Capital Gains Section 54 Chart Pdf Capital Gains Tax Tax Deduction

Capital Gains Section 54 Chart Pdf Capital Gains Tax Tax Deduction From 1st april 2023 the capital gains tax exemption under section 54 to 54f will be restricted to rs.10 crore. earlier, there was no threshold. the above conditions are cumulative. hence, even if one condition is not fulfilled, then the seller cannot avail the benefit of the exemption under section 54. 1. if a new asset is sold within 5 years (3 years before f.y. 2018 19), the amount earlier exempted under this section will be reduced from its coa to calculate capital gains thereon. 2. if a loan is taken on the security of the new specified asset within 5 years, the same will be treated as capital gains. 3.

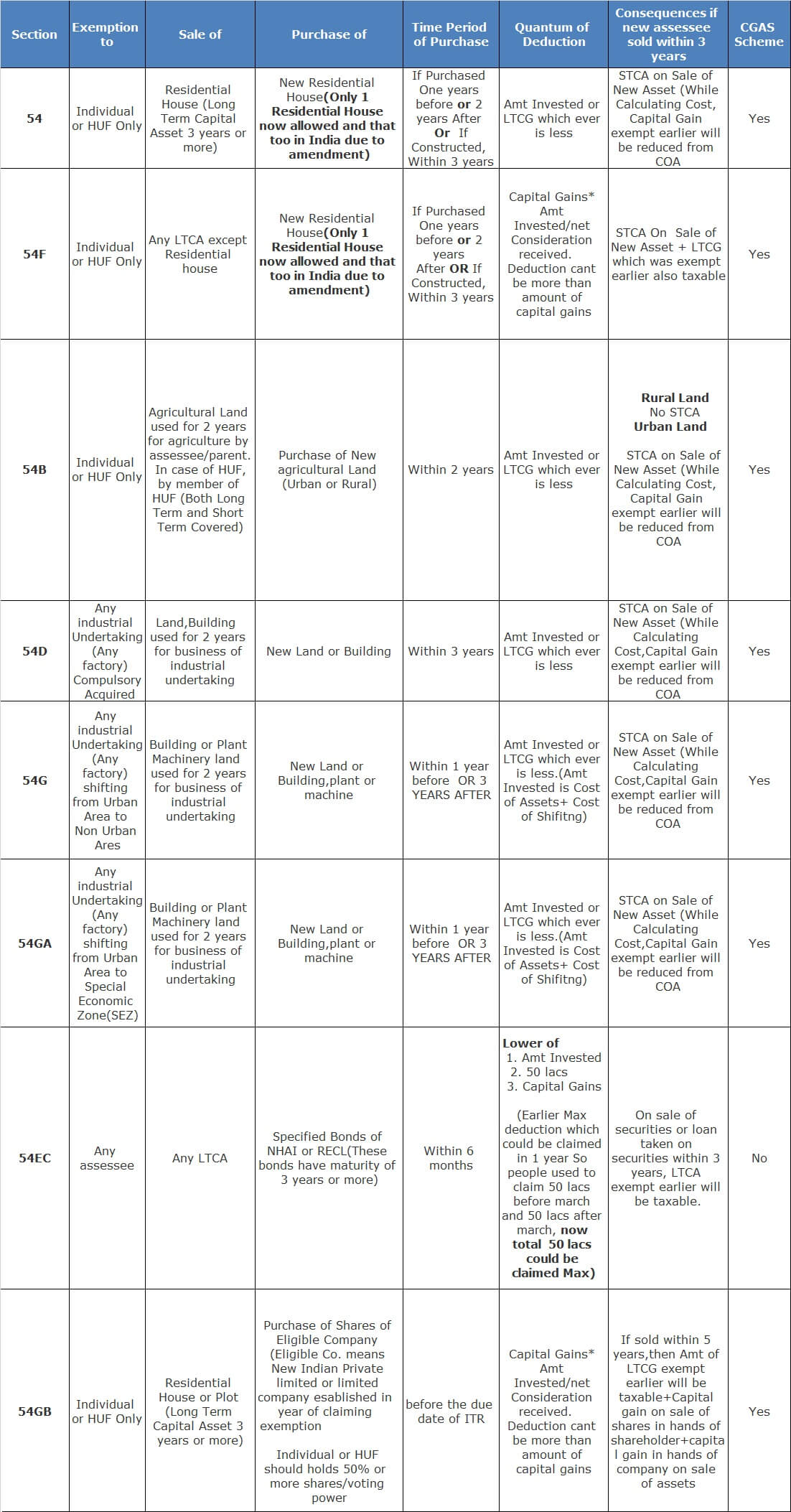

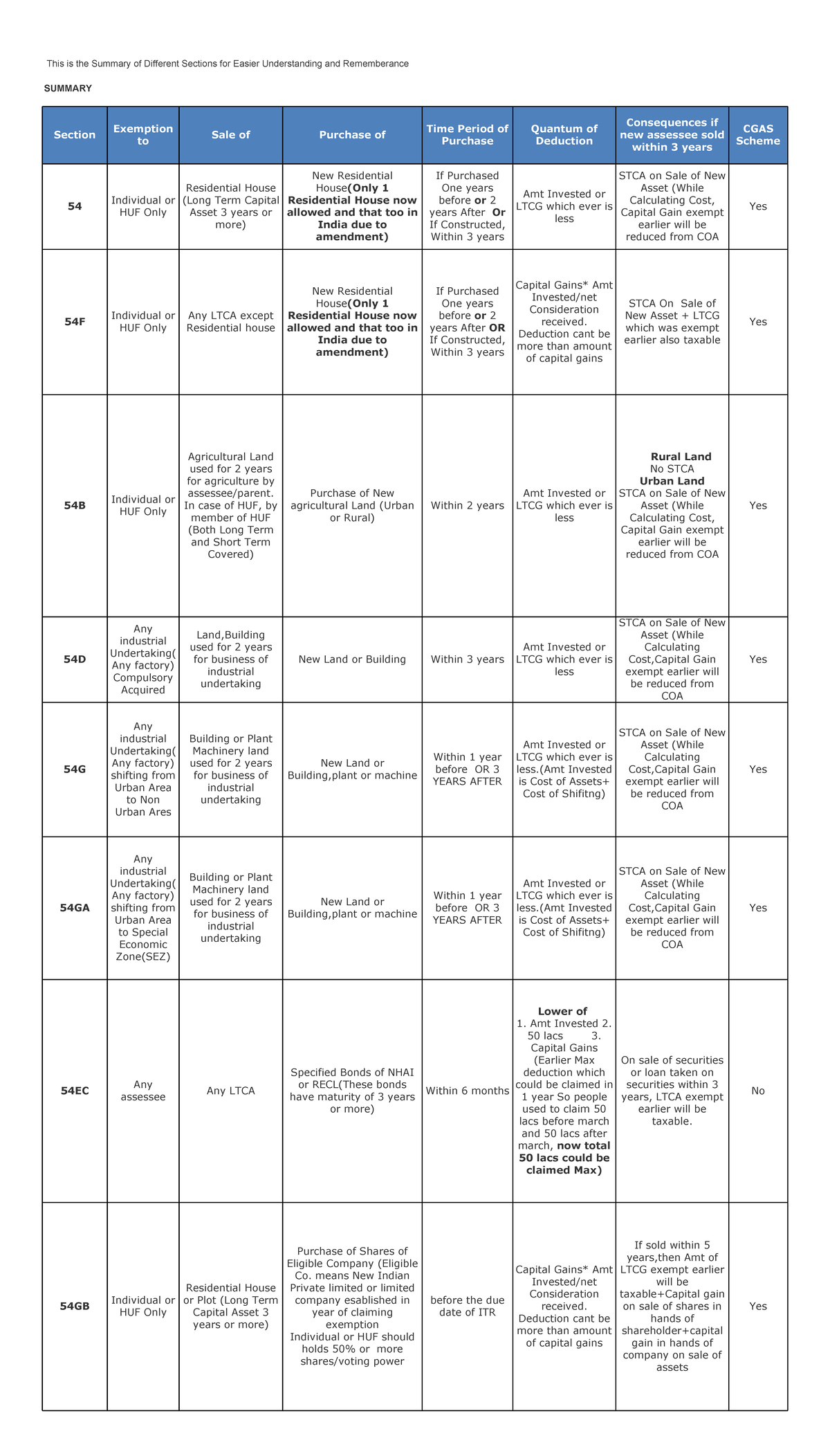

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed. Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. Selling a home can be an emotional and significant financial decision. while the excitement of moving on to a new chapter is undeniable, the thought of paying capital gains tax can add stress to the process. thankfully, section 54 of the income tax act offers relief by allowing individuals and hindu undivided families (hufs) to claim an exemption on the capital gains from the sale of a. Capital gains tax rate 2024. in 2024, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income.

Capital Gains Section 54 Chart Pdf Capital Gains Tax Tax Deduction Selling a home can be an emotional and significant financial decision. while the excitement of moving on to a new chapter is undeniable, the thought of paying capital gains tax can add stress to the process. thankfully, section 54 of the income tax act offers relief by allowing individuals and hindu undivided families (hufs) to claim an exemption on the capital gains from the sale of a. Capital gains tax rate 2024. in 2024, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income. Step 5: long term capital gains chargeable to tax. the long term capital gains chargeable to tax formula is: ltcg chargeable to tax = net sale consideration (indexed cost of acquisition indexed cost of improvement) exemptions under section 54 54b 54d 54ec 54f. A capital gains tax is a tax imposed on the sale of an asset. the long term capital gains tax rates for the 2025 tax year are 0%, 15%, or 20% of the profit, depending on the income of the filer.

Capital Gains Section 54 Chart This Is The Summary Of Different Step 5: long term capital gains chargeable to tax. the long term capital gains chargeable to tax formula is: ltcg chargeable to tax = net sale consideration (indexed cost of acquisition indexed cost of improvement) exemptions under section 54 54b 54d 54ec 54f. A capital gains tax is a tax imposed on the sale of an asset. the long term capital gains tax rates for the 2025 tax year are 0%, 15%, or 20% of the profit, depending on the income of the filer.

Understanding The Capital Gains Tax A Case Study

Some Of The Important Points To Consider For Section 54f Income Tax

Comments are closed.