Cfpb The Closing Disclosure Form In Plain English Youtube

Cfpb The Closing Disclosure Form In Plain English Youtube An explanation of the new closing disclosure form created by the cfpb. the closing disclosure form replaces the tila 2 and hud 1 settlement statement on aug. Learn about the new cfpb closing disclosure form.

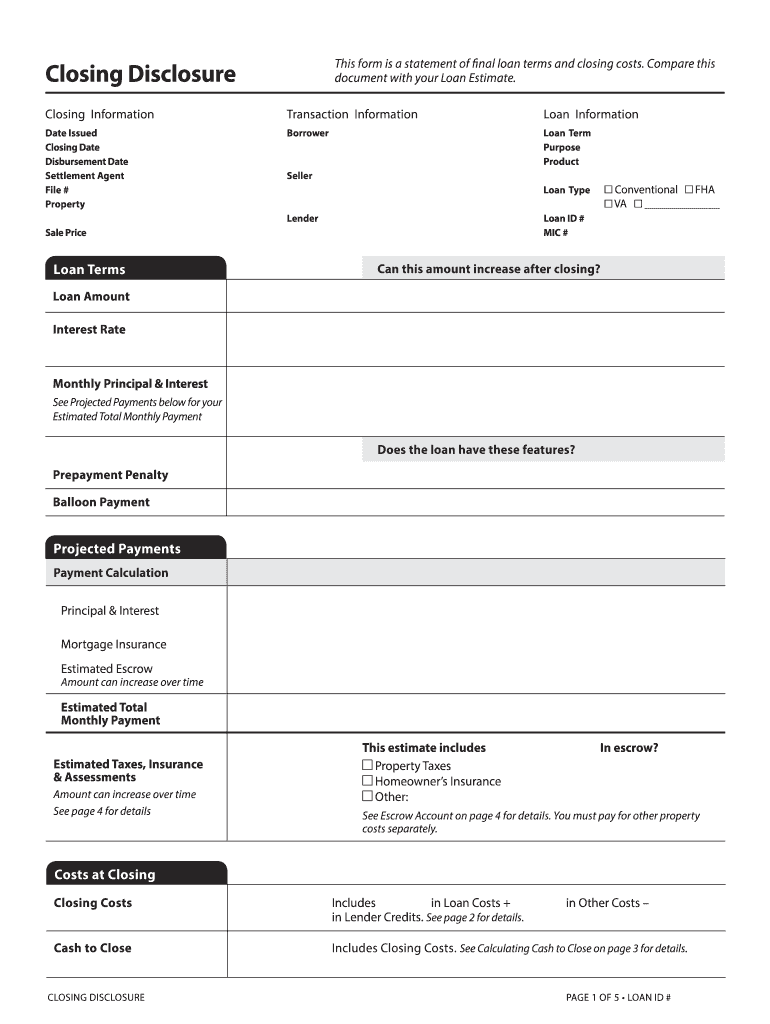

Cfpb Closing Disclosure Training Aid Closing disclosure explainer. use this tool to double check that all the details about your loan are correct on your closing disclosure. lenders are required to provide your closing disclosure three business days before your scheduled closing. use these days wisely—now is the time to resolve problems. In which the consumer must pay additional funds to satisfy the existing mortgage loan securing the property and other existing debt to consummate the transaction. download pdf. page 3 of closing disclosure (summaries of transactions) disclosure of consumer funds from a simultaneous second lien credit transaction. English. español. a closing disclosure is a five page form that provides final details about the mortgage loan you have selected. it includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs). the lender is required to give you the closing disclosure at least. Q: how does the disclosure of recording fees differ between the loan estimate and the closing disclosure (compare § 1026.37(g)(1)(i) with § 1026.38(g)(1)(i)) similar to the loan estimate, the closing disclosure requires the sum of all recording fees to be disclosed as one item. see § 1026.37(g)(1)(i).

Cfpb Closing Disclosure Addendum To Contract In Word And Pdf Formats English. español. a closing disclosure is a five page form that provides final details about the mortgage loan you have selected. it includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs). the lender is required to give you the closing disclosure at least. Q: how does the disclosure of recording fees differ between the loan estimate and the closing disclosure (compare § 1026.37(g)(1)(i) with § 1026.38(g)(1)(i)) similar to the loan estimate, the closing disclosure requires the sum of all recording fees to be disclosed as one item. see § 1026.37(g)(1)(i). The closing disclosure must contain final details about the loan costs and other costs estimated in the “loan costs” and “other costs” tables on the loan estimate, using expanded versions of those tables headed “loan costs” and “other costs” under the master heading of “closing cost details.” [xl] disclosure items must. Origination charges: this fee is typically 0.5% 1% and it represents the administrative cost the lender charges for originating your loan and processing your application, including underwriting. this fee is commonly negotiable but it should not change between the loan estimate and the closing disclosure.

Cfpb Closing Disclosure Training Aid The closing disclosure must contain final details about the loan costs and other costs estimated in the “loan costs” and “other costs” tables on the loan estimate, using expanded versions of those tables headed “loan costs” and “other costs” under the master heading of “closing cost details.” [xl] disclosure items must. Origination charges: this fee is typically 0.5% 1% and it represents the administrative cost the lender charges for originating your loan and processing your application, including underwriting. this fee is commonly negotiable but it should not change between the loan estimate and the closing disclosure.

Cfpb Closing Disclosure Addendum To Contract In Word And Pdf Formats

Cfpb Closing Disclosure Fill And Sign Printable Template Online Us

Comments are closed.