Changes To Psd2 Open Banking Regulations

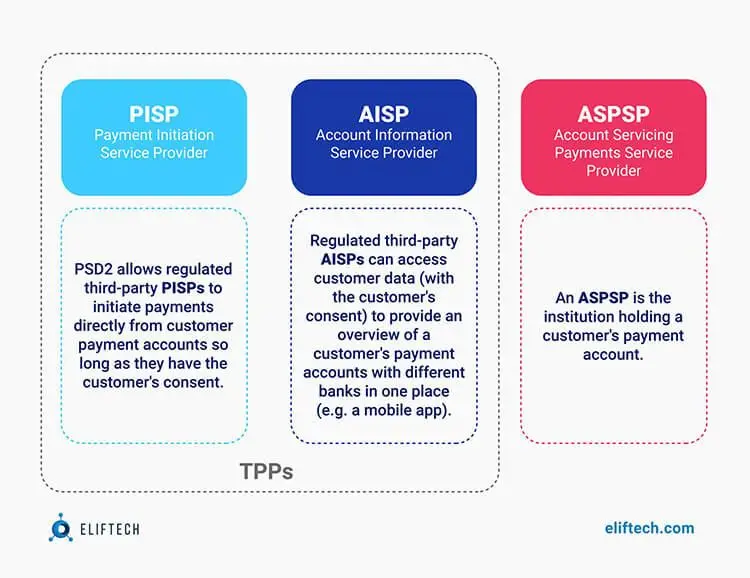

Changes To Open Banking Under Psd2 Regulations Sagars Accountants Ltd The second payment services directive (psd2) is part of a global trend in bank regulation emphasizing security, innovation, and market competition. by requiring banks to provide other qualified payment service providers (psps) connectivity to access customer account data and to initiate payments, psd2 represents a significant step toward commoditization in the eu banking sector. The major changes to open banking europe regulation proposed by the psd3 vs psd2 include: removed obstacles to providing open banking services and increased uptime for banking and financial services. payment initiation service providers (pisps) and account information service providers (aisps) will have the authorization to create personalized.

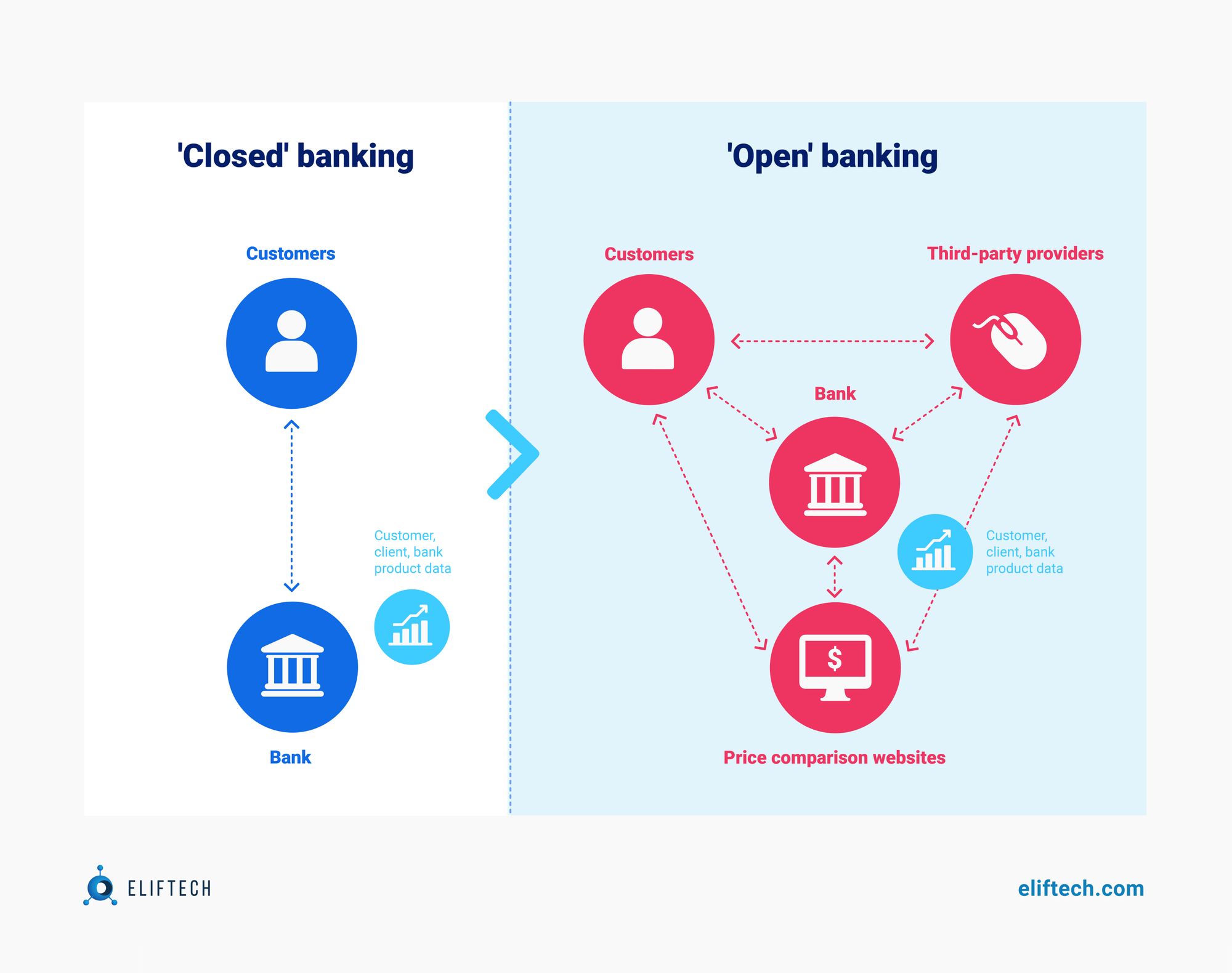

Navigating Open Banking Regulations And Psd2 The psd2 is supplemented by regulatory technical standards on strong customer authentication and common and secure open standards of communication, as well as guidelines on incident reporting and guidelines on security measures for operational and security risks. the three documents were developed by the european banking authority in close. Open banking (i.e. the secure sharing of financial data between banks and third party service providers) was a major innovation of psd2. in spite of the emergence of many new non bank providers on the market offering open banking services, there has been mixed success in its uptake. obstacles to data access. On october 22, 2024, the consumer financial protection bureau (cfpb) announced its long awaited final rule on “personal financial data rights” (the final rule). the final rule implements. 13 jan 2022. the revised payment services directive (psd2) came into force on 13 january 2018, introducing new rules that would kick off an era of open banking in the uk and europe. for the first time, it gave consumers the legal right to access their payment accounts, through third parties (like truelayer). with consumer consent, these third.

Navigating Open Banking Regulations And Psd2 On october 22, 2024, the consumer financial protection bureau (cfpb) announced its long awaited final rule on “personal financial data rights” (the final rule). the final rule implements. 13 jan 2022. the revised payment services directive (psd2) came into force on 13 january 2018, introducing new rules that would kick off an era of open banking in the uk and europe. for the first time, it gave consumers the legal right to access their payment accounts, through third parties (like truelayer). with consumer consent, these third. Psd2 succeeded in making apis the norm in the finance sector, but there is still significant variation in the format, quality, and performance of apis. they can be prone to excessive downtime and often lack support when issues arise. psr responds to this issue with new rules designed to harmonize the implementation of open banking. Psd2 sets a framework for redefining the european payments ecosystem. the directive aims to: encourage innovation and competition by facilitating new market entrants (e.g., third party providers of account information and payment initiation services). enhance the transparency and security of payment services. enable consumers and businesses to.

Navigating Open Banking Regulations And Psd2 Psd2 succeeded in making apis the norm in the finance sector, but there is still significant variation in the format, quality, and performance of apis. they can be prone to excessive downtime and often lack support when issues arise. psr responds to this issue with new rules designed to harmonize the implementation of open banking. Psd2 sets a framework for redefining the european payments ecosystem. the directive aims to: encourage innovation and competition by facilitating new market entrants (e.g., third party providers of account information and payment initiation services). enhance the transparency and security of payment services. enable consumers and businesses to.

Psd2 And Open Banking A Change Of Paradigm Sme Banking Club Magazine

Comments are closed.