Can I Retire At 60 With 700 000 In Retirement Savings Retirement

Can I Retire At 60 With 700 000 In Retirement Savings Retirement 125. $18,534,962. $0. $85,000. $787,735. this calculator helps to estimate how much you need to retire. can you retire with $700,000? will $700k be enough? try changing the values in the calculator box. Retirement age: enter the age you plan to retire. age 67 is considered full retirement age (when you get your full social security benefits) for people born in 1960 or later. life expectancy: this.

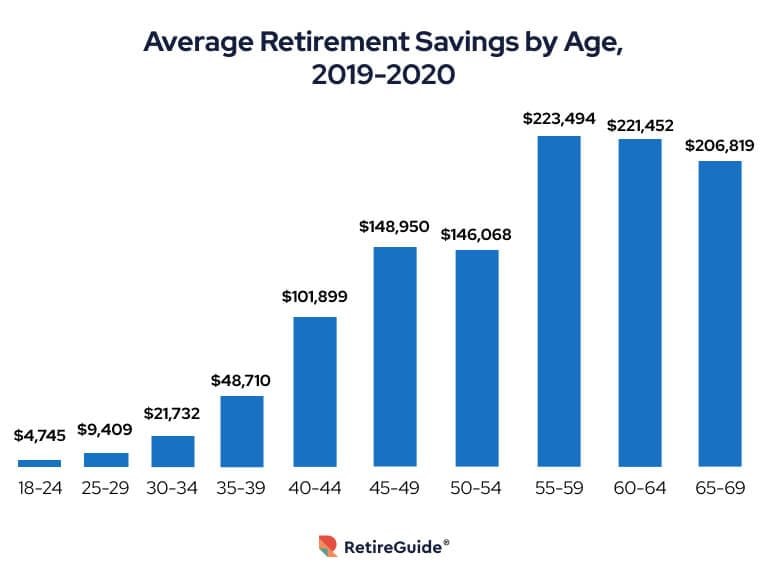

Retirement Savings By Age Chart Simple retirement savings calculator. your savings will run out by age 120. in a real world scenario, anything can happen. small changes in inflation or investment return can have huge impacts on retirement savings. this calculator does not factor in taxes. it converts into today's dollars. scroll down to see a breakdown by age. How long will $700,000 last in retirement? thinking about retiring with around $700k in savings? here's how to determine how long it will last you and what might impact the overall length of time. Our retirement calculator with pension and social security is an online tool designed to help you estimate the savings needed for a comfortable retirement based on your current financial status, savings rate, and retirement goals. the calculator accounts for variables such as inflation, expected returns, and life expectancy to help you evaluate. Assuming you save 15% a year, get 2% annual pay raises and earn a 5% yearly rate of return on your original $75,000 plus your annual savings, you would end up with a nest egg at age 65 of roughly.

Best Retirement Age Full Age For Benefits Average Savings Needed Our retirement calculator with pension and social security is an online tool designed to help you estimate the savings needed for a comfortable retirement based on your current financial status, savings rate, and retirement goals. the calculator accounts for variables such as inflation, expected returns, and life expectancy to help you evaluate. Assuming you save 15% a year, get 2% annual pay raises and earn a 5% yearly rate of return on your original $75,000 plus your annual savings, you would end up with a nest egg at age 65 of roughly. Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners. This calculator can help with planning the financial aspects of your retirement, such as providing an idea where you stand in terms of retirement savings, how much to save to reach your target, and what your retrievals will look like in retirement. your current age. your planned retirement age.

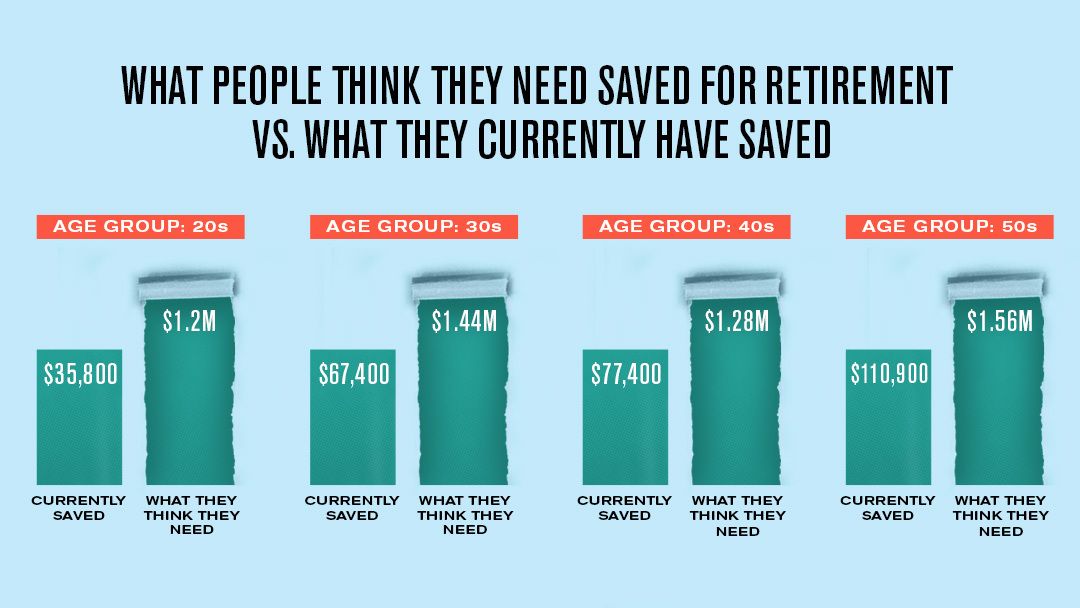

Americans Average Retirement Savings By Age And What They Think They Fidelity suggests that a person earning $50,000 a year could expect social security to replace about 35% of income, with the rest coming from savings. but this share is lower for high earners. This calculator can help with planning the financial aspects of your retirement, such as providing an idea where you stand in terms of retirement savings, how much to save to reach your target, and what your retrievals will look like in retirement. your current age. your planned retirement age.

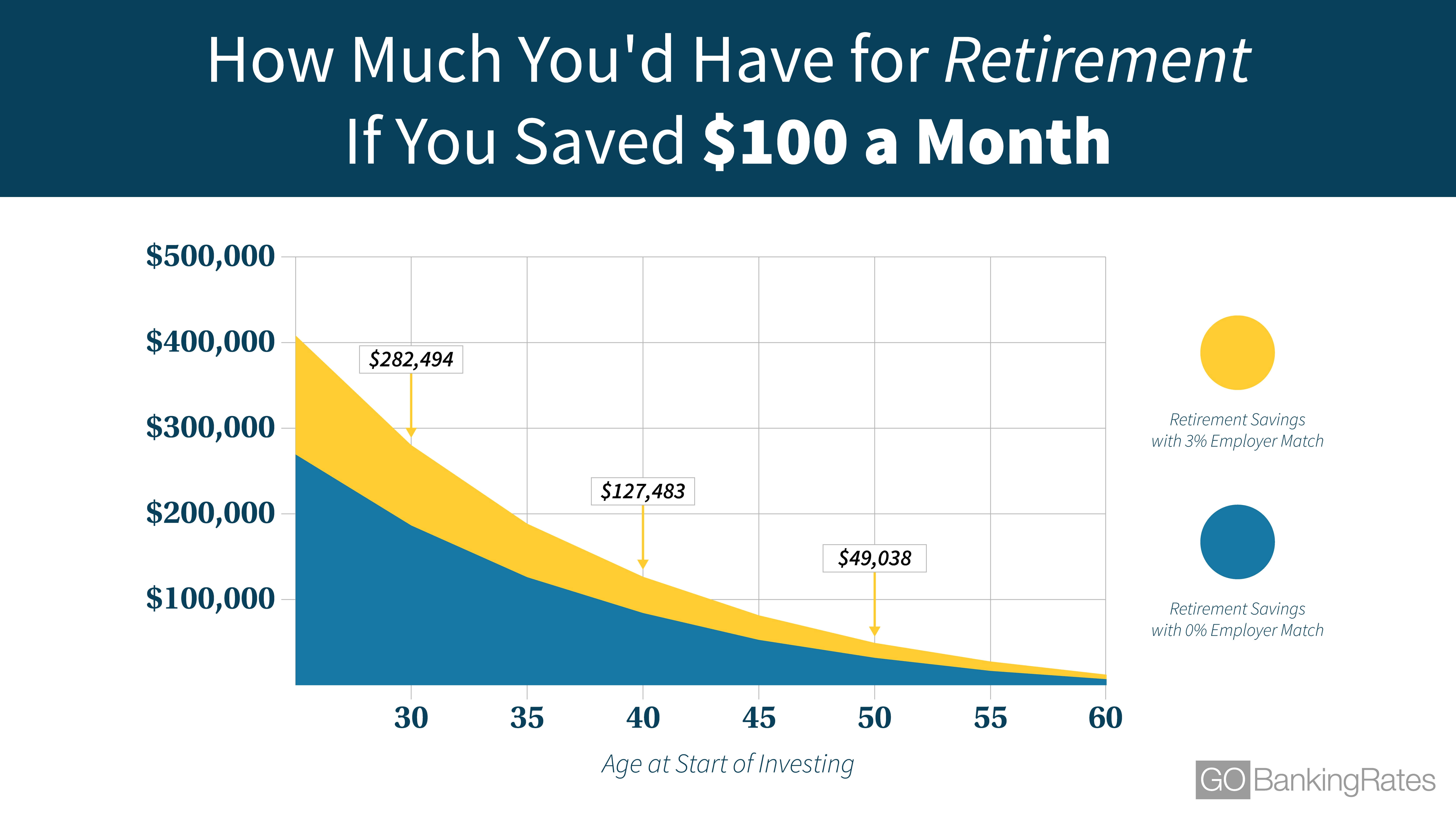

Can You Retire By Saving One Hundred Dollars A Month Gobankingrates

Comments are closed.