Cashfac And The Open Banking Phenomenon Cashfac

Cashfac And The Open Banking Phenomenon Cashfac Open banking is going to most positively impact receivables management. it is going to allow the payee much more control over the cash they receive, even if that cash is “pushed” to them. it is going to allow payees to get that cash more quickly and, crucially, it may no longer be possible for the payer to chargeback or dishonour that payment. Investment and wealth cashfac is a modular “best in class” cash platform which gives wealth managers, life insurers and pension administrators the flexibility to deliver differentiated customer value propositions, operational efficiencies and automated client money risk management. property management we help property managers offer a.

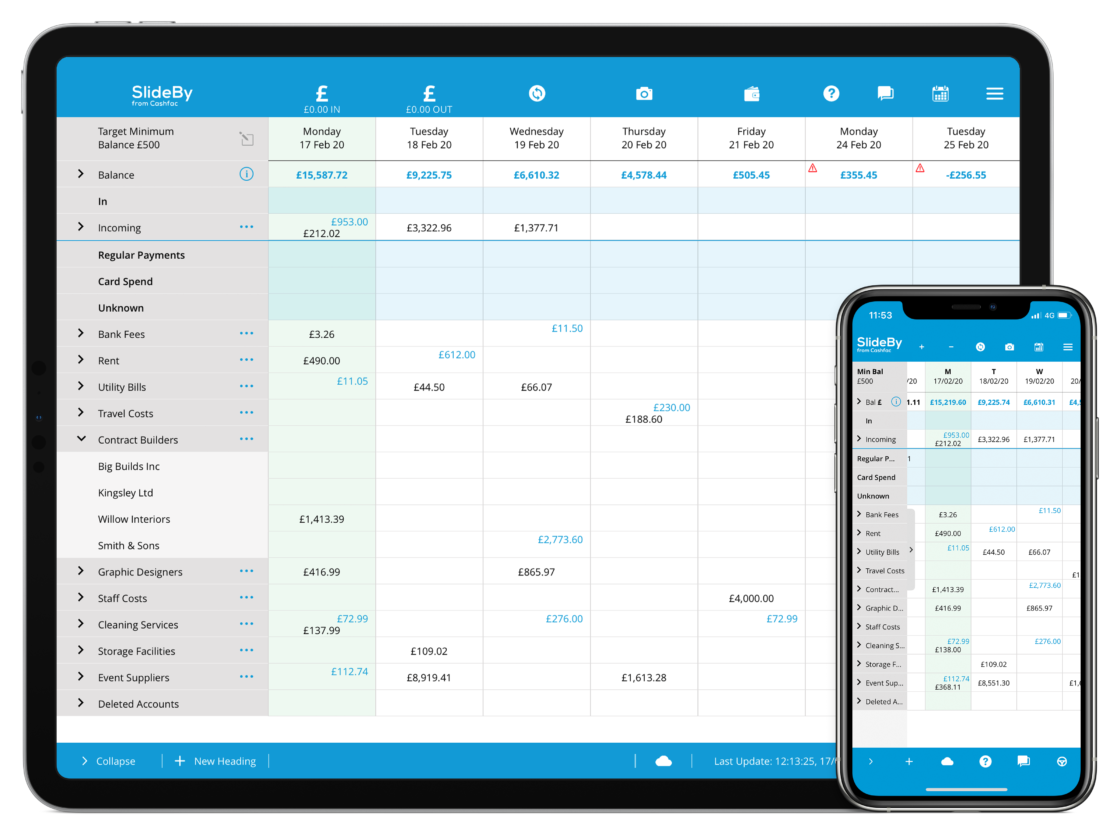

Cashfac Plc Open Banking Cashfac virtual bank technology (vbt) is a packaged, rules driven software as a service (saas) technology that automates complex cash operations. wherever there is a complex operation involving the management of other peoples’ money, cashfac is needed. this is where vbt’s penny precision, compliance and price performance are unmatched. Cashfac plc. delivered direct to customer and distributed globally via bank partners, cashfac’s vbt platform is a widely deployed virtual accounts solution. it is relied upon by banks, financial institutions, corporate and public sector organisations with the aim of improving the productivity, visibility, automation and regulatory compliance. About cashfac. the management of cash receipts has always been a challenge for businesses. it is crucial that all businesses seek to increase the accuracy and shorten the timeline of cash processing for client and corporate cash. cashfac’s state of the art virtual accounts solution is capable of managing these issues, making cash receivables. Cashfac pointed to the lower costs of virtual banking for a financial institution, the ability to offer more tailored solutions to corporate clients and a stronger relationship with customers.

Cashfac Virtual Account Management Cashfac About cashfac. the management of cash receipts has always been a challenge for businesses. it is crucial that all businesses seek to increase the accuracy and shorten the timeline of cash processing for client and corporate cash. cashfac’s state of the art virtual accounts solution is capable of managing these issues, making cash receivables. Cashfac pointed to the lower costs of virtual banking for a financial institution, the ability to offer more tailored solutions to corporate clients and a stronger relationship with customers. The bank has $22.4 billion in deposits, and $30 billion in assets. the bank is a wholly owned subsidiary of sterling bancorp, a regional bank holding company founded in 1988. “cashfac provides us with a unique opportunity to leverage a world renowned contemporary solution in the us,” says luis massiani, sterling national bank president. Cashfac technologies is a global provider of cash management solutions to financial institutions, corporates and public sector organisations. we are headquartered in london with offices in livingston, edinburgh, melbourne and sydney.

Cashfac Plc Open Banking The bank has $22.4 billion in deposits, and $30 billion in assets. the bank is a wholly owned subsidiary of sterling bancorp, a regional bank holding company founded in 1988. “cashfac provides us with a unique opportunity to leverage a world renowned contemporary solution in the us,” says luis massiani, sterling national bank president. Cashfac technologies is a global provider of cash management solutions to financial institutions, corporates and public sector organisations. we are headquartered in london with offices in livingston, edinburgh, melbourne and sydney.

Comments are closed.