Changes To Open Banking Under Psd2 Regulations Sagars Accountants Ltd

Changes To Open Banking Under Psd2 Regulations Sagars Accountants Ltd There is then a legal requirement for the consumer’s bank to ‘re authenticate’ the account access after 90 days. the process for this is: the aisp lets the consumer know that access to the account data has expired. the aisp redirects the consumer to their bank to re authenticate. access to the data for the aisp is renewed by the bank. 13 jan 2022. the revised payment services directive (psd2) came into force on 13 january 2018, introducing new rules that would kick off an era of open banking in the uk and europe. for the first time, it gave consumers the legal right to access their payment accounts, through third parties (like truelayer). with consumer consent, these third.

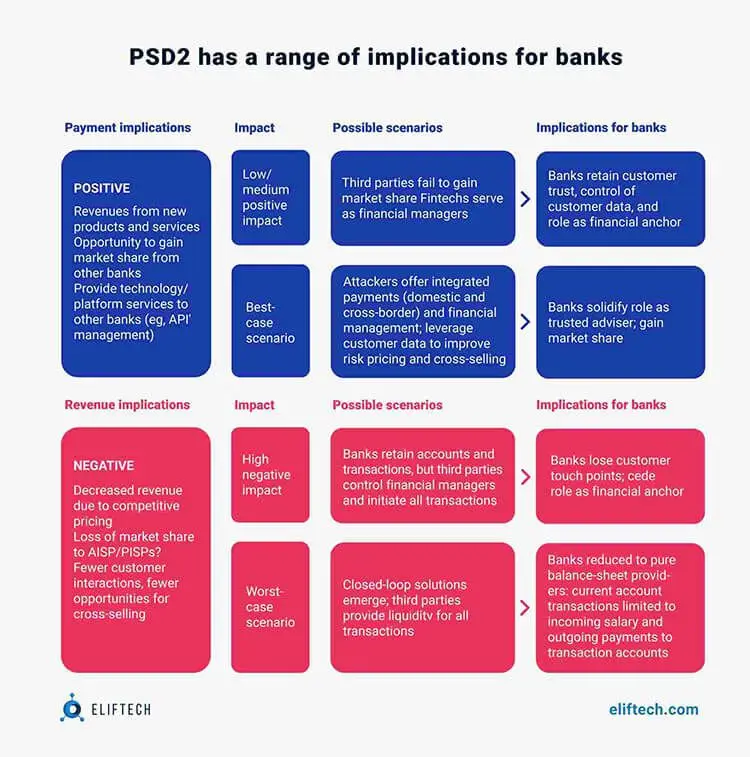

Psd2 And Open Banking A Change Of Paradigm Sme Banking Club Magazine The second payment services directive (psd2) is part of a global trend in bank regulation emphasizing security, innovation, and market competition. by requiring banks to provide other qualified payment service providers (psps) connectivity to access customer account data and to initiate payments, psd2 represents a significant step toward commoditization in the eu banking sector. Based on the evaluation findings, the commission has proposed amendments to psd2, accompanied by an impact assessment. main changes in open banking after entering into the force the new psr and. Open finance will, and already does, enable companies of all kinds to offer banking as a service (baas) capabilities and platform banking. “this is where banks integrate products and services from the larger financial ecosystem into their offerings to enrich the user experience,” notes mhenni. he continues: “ leveraging open banking. Psd3 is a proposed update to the second european union’s payment services directive (psd2) that provides rules for the authorization and supervision of non bank payment service providers (psps) in the eu. the psd3 aims to protect consumers’ rights and personal information while fostering healthy competitiveness in the digital payments sector.

Navigating Open Banking Regulations And Psd2 Open finance will, and already does, enable companies of all kinds to offer banking as a service (baas) capabilities and platform banking. “this is where banks integrate products and services from the larger financial ecosystem into their offerings to enrich the user experience,” notes mhenni. he continues: “ leveraging open banking. Psd3 is a proposed update to the second european union’s payment services directive (psd2) that provides rules for the authorization and supervision of non bank payment service providers (psps) in the eu. the psd3 aims to protect consumers’ rights and personal information while fostering healthy competitiveness in the digital payments sector. Impact on the market. smarter data sharing – psd2 and open banking standards will change the way financial data is shared between banks and third parties, including fms and accounting software providers such as quickbooks. bank feeds will be upgraded too, so you’ll get a much better connection. intuit quickbooks was one of the first. The european commission has published draft legislation for the third payment services directive (psd3) and a new payment services regulation (psr) to build on the progress made since psd2. psd3 psr aim to drive further development in open banking, as well as addressing issues like api quality. tink’s head of industry & wallets, jan van vonno.

Open Banking Apis Under Psd2 White Paper Onespan Impact on the market. smarter data sharing – psd2 and open banking standards will change the way financial data is shared between banks and third parties, including fms and accounting software providers such as quickbooks. bank feeds will be upgraded too, so you’ll get a much better connection. intuit quickbooks was one of the first. The european commission has published draft legislation for the third payment services directive (psd3) and a new payment services regulation (psr) to build on the progress made since psd2. psd3 psr aim to drive further development in open banking, as well as addressing issues like api quality. tink’s head of industry & wallets, jan van vonno.

Comments are closed.