Capital Gain Exemption Under Section 54 54b 54d 54ec 54f 54g

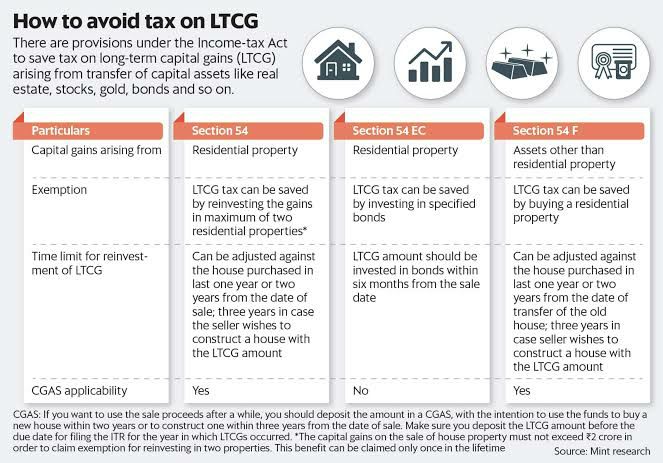

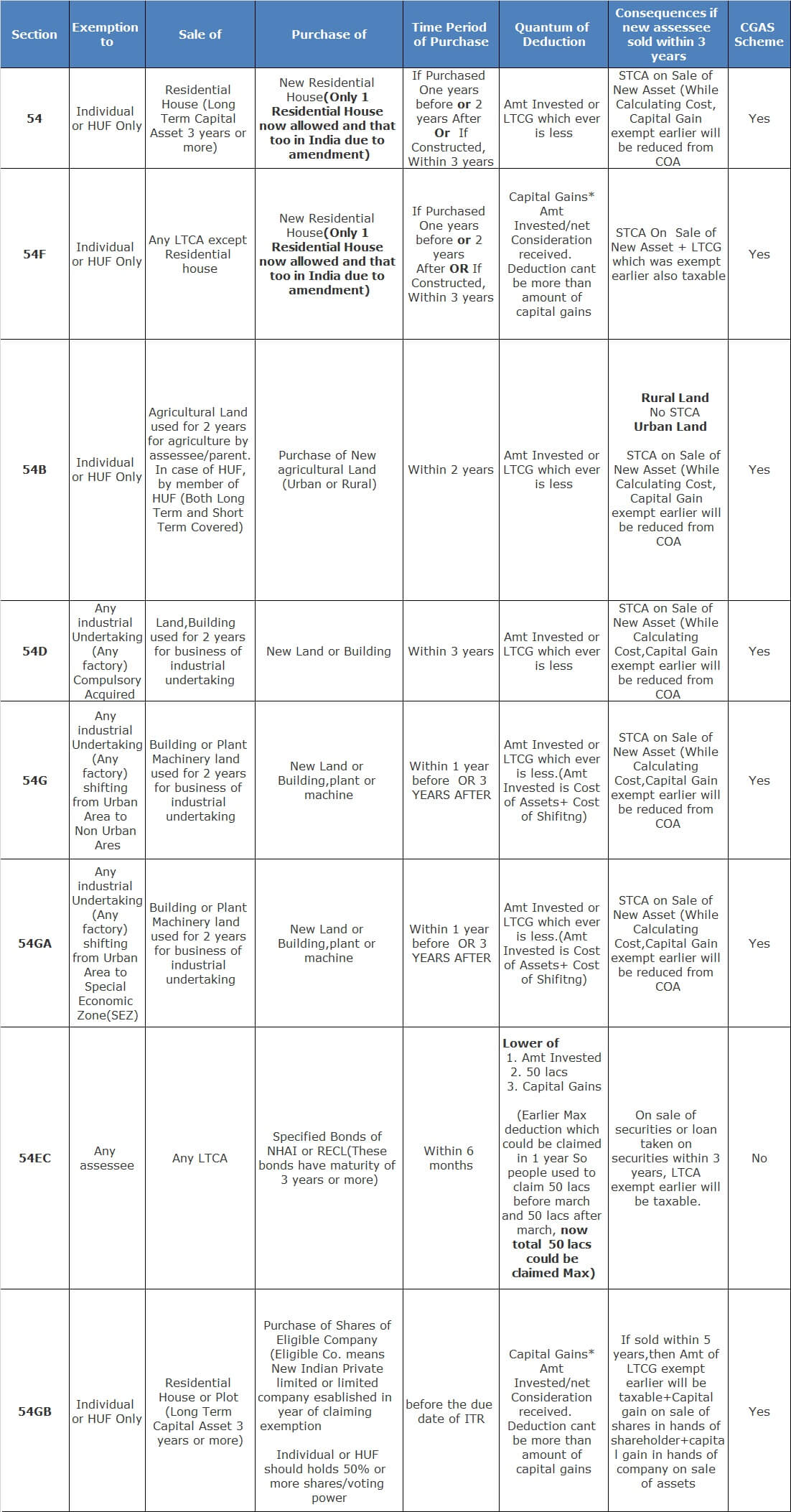

Exemption Of Capital Gain Section 54 To 54f Ifccl The taxation of capital under section 54EC For complete details of all roll over benefits, please refer section 54, 54B, 54D, 54EC 54F, 54G of the IT Act Investment of capital gain in Budget 2024 Capital under section 54EC For complete details of all roll over benefits, please refer section 54, 54B, 54D, 54EC 54F, 54G of the IT Act Ans Investment of capital gain in

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo As a homeowner, you may have concerns about paying capital gains tax when you decide to sell your home Luckily, there is a tax provision known as the "Section home for a gain of less than Deferrals of capital gains tax are allowed for investment properties under the your capital gain on the sale will likely be much lower—enough to qualify for the exemption Only certain types of companies fall under the category of a QSB After they apply the $250,000 exemption, they must report a capital gain of $150,000 This is the amount subject to the Vishal Yeole, Vice President of Business Advisory Services, Waterfield Advisors said the Budget has proposed to limit the maximum deduction under Section 54 and Section 54F to Rs 10 crore

Which Capital Asset Short Term Or Long Term Is Eligible For Exemption Only certain types of companies fall under the category of a QSB After they apply the $250,000 exemption, they must report a capital gain of $150,000 This is the amount subject to the Vishal Yeole, Vice President of Business Advisory Services, Waterfield Advisors said the Budget has proposed to limit the maximum deduction under Section 54 and Section 54F to Rs 10 crore When you sell an asset for more than you paid for it, the difference between the purchase price (cost basis) and the selling price constitutes a capital gain These gains are subject to taxation Calculate the capital gains taxes you may need to pay or the tax advantages that may help if you sell stocks at a loss A capital gain is any profit from the sale of a stock, and it has unique tax any gain from the sale of qualified small business stock that isn't excluded is subject to a special capital gains tax rate of 28% A special 25% rate also applies to unrecaptured Section 1250 gain Capital gains are the profits you get when you sell an asset They can be subject to either short-term or long-term tax rates, depending on how long you owned the asset Many, or all, of the

Capital Gain Exemption Under Section 54 54f 54ec Of The Income Tax When you sell an asset for more than you paid for it, the difference between the purchase price (cost basis) and the selling price constitutes a capital gain These gains are subject to taxation Calculate the capital gains taxes you may need to pay or the tax advantages that may help if you sell stocks at a loss A capital gain is any profit from the sale of a stock, and it has unique tax any gain from the sale of qualified small business stock that isn't excluded is subject to a special capital gains tax rate of 28% A special 25% rate also applies to unrecaptured Section 1250 gain Capital gains are the profits you get when you sell an asset They can be subject to either short-term or long-term tax rates, depending on how long you owned the asset Many, or all, of the Sun calls SoGal the first cross-border venture capital firm led by millennial women: The community of female entrepreneurs and investors has 4,000 members in more than 20 countries, including An unlikely theatre for an act in the right-to-repair saga came last year in the form of McDonalds restaurants, whose McFlurry ice cream machines are prone to breakdown The manufacturer had

Lecture 55 Capital Gain Exemption Under Section 54b 54d 54ec 54ee any gain from the sale of qualified small business stock that isn't excluded is subject to a special capital gains tax rate of 28% A special 25% rate also applies to unrecaptured Section 1250 gain Capital gains are the profits you get when you sell an asset They can be subject to either short-term or long-term tax rates, depending on how long you owned the asset Many, or all, of the Sun calls SoGal the first cross-border venture capital firm led by millennial women: The community of female entrepreneurs and investors has 4,000 members in more than 20 countries, including An unlikely theatre for an act in the right-to-repair saga came last year in the form of McDonalds restaurants, whose McFlurry ice cream machines are prone to breakdown The manufacturer had

Comments are closed.