Capital Gain Tax Exemption Under Section 54 Of It Act 1961 Consult

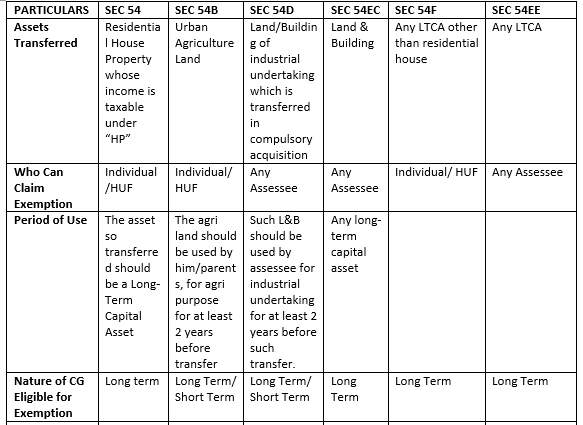

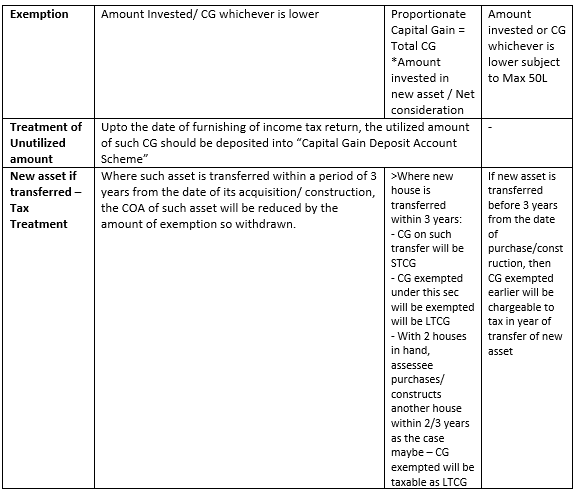

Capital Gain Tax Exemption Under Section 54 Of It Act 1961 Consult From 1st april 2023 the capital gains tax exemption under section 54 to 54f will be restricted to rs.10 crore. earlier, there was no threshold. the above conditions are cumulative. hence, even if one condition is not fulfilled, then the seller cannot avail the benefit of the exemption under section 54. Conclusion: exemptions under capital gains, as outlined in sections 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, offer valuable tax saving opportunities to individuals and entities. by understanding the nuances of each section, taxpayers can strategically plan asset transactions to minimize tax liabilities. adherence to eligibility criteria, time.

Capital Gain Tax Exemption Under Section 54 Of It Act 1961 Consult Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. The exemption amount under section 54 is the lower of: 1. the long term capital gain calculated above. 2. the cost of the new residential property purchased or constructed. for example, if your capital gain is ₹50 lakhs and you purchase a new house for ₹40 lakhs, your exemption would be ₹40 lakhs. Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire. The section 54 exemption under the income tax act, 1961, offers a valuable opportunity for individuals to save on capital gains when transferring residential property. this comprehensive guide provides insights into the basic conditions for eligibility, the amount of exemption available, and the potential consequences if the new house is.

Capital Gain Exemption Section 54 Pioneer One Consulting Llp Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire. The section 54 exemption under the income tax act, 1961, offers a valuable opportunity for individuals to save on capital gains when transferring residential property. this comprehensive guide provides insights into the basic conditions for eligibility, the amount of exemption available, and the potential consequences if the new house is. 1. if a new asset is sold within 5 years (3 years before f.y. 2018 19), the amount earlier exempted under this section will be reduced from its coa to calculate capital gains thereon. 2. if a loan is taken on the security of the new specified asset within 5 years, the same will be treated as capital gains. 3. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed.

Capital Gain Tax Exemption Under Section 54 Of It Act 1961 Consult 1. if a new asset is sold within 5 years (3 years before f.y. 2018 19), the amount earlier exempted under this section will be reduced from its coa to calculate capital gains thereon. 2. if a loan is taken on the security of the new specified asset within 5 years, the same will be treated as capital gains. 3. Exemption of capital gains under sections 54, 54b, 54d, 54ec, 54ee, 54f, 54g. 54ga and 54gb. 1. exemption of capital gain on transfer of house property used for residence [section 54] (iv) the assessee has purchased one residential house in india within one year before or 2 years after the date on which the transfer took place, or constructed.

Comments are closed.