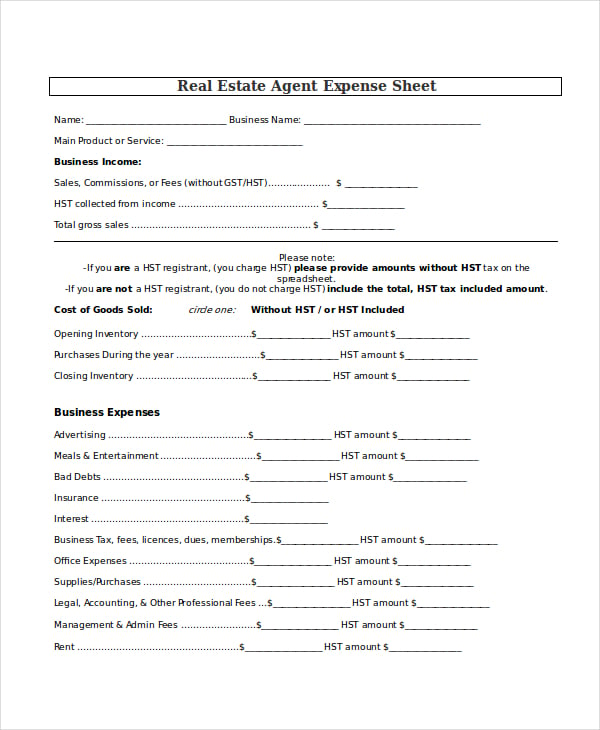

Real Estate Agent Tax Deductions Worksheet Printable Word Searches Realtor real estate agent tax deduction cheat sheet. nizational costs for your entity (pllc, s corp, etc.)the information inc. uded on this cheat sheet is meant as an outline only. please always confirm all deductions with your cpa o. tax professional as the laws may change at any time. this document is not inten. Here’s a tax deductions cheat sheet for real estate agents: real estate license expenses. licensure costs (including your state license fees, exam fees, fingerprint fees, etc.) association dues (such as mls, nar, chamber of commerce, etc.) brokerage and franchise fees. The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business. 101 real estate agent tax deductions. there are a lot of tax deductions real estate agents are not using as tax write offs. it's important to remember that anything you spend money on for your business as a real estate agent can potentially be used as a tax write off. tax laws change often, so whether you're doing your own taxes or using a.

Tax Deduction Worksheet For Realtors The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business. 101 real estate agent tax deductions. there are a lot of tax deductions real estate agents are not using as tax write offs. it's important to remember that anything you spend money on for your business as a real estate agent can potentially be used as a tax write off. tax laws change often, so whether you're doing your own taxes or using a. A desk fee is a payment agreement between a real estate agent and their broker in which the broker charges a monthly fee for providing office space and a desk to the agent. if you exercise your license for a broker and pay a desk fee, then your desk fee is 100% deductible. you may deduct your desk fee or home office expenses, but not both. You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023.

Printable Real Estate Agent Tax Deductions Worksheet A desk fee is a payment agreement between a real estate agent and their broker in which the broker charges a monthly fee for providing office space and a desk to the agent. if you exercise your license for a broker and pay a desk fee, then your desk fee is 100% deductible. you may deduct your desk fee or home office expenses, but not both. You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023.

Comments are closed.