Chapter Quiz Key Quiz 3 0472 271 05 1 9 Points Stock A Has A

Chapter Quiz Key Quiz 3 0472 271 05 1 9 Points Stock A Has A Quiz 3 [0472 271 05] 1 (9 points) stock a has a beta of 1 and an expected return of 16%. the risk free asset currently earns 5%. i what is the expected return on a portfolio that is equally invested in both stock a and the risk free asset?. View test prep quiz 3 [key].docx from business 0472271 at university of windsor. quiz 3 [0472 271 05] 1 (9 points) stock a has a beta of 1.6 and an expected return of 16%. the risk free.

Quiz 6 0472 271 05 Key Quiz 6 1 10 Points The Smith Company Has Warning: tt: undefined function: 22 quiz 2 [0472 271 05] 1 (9 points) a project has the following estimated data: price = $85 per unit; variable cost = $42 per unit; fixed costs = $7,350; required return = 16%; initial investment = $14,000; life = 5 years. Related documents. solutions and test bank for business analytics 2nd edition by sanjiv jaggia; unit 1 topic 2 feasibility report final; quiz 9 0472 271 05 key. The stock has a beta of 1.3, the risk free interest rate is 6 percent, and the expected return q&a a firm has common stock with a market price of p55 per share and an expected dividend of p2.81 per share at the end of the coming year. View test prep quiz 8 key [0472 271 05] from finance 72271 at university of windsor. quiz 8 [0472 271 05] 1 (10 points) xyz inc. expects its ebit to be $125,000 every year forever. the firm.

Quiz 6 Key Docx Quiz 6 0472 271 05 1 7 Points Abc Corp Is The stock has a beta of 1.3, the risk free interest rate is 6 percent, and the expected return q&a a firm has common stock with a market price of p55 per share and an expected dividend of p2.81 per share at the end of the coming year. View test prep quiz 8 key [0472 271 05] from finance 72271 at university of windsor. quiz 8 [0472 271 05] 1 (10 points) xyz inc. expects its ebit to be $125,000 every year forever. the firm. 1 (10 points) the smith company has 8,000 bonds outstanding. the bonds are selling at 105% of face value, have a 9% coupon rate, pay interest quarterly , and mature in 7 years. Answer key chapter 05 (34.0k) answer key chapter 06 (30.0k) answer key chapter 07 (39.0k) answer key chapter 08 (40.0k) answer key chapter 09 (37.0k) answer key chapter 10 (32.0k) answer key chapter 11 (34.0k) answer key chapter 12 (42.0k) answer key chapter 13 (36.0k) answer key chapter 14 (39.0k) answer key chapter 15.

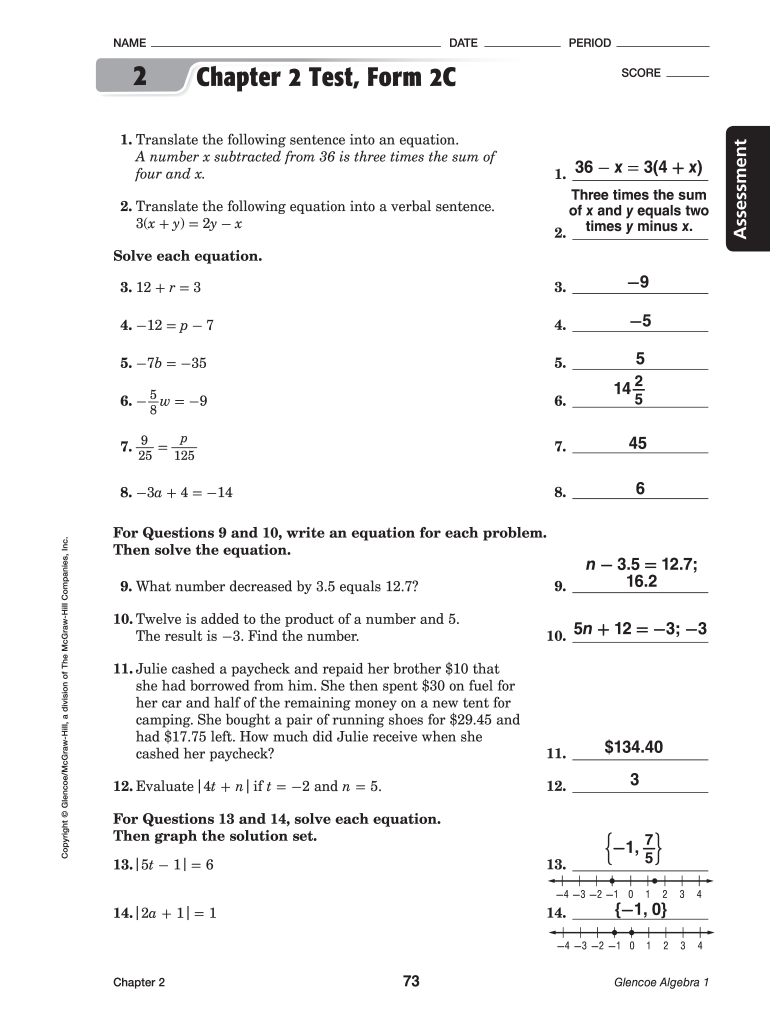

Glencoe Geometry Chapter 2 Test Form 1 Answer Key Airslate Signnow 1 (10 points) the smith company has 8,000 bonds outstanding. the bonds are selling at 105% of face value, have a 9% coupon rate, pay interest quarterly , and mature in 7 years. Answer key chapter 05 (34.0k) answer key chapter 06 (30.0k) answer key chapter 07 (39.0k) answer key chapter 08 (40.0k) answer key chapter 09 (37.0k) answer key chapter 10 (32.0k) answer key chapter 11 (34.0k) answer key chapter 12 (42.0k) answer key chapter 13 (36.0k) answer key chapter 14 (39.0k) answer key chapter 15.

Forms Of Government Scenarios Ss 7 C 3 2 Answer Key At Laura Valentin Blog

Comments are closed.