Business Loan Requirements 5 Essentials You Should Know Getmoney

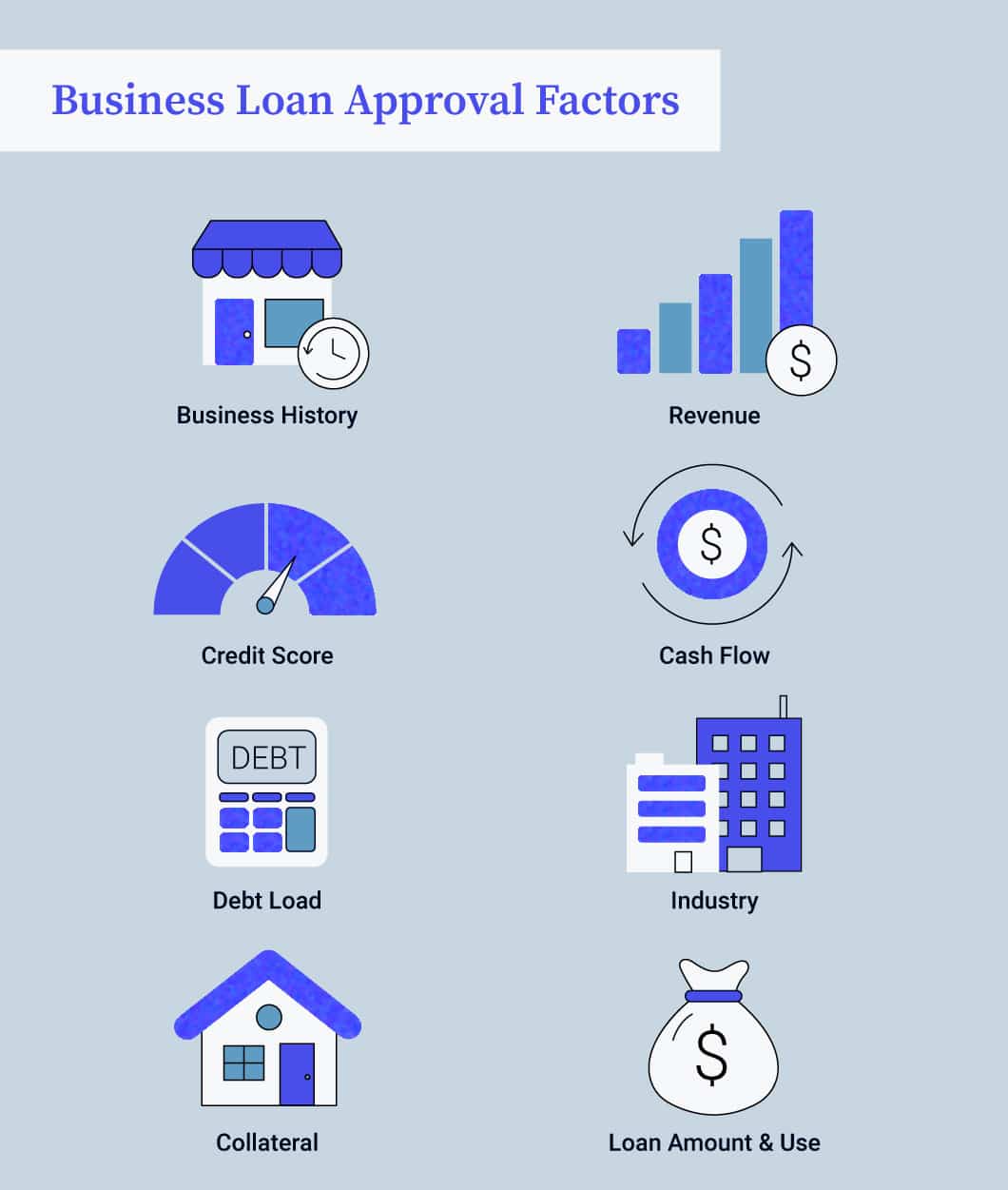

Business Loan Requirements 5 Essentials You Should Know Getmoney This business loan requirement varies by lender — it could be anywhere from $5,000 to $25,000 or more per month — and may also depend on how long you’ve been in business. like credit scores. 1. personal and business credit scores. you’ll likely need good personal credit (typically a score of 690 or higher) or excellent business credit to qualify for a government backed sba loan or.

Business Loan Requirements 5 Essentials You Should Know Getmoney These loans, which include both traditional loans and equipment loans, can be funded within a day in some cases. 2. check your eligibility. although business loan requirements vary, here are four. Business loans can help you survive difficult times, improve cash flow or grow your business. here are eight common small business loan requirements you should know. To help you qualify for a small business loan, we’ve identified eight common requirements for a business loan. 1. annual revenue requirement. while revenue requirements vary by lenders, most. 1. time in business. every lender will ask how long you have operated your business. the longer you’ve been in business, the better it is for your application because it shows a lender that your business has had long term success. ultimately, the threshold that you should keep in mind is two years.

Business Loan Requirements For Faster Funding Fast Capital 360 To help you qualify for a small business loan, we’ve identified eight common requirements for a business loan. 1. annual revenue requirement. while revenue requirements vary by lenders, most. 1. time in business. every lender will ask how long you have operated your business. the longer you’ve been in business, the better it is for your application because it shows a lender that your business has had long term success. ultimately, the threshold that you should keep in mind is two years. Yes, business loan lenders evaluate your personal credit score —the same score you use to buy a car or get a personal loan. most small business lenders ask for a score of at least 620; if you have a lower score, expect to have limited choices. as a general rule, as your credit score increases, so do your credit options. Baseline small business loan requirements typically include a good credit rating and an annual income of at least $20,000 (if you’re new in the business, some lenders will go as low as $10,000). however, since exact requirements vary from lender to lender, we’ve reviewed an assortment of lenders who can work around your unique needs.

Comments are closed.