Calculating Capitalization Rate For Real Estate

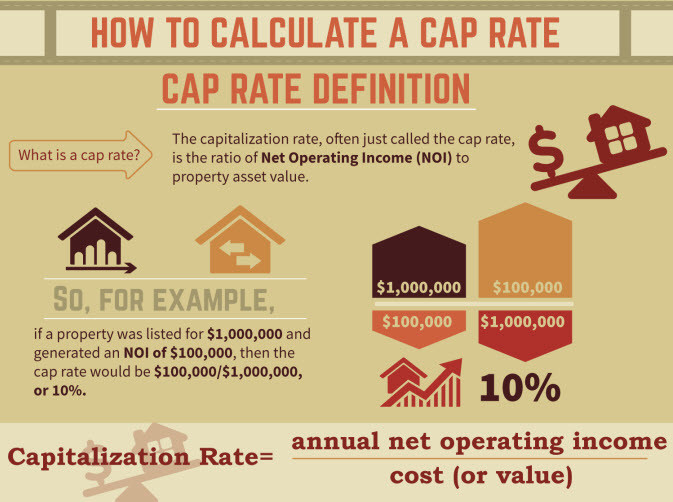

The Beginner S Guide To The Cap Rate Calculation In Real Estate Mashvisor For this cap rate formula example, let’s say the net operating income is $50,000 per year. now that we have all the variables, the next step is dividing the noi ($50,000) by the purchase price current market value ($750,000): $50,000 ÷ $750,000 = 0.0667. the answer you get is 0.0667. The cap rate calculator, alternatively called the capitalization rate calculator, is a tool for everyone interested in real estate. as the name suggests, it calculates the cap rate based on the value of the real estate property and the income from renting it. you can use it to decide whether a property's price is justified or determine the.

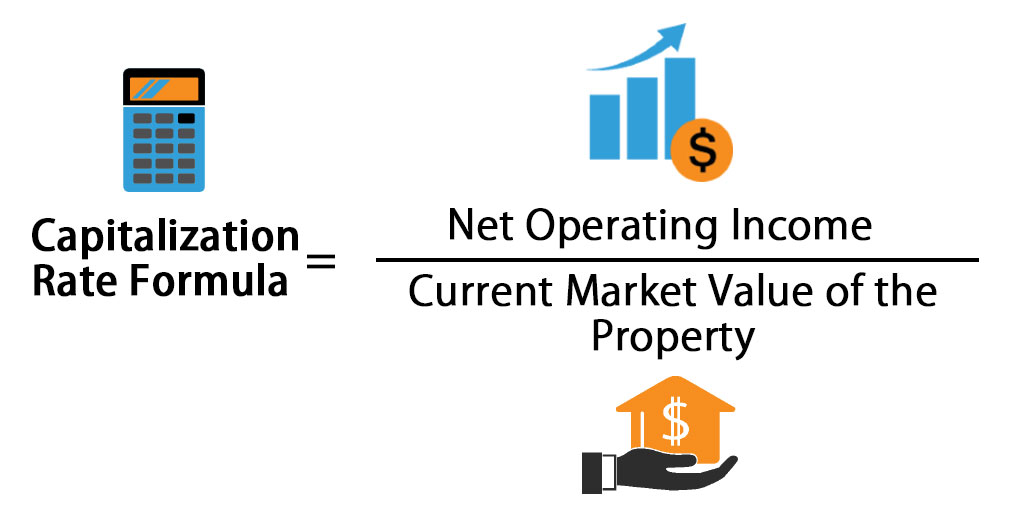

Understanding Cap Rate In Commercial Real Estate The cap rate calculator can be used to accurately calculate the capitalization rate of real estate. in the real estate lending and appraisal sector, the cap rate is a valuable metric that uses the amount of income a property is able to generate as the means of estimating that property's value. For instance, say the net operating income of a property is $50,000, and it is expected to rise by 2% annually. if the investor’s expected rate of return is 10% per annum, then the net cap rate. Investors use the cap rate as a quick guide to an investment’s value compared to other similar real estate investments. but as an indicator, the cap rate leaves out important aspects of a real estate investment such as the leverage undertaken to purchase and develop a property, and the time it will take to realize cash flows from improvements. The capitalization rate is a profitability metric used to determine the return on investment of a real estate property. the formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. the capitalization rate can be used to determine the riskiness of an investment opportunity – a.

:max_bytes(150000):strip_icc()/how-to-calculate-capitalization-rate-for-real-estate-2866786_v4-5b87061f46e0fb002538d596.png)

Calculating Capitalization Rate For Real Estate Investors use the cap rate as a quick guide to an investment’s value compared to other similar real estate investments. but as an indicator, the cap rate leaves out important aspects of a real estate investment such as the leverage undertaken to purchase and develop a property, and the time it will take to realize cash flows from improvements. The capitalization rate is a profitability metric used to determine the return on investment of a real estate property. the formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. the capitalization rate can be used to determine the riskiness of an investment opportunity – a. Implied property value = $12 million ÷ 6.0% = $200 million. since net operating income (noi) and property value—the two variables in the cap rate formula—are known, we can solve for the cap rate by dividing the noi by the property value. cap rate = $12 million ÷ $200 million = 6.0%. A real estate capitalization rate, or cap rate, is a popular metric to estimate the rate of return on an investment property. the cap rate is a simple calculation of a property's noi divided.

Ultimate Commercial Real Estate Glossary Top 100 Terms You Need To Know Implied property value = $12 million ÷ 6.0% = $200 million. since net operating income (noi) and property value—the two variables in the cap rate formula—are known, we can solve for the cap rate by dividing the noi by the property value. cap rate = $12 million ÷ $200 million = 6.0%. A real estate capitalization rate, or cap rate, is a popular metric to estimate the rate of return on an investment property. the cap rate is a simple calculation of a property's noi divided.

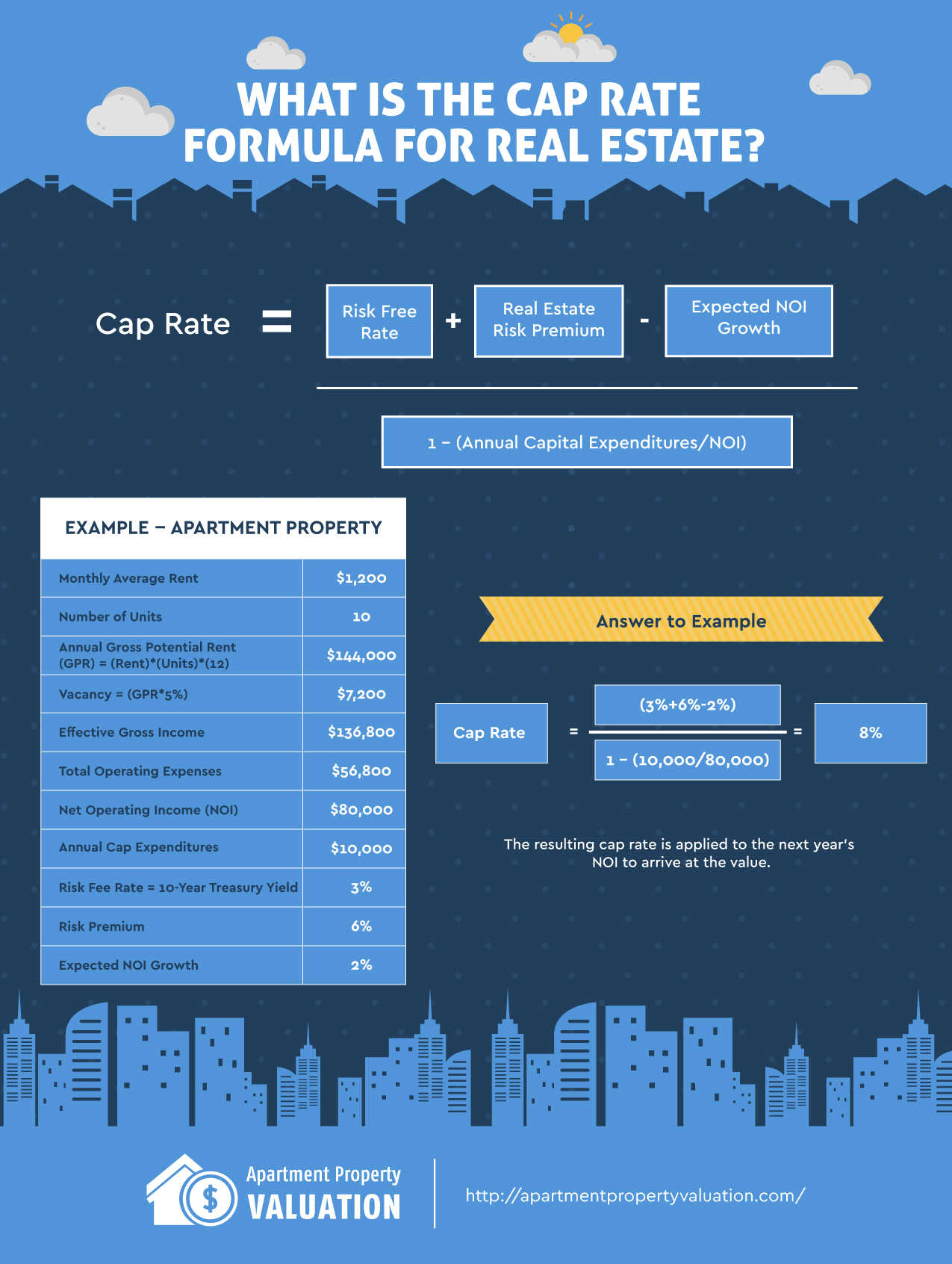

Cap Rate Formula For Real Estate Apartment Property Valuation

How To Use Cap Rate Real Estate At Frances Lazo Blog

Comments are closed.