Breakdown Of The Costs Of Buying A Home In 2023

2023 Housing Forecast What To Expect With Rates Prices And The Closing costs on a $100,000 mortgage might be $5,000 (5%), but on a $500,000 mortgage they’d likely be closer to $10,000 (2%). in addition, mortgage closing costs are often a smaller percentage. That’s a total of $116,300 for upfront costs. for ongoing costs, factor in the $2,300 monthly mortgage payment, plus property taxes, homeowners insurance, utilities and hoa fees. and don’t.

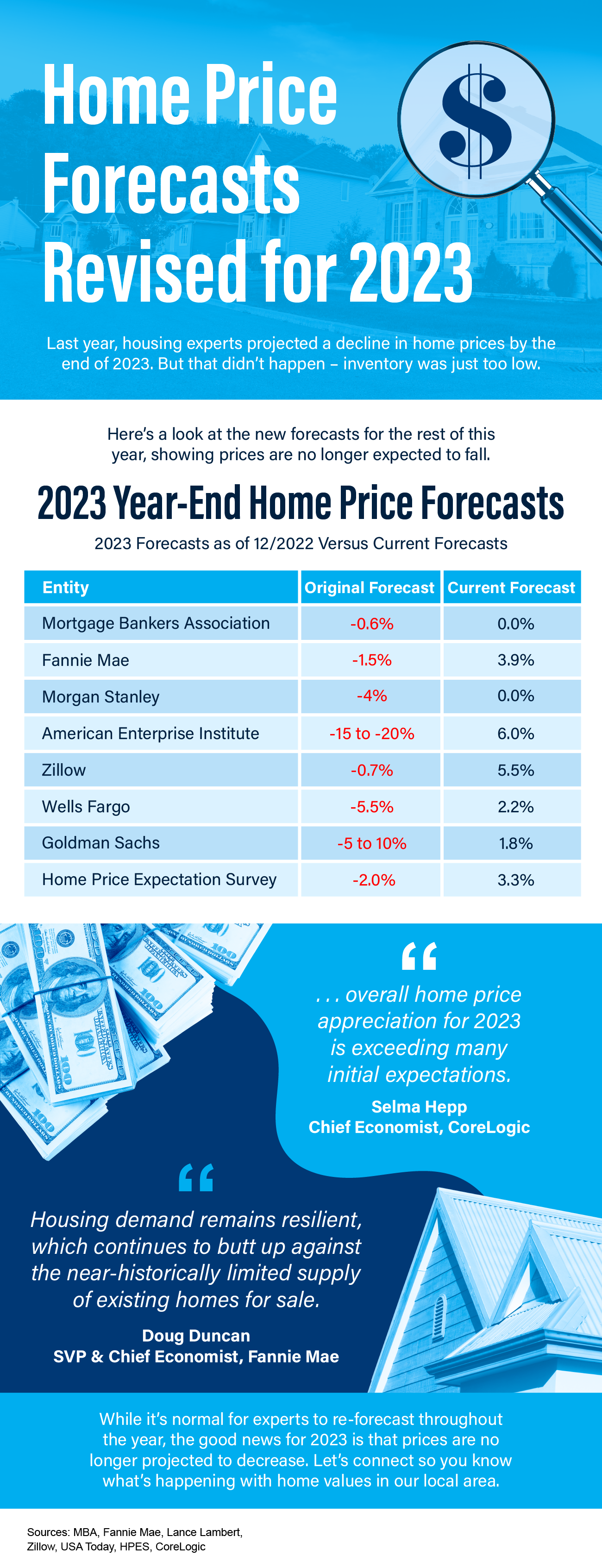

Home Price Forecasts Revised For 2023 Infographic Richardson Costs of buying a home #1: earnest money. to prove you’re “earnest” in your purchase commitment, expect to plunk down 1% to 2% of the total purchase price as an earnest money deposit. this. Home inspection how much it costs: $300 to $1,000, depending on where you live and the home’s size. lenders don’t require a home inspection, but you should always get one for a top to bottom look at all the working (and nonworking) parts of the home you’re buying. home warranty how much it costs: from $220 to just over $1,800. Closing costs are typically 2% to 5% of the loan amount. for a $350,000 home loan, this would put closing costs around $7,000 to $17,500. several costs go into closing, including lender fees. ally home does not charge application, origination, processing or underwriting fees. You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. alternatively, you can pay your closing costs in cash, similar to your down payment.

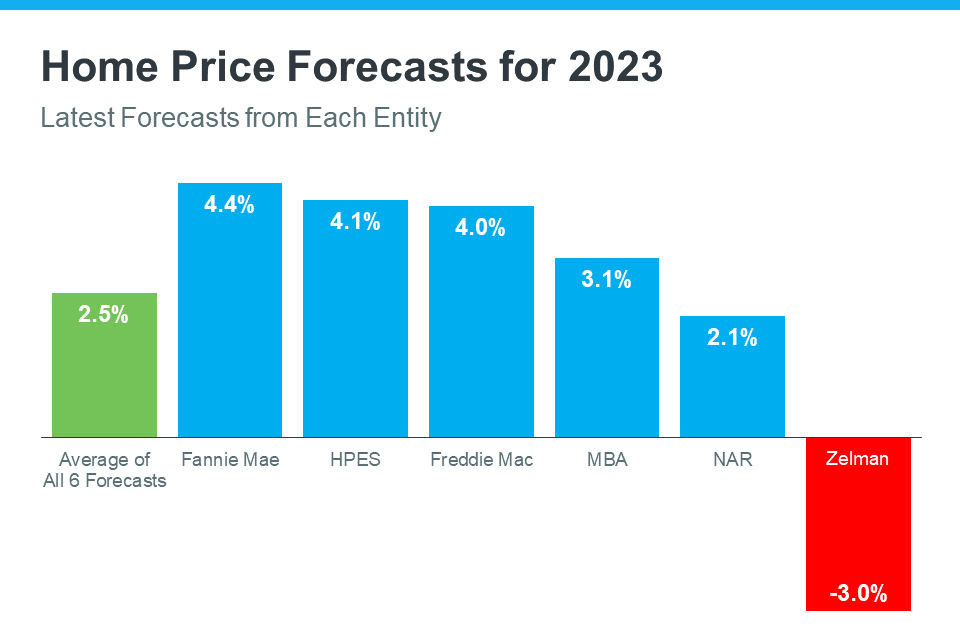

What Experts Say Will Happen With 2023 Home Prices Helping You Get Home Closing costs are typically 2% to 5% of the loan amount. for a $350,000 home loan, this would put closing costs around $7,000 to $17,500. several costs go into closing, including lender fees. ally home does not charge application, origination, processing or underwriting fees. You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. alternatively, you can pay your closing costs in cash, similar to your down payment. Even in the state’s fastest rising market—burlington—the median home cost just $132,000 ($98 per square foot) in september 2023. the area with the second highest rate of price increases. The cost of your funding fee ranges from 0.5% to 3.6% of the total loan cost, depending on a few factors like the type of home you’re buying and if you’ve used va loan benefits before. there are limits to seller concessions for va loans. as the buyer, you can’t have the seller pay more than 4% of the total loan amount in closing costs.

Buying A House In 2023 A Window Of Opportunity Emerges Even in the state’s fastest rising market—burlington—the median home cost just $132,000 ($98 per square foot) in september 2023. the area with the second highest rate of price increases. The cost of your funding fee ranges from 0.5% to 3.6% of the total loan cost, depending on a few factors like the type of home you’re buying and if you’ve used va loan benefits before. there are limits to seller concessions for va loans. as the buyer, you can’t have the seller pay more than 4% of the total loan amount in closing costs.

Home Buying And Mortgage Facts For 2023 Rocket Mortgage

Comments are closed.