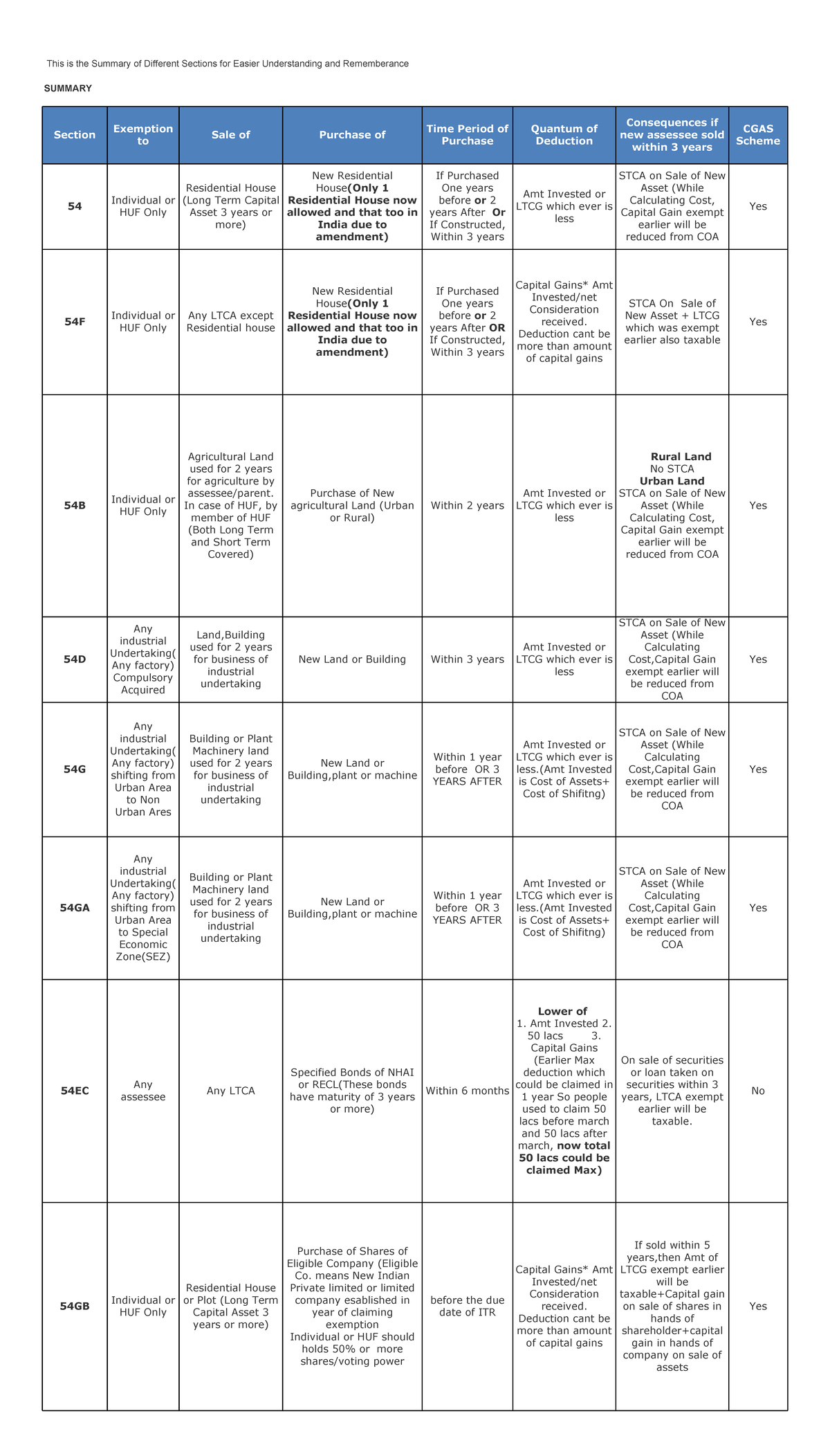

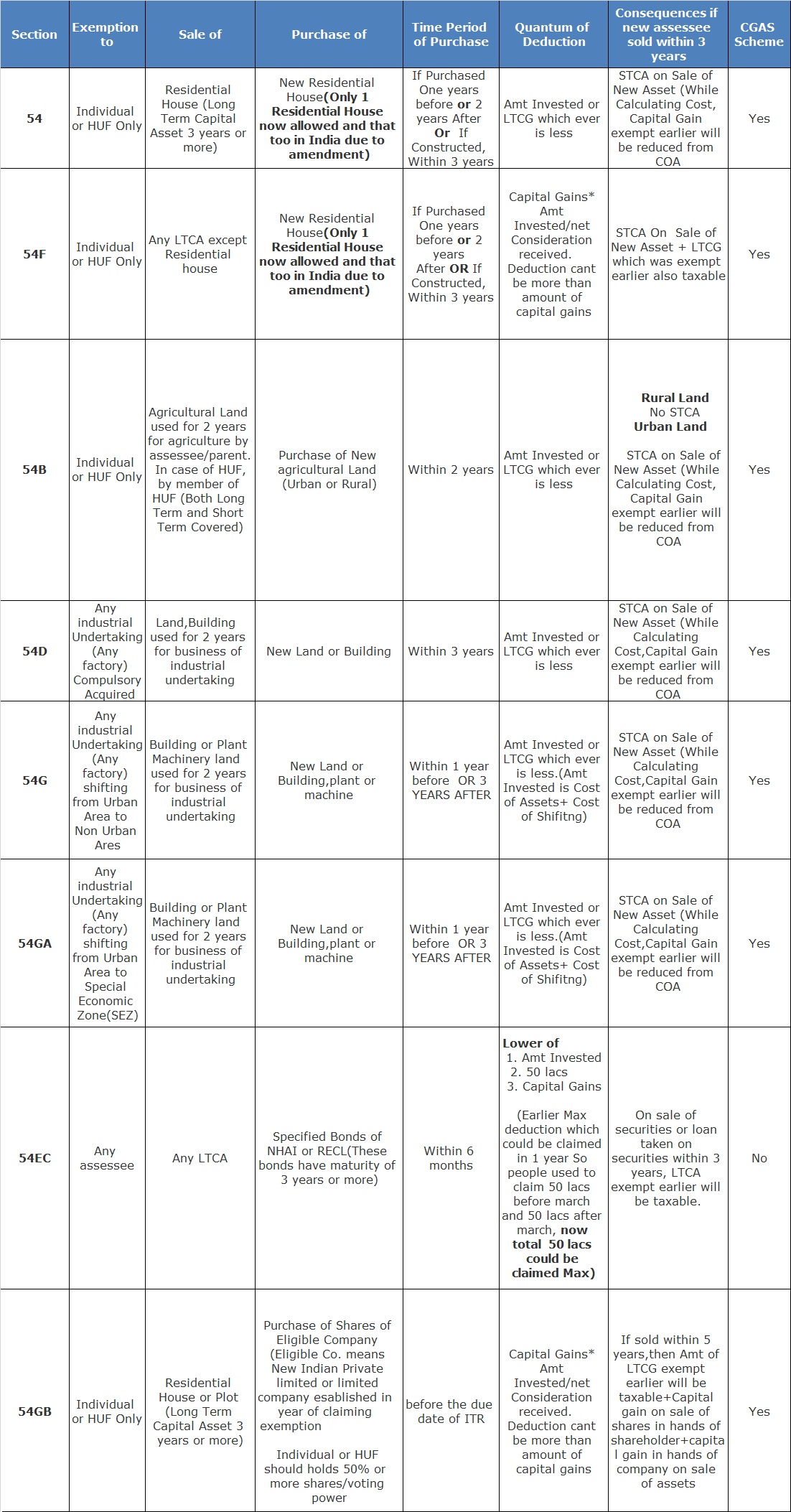

Capital Gains Section 54 Chart This Is The Summary Of Different

Capital Gains Section 54 Chart This Is The Summary Of Different From 1st april 2023 the capital gains tax exemption under section 54 to 54f will be restricted to rs.10 crore. earlier, there was no threshold. the above conditions are cumulative. hence, even if one condition is not fulfilled, then the seller cannot avail the benefit of the exemption under section 54. Capital gains tax rate 2024. in 2024, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income.

Section 54 To 54h Of Income Tax Act Download Chart Section 54 To Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed. You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year. when calculating the holding period—or the amount of time you owned. Section 54 of the finance act 2020 has been amended to extend the benefit of exemption to investments in two residential houses from assessment year 2021 22. a tax exemption shall be available for investments made through the purchase or construction of two residential properties if their long term capital gains do not exceed ₹2 crores. Selling a home can be an emotional and significant financial decision. while the excitement of moving on to a new chapter is undeniable, the thought of paying capital gains tax can add stress to the process. thankfully, section 54 of the income tax act offers relief by allowing individuals and hindu undivided families (hufs) to claim an exemption on the capital gains from the sale of a.

Capital Gains Section 54 Chart Pdf Capital Gains Tax Tax Deduction Section 54 of the finance act 2020 has been amended to extend the benefit of exemption to investments in two residential houses from assessment year 2021 22. a tax exemption shall be available for investments made through the purchase or construction of two residential properties if their long term capital gains do not exceed ₹2 crores. Selling a home can be an emotional and significant financial decision. while the excitement of moving on to a new chapter is undeniable, the thought of paying capital gains tax can add stress to the process. thankfully, section 54 of the income tax act offers relief by allowing individuals and hindu undivided families (hufs) to claim an exemption on the capital gains from the sale of a. This is the summary of different sections of income tax act for easier understanding and rememberancedownload chart in excelsection 54 income tax capital gains chart.xlsxsummarysectionexemption tosale ofpurchase oftime period of purchasequantum of deductionconsequences if new assessee sold within 3. 1. if a new asset is sold within 5 years (3 years before f.y. 2018 19), the amount earlier exempted under this section will be reduced from its coa to calculate capital gains thereon. 2. if a loan is taken on the security of the new specified asset within 5 years, the same will be treated as capital gains. 3.

Capital Gains Section 54 Chart Pdf Capital Gains Tax Tax Deduction This is the summary of different sections of income tax act for easier understanding and rememberancedownload chart in excelsection 54 income tax capital gains chart.xlsxsummarysectionexemption tosale ofpurchase oftime period of purchasequantum of deductionconsequences if new assessee sold within 3. 1. if a new asset is sold within 5 years (3 years before f.y. 2018 19), the amount earlier exempted under this section will be reduced from its coa to calculate capital gains thereon. 2. if a loan is taken on the security of the new specified asset within 5 years, the same will be treated as capital gains. 3.

Comments are closed.