Catalytic Investing In Emerging Markets Factor E Ventures

Catalytic Investing In Emerging Markets Factor E Ventures Catalytic investing in emerging markets. in emerging markets, big opportunities are disguised as challenges. we need more entrepreneurs focused on building innovative start up ventures in these contexts. but building high growth ventures is hard. recruiting world class talent is hard. raising critical funding from investors in order to scale is. Factor e ventures | oct 03, 2024. catalytic investing in emerging markets jamie doyen | dec 17, 2020. in emerging markets, big opportunities are disguised as.

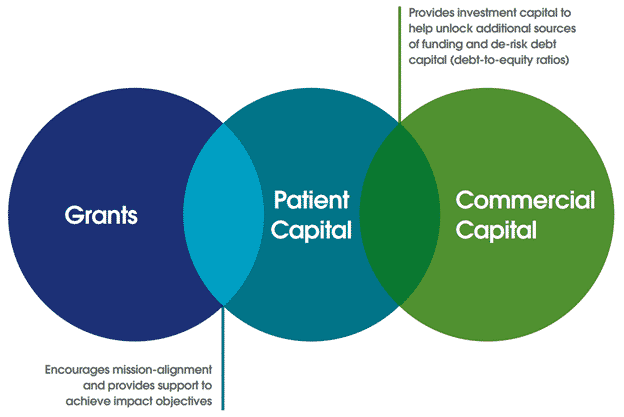

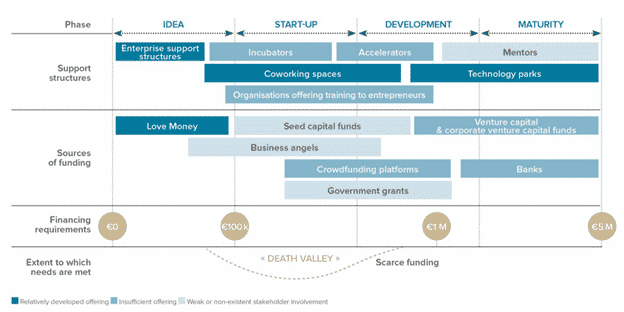

Catalytic Investing In Emerging Markets Factor E Ventures Factor e is an impact investment firm that identifies and invests in solutions to some of the world’s toughest climate and development problems. working at the intersection of risk capital, technology, and emerging markets, factor e accelerates the pace at which innovation positively impacts economies, environments, and communities. Factor[e] ventures | 6,648 followers on linkedin. investing capital and hands on support in early stage technology companies creating impact in emerging markets. | we are a team of impact venture. Factor[e] ventures, an impact investor and venture builder, uses hands on investment and technical expertise to support enterprises turning challenges in energy, agriculture, waste, and mobility into de carbonized solutions. factor[e] uses a range of innovative techniques to help early stage companies in emerging and frontier markets reach the. Obfuscated. contact email morgan@factore . phone number 1 970 215 8025. factor [e] ventures impact venture builders, dedicated to supporting the people and ideas that will turn the tables in the global battle for sustainable solutions to energy, agriculture, mobility, and waste challenges in emerging & frontier markets.

Factor E Ventures Investment Guide Africa Factor[e] ventures, an impact investor and venture builder, uses hands on investment and technical expertise to support enterprises turning challenges in energy, agriculture, waste, and mobility into de carbonized solutions. factor[e] uses a range of innovative techniques to help early stage companies in emerging and frontier markets reach the. Obfuscated. contact email morgan@factore . phone number 1 970 215 8025. factor [e] ventures impact venture builders, dedicated to supporting the people and ideas that will turn the tables in the global battle for sustainable solutions to energy, agriculture, mobility, and waste challenges in emerging & frontier markets. Factor(e) ventures is an impact investor that provides early stage companies in emerging markets with seed capital and the tools and resources needed to scale their businesses and become investment ready. factor(e) ventures invests in ventures across the energy, mobility, water and agriculture sectors. According to imf data, the 24 countries making up the msci emerging market index today combined to 13.4% of global nominal gdp in 1988. that number grew to 35.7% by the end of 2022. over the past.

Comments are closed.