Centralised Exchanges Cex Vs Decentralised Exchanges Dex

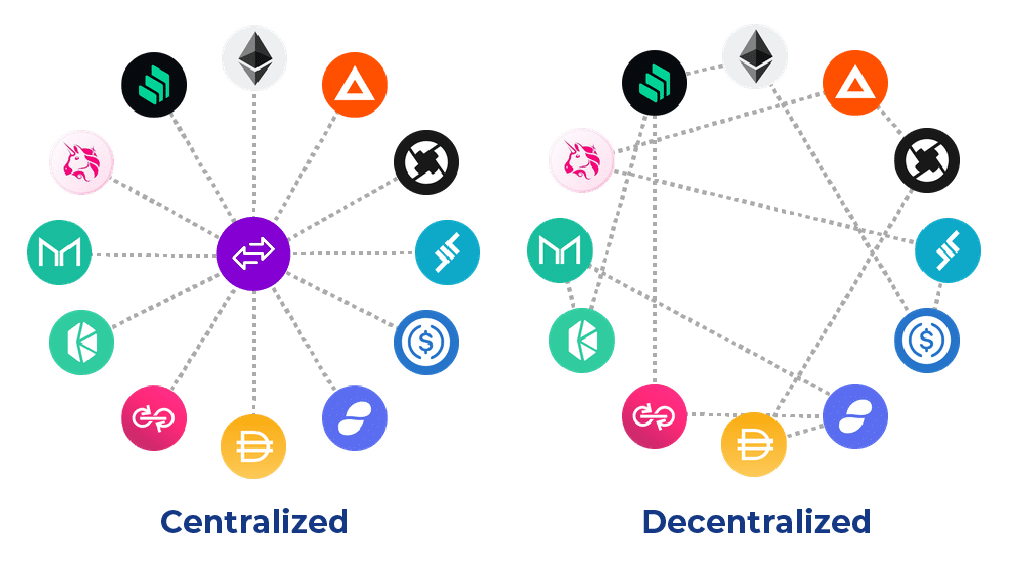

Centralized Exchange Cex Vs Decentralized Exchange Dex The recent chaos around the centralized exchange ftx has sparked questions about the pros and cons of keeping your coins on centralized versus decentralized exchanges. we break it down. A centralized exchange is a trading platform acting as an intermediary between buyers and sellers in the crypto market. it matches orders, manages user accounts, and maintains control over private keys. cexs are popular among crypto newbies since they manage the whole transaction procedure, resulting in a quick and simple user experience.

Centralised Exchanges Cex Vs Decentralised Exchanges Dex Centralized cryptocurrency exchanges usually have higher trading volumes than dex platforms. global cex trading volumes are valued at billions of dollars every month. decentralized platforms also have high trading volumes, but these can fluctuate rapidly because of low liquidity and market volatility. Centralized vs decentralized exchanges (cex vs dex): explained. in a very basic sense, the difference is simple: a centralized exchange is a service that allows you to buy and sell crypto using a centralized model, and a decentralized exchange allows you to do the same thing but without a middleman. but there’s a bit more to it than that. Dexes are generally slower to execute trades than cexes. depending on how busy the chain is, a transaction can take quite some time (and cost you some high gas fees) before completing, whereas a centralized exchange executes trades in milliseconds. if speed is important to you, dex trading may not be for you. Centralized and decentralized exchanges (cex vs dex) each offer unique advantages and drawbacks, making them suitable for different users. cexs, like coinbase and binance, are user friendly, with high liquidity and customer support, making them ideal for beginners.

Centralized Cex Vs Decentralized Dex Cryptocurrency Exchanges Dexes are generally slower to execute trades than cexes. depending on how busy the chain is, a transaction can take quite some time (and cost you some high gas fees) before completing, whereas a centralized exchange executes trades in milliseconds. if speed is important to you, dex trading may not be for you. Centralized and decentralized exchanges (cex vs dex) each offer unique advantages and drawbacks, making them suitable for different users. cexs, like coinbase and binance, are user friendly, with high liquidity and customer support, making them ideal for beginners. For beginners, a cex provides the simplest way to get started without needing in depth knowledge of blockchain infrastructure and tools. a decentralized exchange (dex) uses on chain smart contracts to run its exchange services. in most cases, users swap tokens from liquidity pools, with liquidity provided by other users in exchange for swap. Centralized crypto exchanges such as binance and coinbase use an order book as well, and retain many of the features offered by traditional cexs. so how does a dex differ from a cex? well, since it doesn't have a central authority to keep track of an order book and match orders, dexs had to devise a different approach to facilitate price discovery.

Centralised Exchanges Cex Vs Decentralised Exchanges Dex For beginners, a cex provides the simplest way to get started without needing in depth knowledge of blockchain infrastructure and tools. a decentralized exchange (dex) uses on chain smart contracts to run its exchange services. in most cases, users swap tokens from liquidity pools, with liquidity provided by other users in exchange for swap. Centralized crypto exchanges such as binance and coinbase use an order book as well, and retain many of the features offered by traditional cexs. so how does a dex differ from a cex? well, since it doesn't have a central authority to keep track of an order book and match orders, dexs had to devise a different approach to facilitate price discovery.

Comments are closed.