Business Loan Requirements What You Need To Know

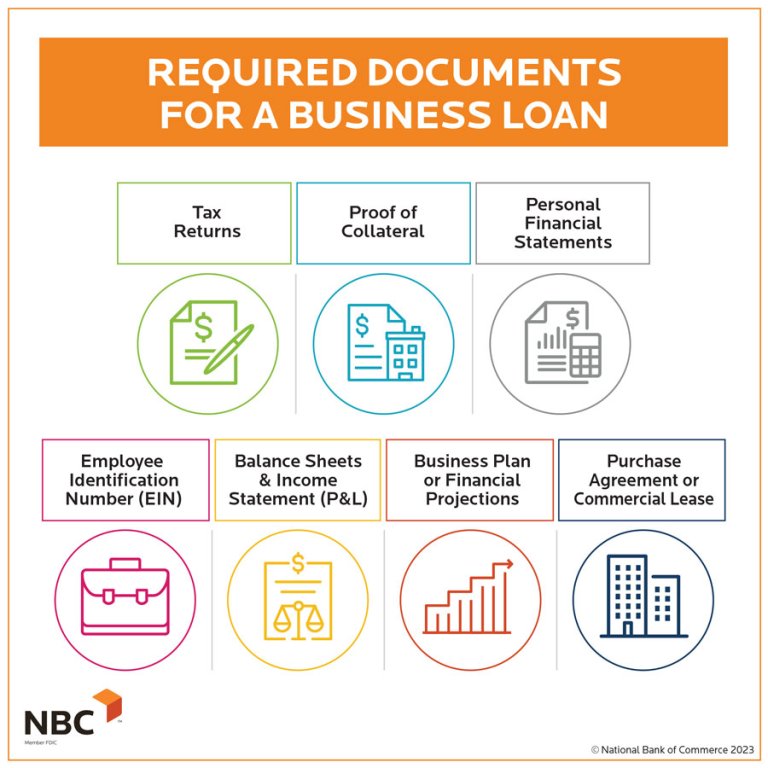

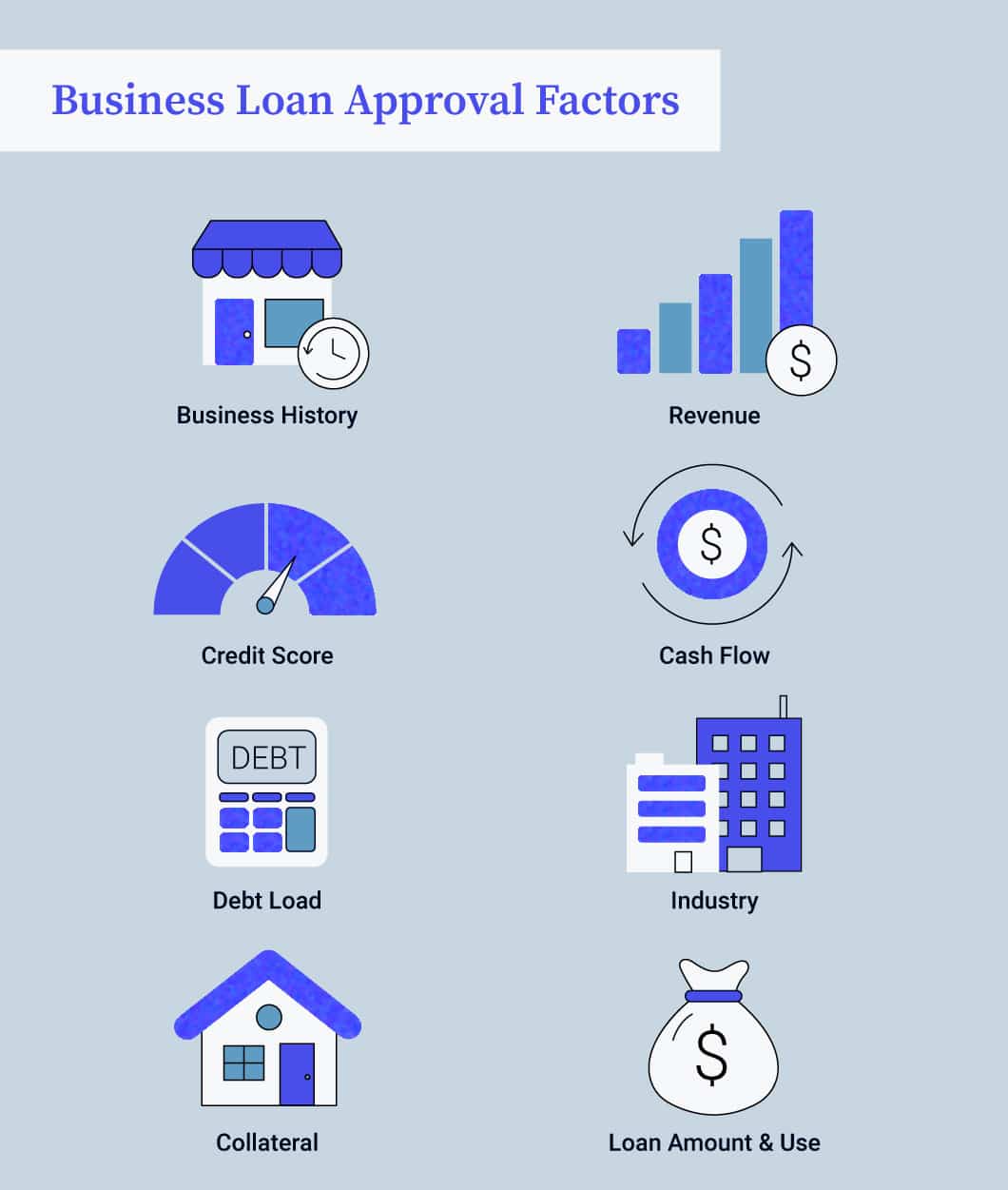

How To Qualify For A Business Loan Required Documents More Business loan requirements: 1. personal and business credit scores; 2. annual revenue; 3. years in business; 4. business industry and size. Most lenders will want to know how you decided on the exact amount of funding you need and what you intend to use the loan funds for. making big business changes just before applying.

Business Loan Requirements 6 Things You Need To Get A Loan To help you qualify for a small business loan, we’ve identified eight common requirements for a business loan. 1. annual revenue requirement. while revenue requirements vary by lenders, most. These loans, which include both traditional loans and equipment loans, can be funded within a day in some cases. 2. check your eligibility. although business loan requirements vary, here are four. 2. gross revenue. common lender criteria: you may be required to show your business’s sales or revenue numbers. this business loan requirement varies by lender — it could be anywhere from. Yes, business loan lenders evaluate your personal credit score —the same score you use to buy a car or get a personal loan. most small business lenders ask for a score of at least 620; if you have a lower score, expect to have limited choices. as a general rule, as your credit score increases, so do your credit options.

Business Loan Requirements For Faster Funding Fast Capital 360 2. gross revenue. common lender criteria: you may be required to show your business’s sales or revenue numbers. this business loan requirement varies by lender — it could be anywhere from. Yes, business loan lenders evaluate your personal credit score —the same score you use to buy a car or get a personal loan. most small business lenders ask for a score of at least 620; if you have a lower score, expect to have limited choices. as a general rule, as your credit score increases, so do your credit options. Get $500 to $5.5 million to fund your business. loans guaranteed by sba range from small to large and can be used for most business purposes, including long term fixed assets and operating capital. some loan programs set restrictions on how you can use the funds, so check with an sba approved lender when requesting a loan. Term loan: minimum annual revenue starts at $96,000. line of credit: minimum annual revenue typically starts at $50,000. invoice factoring: this type of financing usually requires a minimum of $10,000 in monthly invoices. equipment financing: revenue requirements vary widely, but generally start at $50,000.

What Are The Requirements To Get A Business Loan Iifl Finance Get $500 to $5.5 million to fund your business. loans guaranteed by sba range from small to large and can be used for most business purposes, including long term fixed assets and operating capital. some loan programs set restrictions on how you can use the funds, so check with an sba approved lender when requesting a loan. Term loan: minimum annual revenue starts at $96,000. line of credit: minimum annual revenue typically starts at $50,000. invoice factoring: this type of financing usually requires a minimum of $10,000 in monthly invoices. equipment financing: revenue requirements vary widely, but generally start at $50,000.

Comments are closed.