Can I Save A W2 For Next Year How To File Taxes When You Re Self Employed

Can I Save A W2 For Next Year How To File Taxes When You Re Self Employed Next, apply the 15.3% tax rate to the amount subject to the self employment tax. then, divide the number by four to arrive at the amount you should pay the irs every quarter. (remember that you. Self employed individuals generally must pay self employment (se) tax as well as income tax. se tax is a social security and medicare tax primarily for individuals who work for themselves. it is similar to the social security and medicare taxes withheld from the pay of most wage earners. in general, the wording "self employment tax" only refers.

Can You File Self Employed Taxes With W2 Form Employment Form Filing taxes when you’re self employed can be, well, taxing. but there are steps you can take to make the process easier. the steps are: 1. start early: mark when tax returns are due. 2. decide. Self employed people pay self employment taxes. as a business, you are required to pay self employment taxes, which include social security and medicare taxes. these need to be paid by anyone who works for themselves and earns $400 or more in 2024. self employment taxes are assessed on a percentage of your net earnings. As a sole proprietor, on the other hand, you’re responsible for 100% of these taxes. these taxes are referred to as self employment taxes and currently, the self employment tax rate is 15.3% of. Here’s how you’d calculate your self employment taxes: determine your self employment tax base. multiply your net earnings by 92.35% (0.9235) to get your tax base: $50,000 x 92.35% = $46,175.

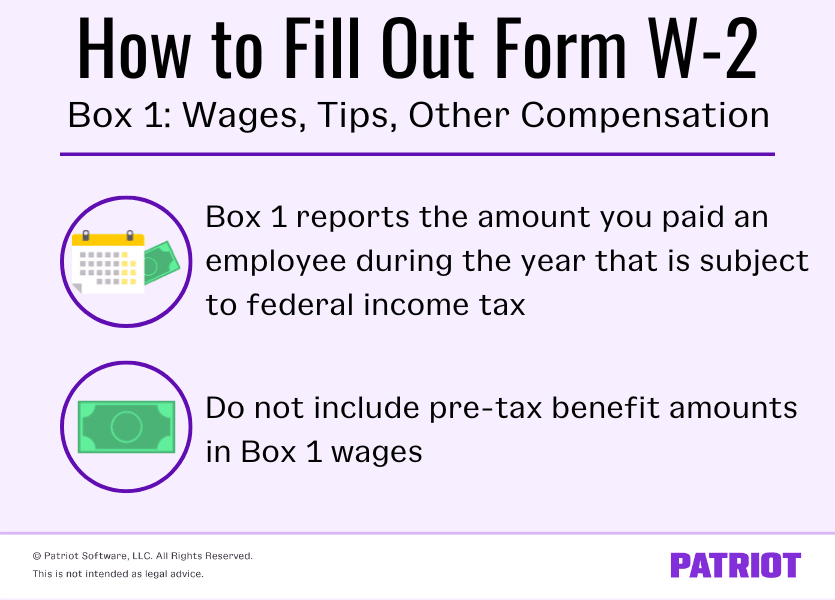

How To Fill Out Form W 2 Online W 2 Form Generator As a sole proprietor, on the other hand, you’re responsible for 100% of these taxes. these taxes are referred to as self employment taxes and currently, the self employment tax rate is 15.3% of. Here’s how you’d calculate your self employment taxes: determine your self employment tax base. multiply your net earnings by 92.35% (0.9235) to get your tax base: $50,000 x 92.35% = $46,175. Schedule se for sole proprietors. you generally must pay self employment taxes if you have a profit of $400 or more as a sole proprietor or other self employed person. but as mentioned earlier, you can also deduct 50% of the self employment tax you must pay. Filing self employment taxes is fairly straightforward. you basically tell the irs how much you earn and subtract business expenses from that amount. then, you calculate the tax you owe and pay it.

How To File Taxes Without W2 The Simple Guide Schedule se for sole proprietors. you generally must pay self employment taxes if you have a profit of $400 or more as a sole proprietor or other self employed person. but as mentioned earlier, you can also deduct 50% of the self employment tax you must pay. Filing self employment taxes is fairly straightforward. you basically tell the irs how much you earn and subtract business expenses from that amount. then, you calculate the tax you owe and pay it.

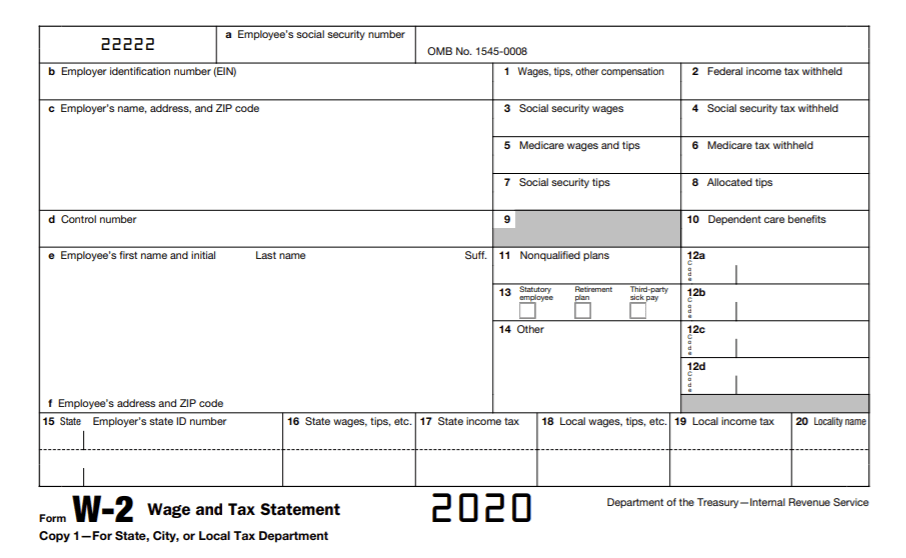

How To Fill Out Form W 2 Detailed Guide For Employers

How To File Tax Return With Just W2 Youtube

Comments are closed.