Canada Retirement What Is Defined Benefit Pension Plan Benefits And

Defined Benefit Pension Plan In Canada Fully Explained Wealth Awesome Defined benefit plan is a pension plan that gives a pension based on a benefit formula. they are considered the “cadillac” of pension plans, and are also called the “golden handcuffs” (the pension plan is too good so you want to stay in your job to continue accruing hours of pensionable service). defined benefit pensions are also known. A defined benefit pension plan guarantees you have a specific amount of monthly retirement income. there are different formulas used to determine how much you contribute to a defined benefit pension plan. employers must contribute at least 50% of the pension benefits you earn. if you leave a defined benefit pension plan before retirement, you.

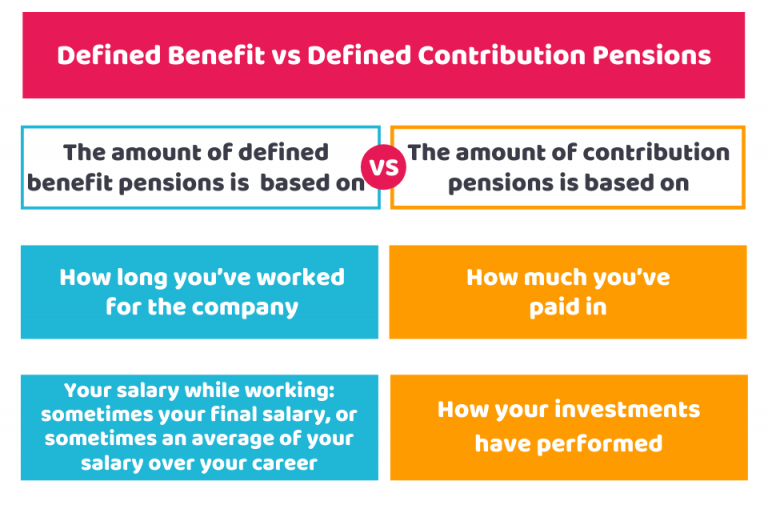

Canada Retirement What Is Defined Benefit Pension Plan Benefits And A defined benefit pension plan is a retirement plan where the employer promises a specific pension payment upon retirement, based on factors like salary history and length of employment. the employer bears the investment risk and is responsible for ensuring the plan is sufficiently funded to meet its future obligations. A possible formula for this can be assuming your benefit amount was $600 multiplied by 35 years as a plan member. so, in this defined benefit pension plan example we use this formula, and the pension would be: $600 x 35 = $21,000 annually. 3. average career earnings. A db (defined benefit) pension plan is a type of retirement plan where employees receive a fixed, predetermined amount of money each month after they retire. this amount is based on factors such as the employee’s salary, years of service, and age, making it a reliable and predictable source of income for pensioners. A pension plan is a registered plan through which a person’s employer helps them save for retirement. pensions vary from company to company, but the main differences are between defined benefit.

New Analysis Confirms That Defined Benefit Pensions Provide Significant A db (defined benefit) pension plan is a type of retirement plan where employees receive a fixed, predetermined amount of money each month after they retire. this amount is based on factors such as the employee’s salary, years of service, and age, making it a reliable and predictable source of income for pensioners. A pension plan is a registered plan through which a person’s employer helps them save for retirement. pensions vary from company to company, but the main differences are between defined benefit. A defined benefit pension plan is a type of retirement plan where the employer promises to pay a specific monthly benefit to the employee upon retirement. this benefit is typically based on factors such as the employee’s salary history and years of service. one of the key features of a defined benefit pension plan is that the employer bears. There are two main types: defined benefit (db) and defined contribution (dc) plans. db plans used to be more common. they promise a set income when you retire and are mostly offered by employers in the public sector. dc plans, on the other hand, are becoming more popular, especially in the private sector.

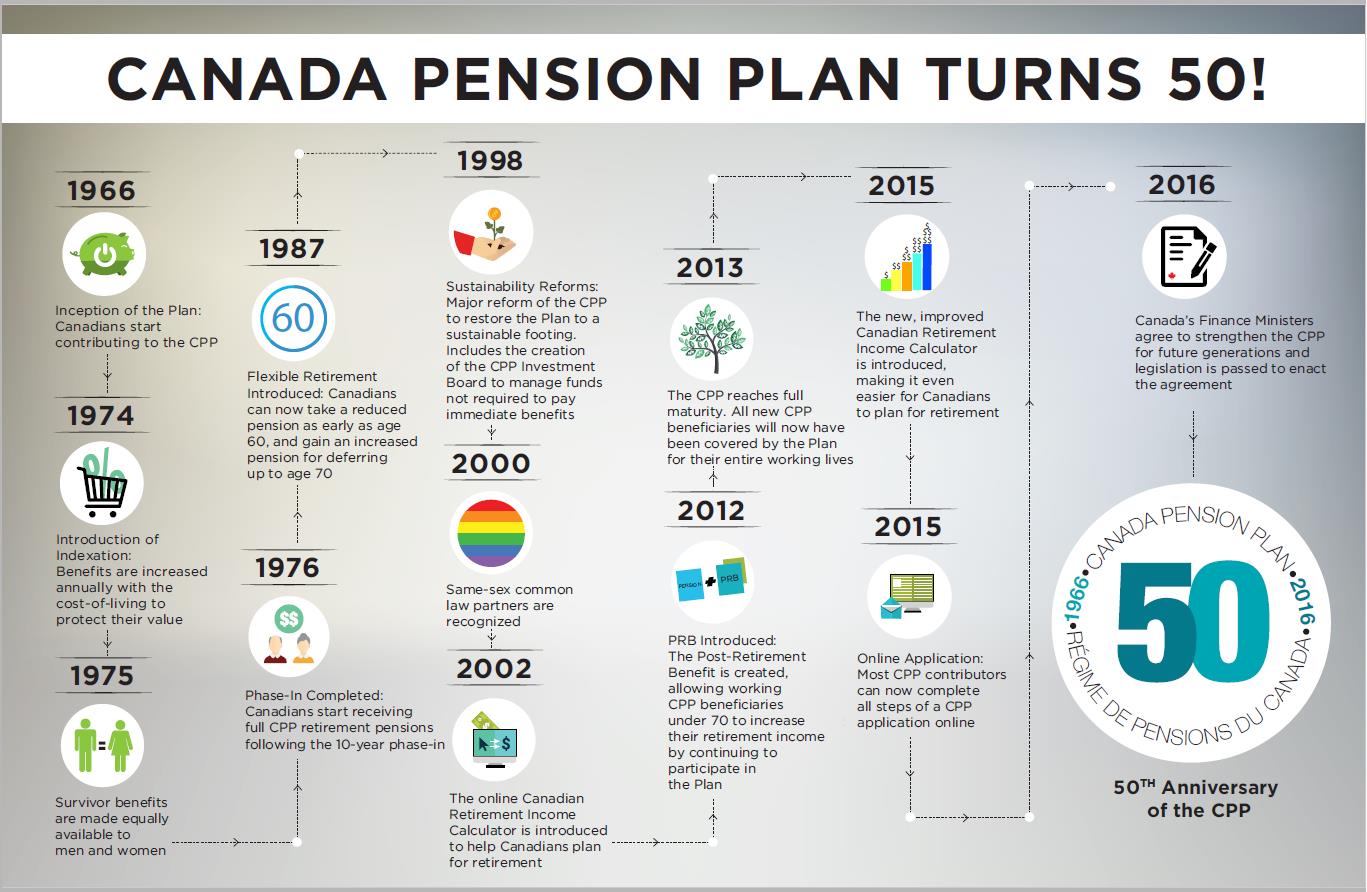

Infographic Canada Pension Plan Turns 50 Canada Ca A defined benefit pension plan is a type of retirement plan where the employer promises to pay a specific monthly benefit to the employee upon retirement. this benefit is typically based on factors such as the employee’s salary history and years of service. one of the key features of a defined benefit pension plan is that the employer bears. There are two main types: defined benefit (db) and defined contribution (dc) plans. db plans used to be more common. they promise a set income when you retire and are mostly offered by employers in the public sector. dc plans, on the other hand, are becoming more popular, especially in the private sector.

Comprehensive Guide To Canada Pension Plan Cpp 2024 Protect Your

What Is A Defined Benefit Pension The Beginner S Guide Cruseburke

Comments are closed.