Buying A Property Follow The Guide Multi Prets Mortgages

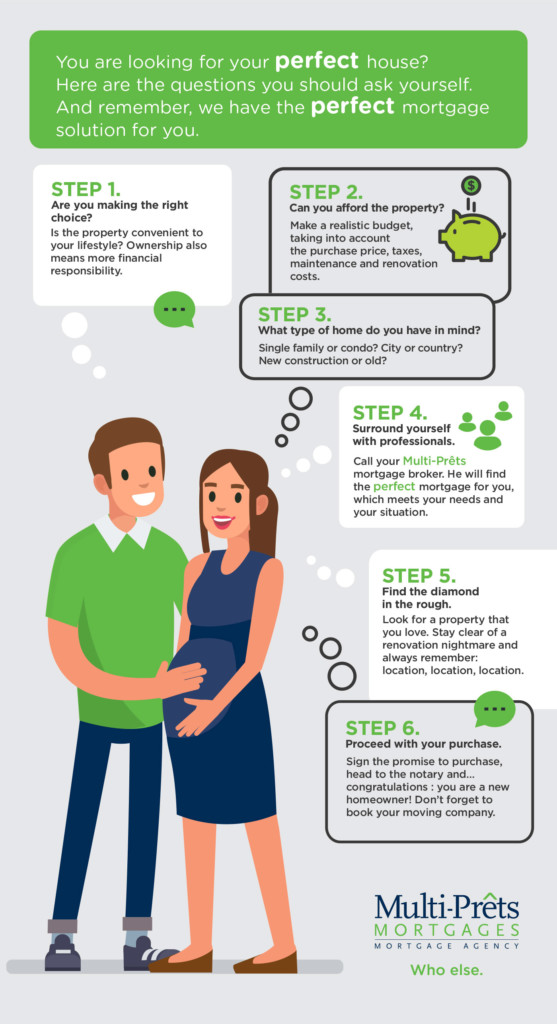

Buying A Property Follow The Guide Multi Prêts Mortgages Is the property in question convenient to your lifestyle and priorities? ownership does have its benefits, but that also means more financial responsibility and stress. step 2. can you afford the property? when buying a house, you must not only consider the purchase price and taxes, but also take into account the maintenance and renovation costs. How your multi prêts broker can help you. weigh the pros and cons, and decide whether you want to be a tenant or an owner. establish your budget so you can focus your search on a property you can afford. determine your downpayment and save as much as you can. calculate all costs associated with the purchase of a property.

Evaluating A House S Market Value Multi Prêts Mortgages By denis doucet what you’ll learn the five step process during a property acquisition to make it a little easier, here’s a handy step by step guide to follow when purchasing a new property: step 1. are you making the right choice? is the property in question convenient to your lifestyle and priorities? ownership does have its benefits, […]. It grants eligible families a crédit d’accession—an interest free loan equivalent to 5.5% of the property’s selling price. if the house is novoclimat certified, the owners receive an additional 3.5% direct rebate on their mortgage. therefore, when they resell the home, they must repay either 5.5% or 9% of the capital gain realized on the. Your multi prêts mortgage broker has in mind your interests not only in terms of interest rates, but also by thinking of the product that best fits your client profile while satisfying your needs. whether for the most suitable closing costs or even the most convenient flexibility for you. his mortgage expertise will help you be better informed. Find the up and coming neighborhoods. navigate the mortgage and preapproval process. negotiate with sellers and handle potential bidding wars. juggle paperwork and prepare for closing. a good agent will play an especially important role in guiding home buyers through many of the later steps on this home buying checklist.

The Complete Guide To Buying A Property Property Road Your multi prêts mortgage broker has in mind your interests not only in terms of interest rates, but also by thinking of the product that best fits your client profile while satisfying your needs. whether for the most suitable closing costs or even the most convenient flexibility for you. his mortgage expertise will help you be better informed. Find the up and coming neighborhoods. navigate the mortgage and preapproval process. negotiate with sellers and handle potential bidding wars. juggle paperwork and prepare for closing. a good agent will play an especially important role in guiding home buyers through many of the later steps on this home buying checklist. Buying a multifamily property is a popular way to get started in real estate investing. multifamily homes help you earn a steady cash flow from multiple rental units and benefit from potential price appreciation. the process involves several steps, however, including deciding how you’ll finance and manage the property. Generally speaking, buying a home can take anywhere between 12 weeks and eight months (roughly). below is our timeline illustrating what the homebuying process typically involves in england, wales and northern ireland. (we've got a separate guide for scotland.) we've split this into 10 stages, but do be mindful that timescales can vary.

A Practical Guide To Owning Income Property Multi Prêts Mortgages Buying a multifamily property is a popular way to get started in real estate investing. multifamily homes help you earn a steady cash flow from multiple rental units and benefit from potential price appreciation. the process involves several steps, however, including deciding how you’ll finance and manage the property. Generally speaking, buying a home can take anywhere between 12 weeks and eight months (roughly). below is our timeline illustrating what the homebuying process typically involves in england, wales and northern ireland. (we've got a separate guide for scotland.) we've split this into 10 stages, but do be mindful that timescales can vary.

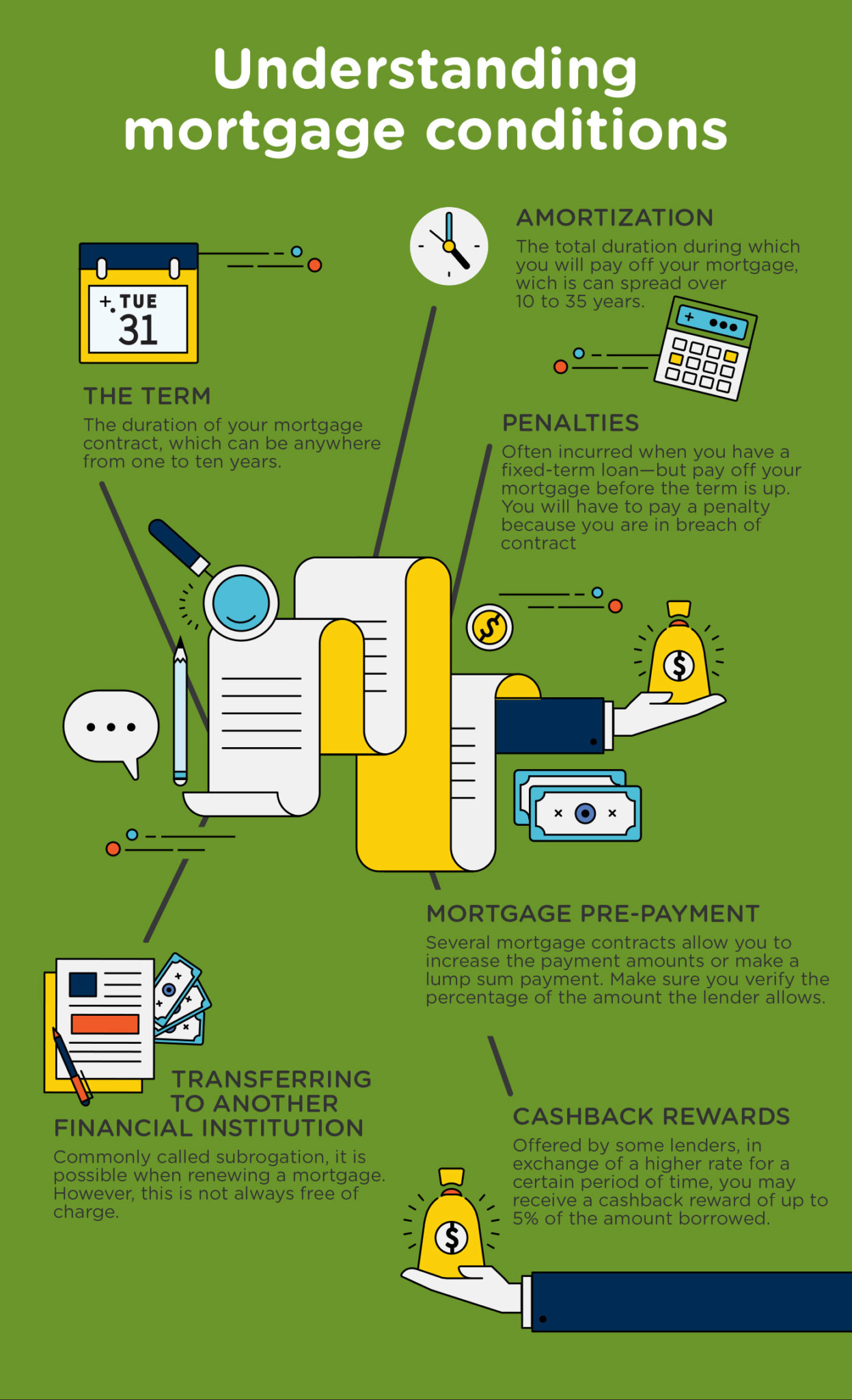

Understanding Mortgage Conditions Multi Prêts Mortgages

Buying A House Without A Down Payment Multi Prêts Mortgages

Comments are closed.