Bitcoin Price Analysis After Correction Btc Facing The Critical 200

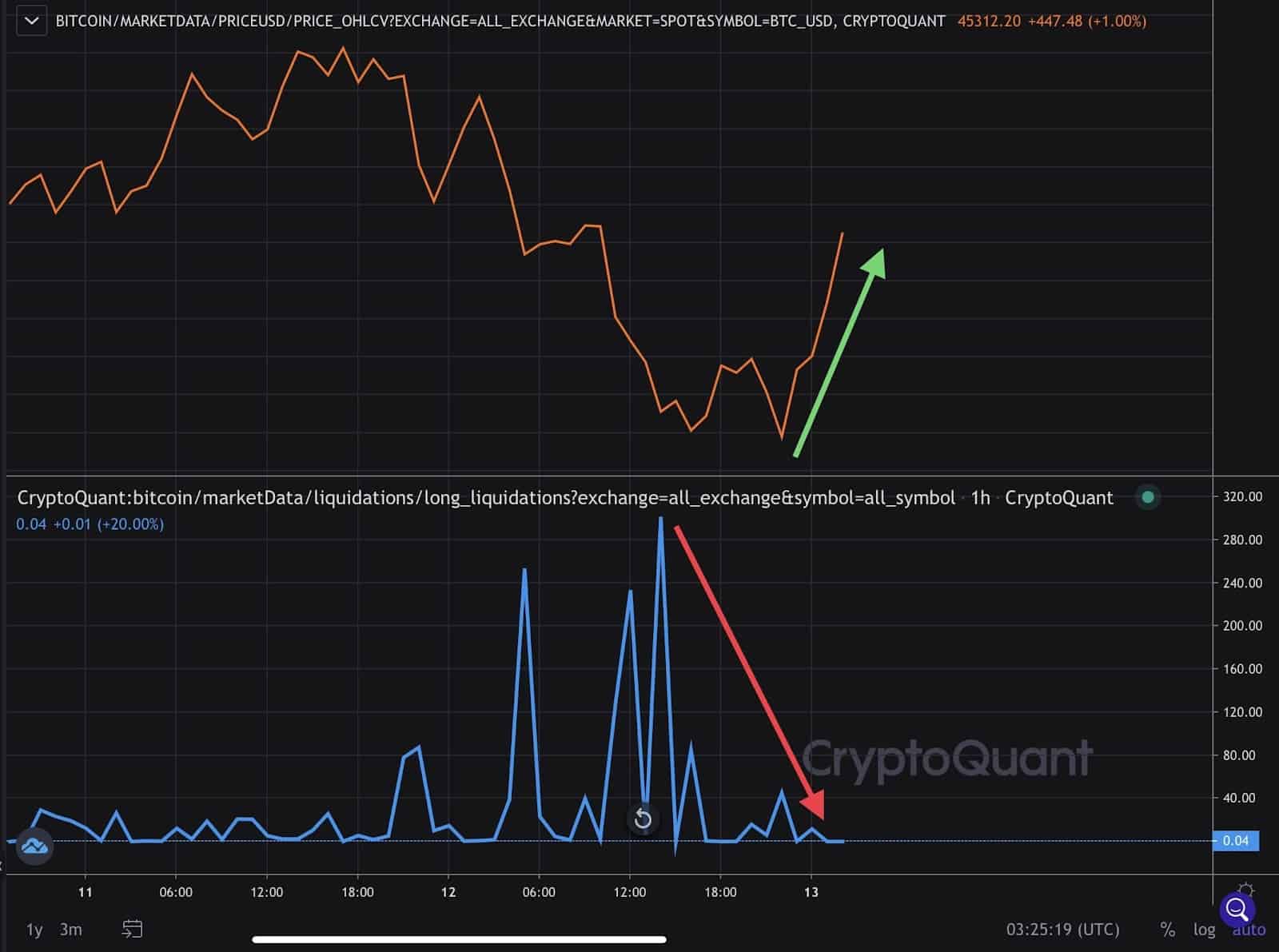

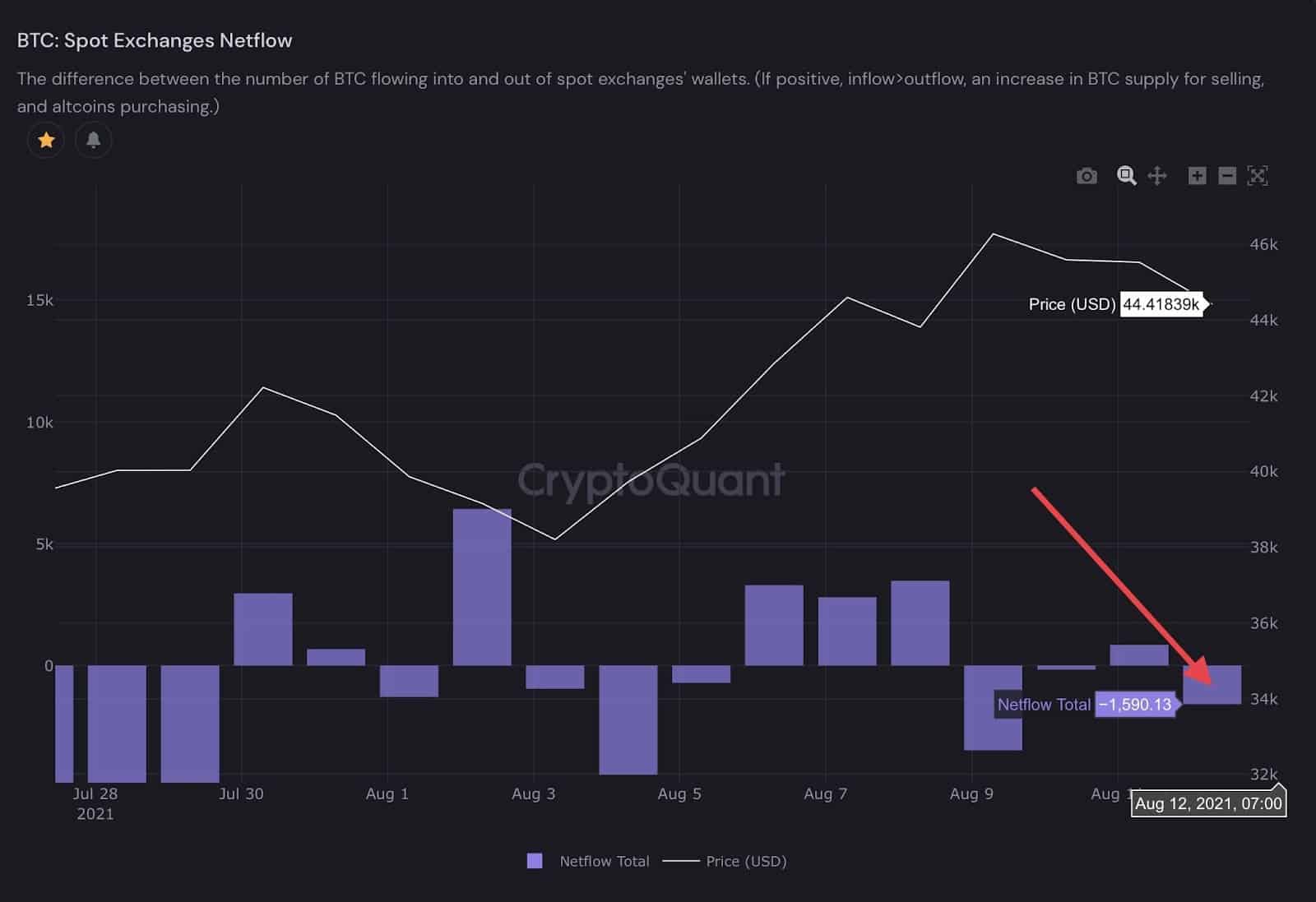

Bitcoin Price Analysis After Correction Btc Facing The Critical 200 Btc bears have been arguing the rally to the 200 day moving average is a bull trap and that whales will use this as an opportunity to dump on retail. so far, on chain data has contradicted this prediction, instead showing further accumulation and spot buying activity, something critical in a recovery phase after btc dropped more than 55% from. The daily chart: after facing rejection at the $30k resistance level in april, bitcoin’s price has been gradually declining on the daily chart. however, a recent rebound from the $25k support level has sparked a continuous rally in the past few days. the price effortlessly surpassed the 50 day moving average at around $27k and is now.

Bitcoin Price Analysis After Correction Btc Facing The Critical 200 Bitcoin price analysis. bitcoin started the next leg of the uptrend after breaking out of the $48,970 resistance on feb. 12. the bears tried to tug the price back below the breakout level and trap. In brief. bitcoin price approaches correction target of $60,000 after 17% drop from ath, with potential support at $60,270. further downside targets at $51,500 and $36,000, but bullish rebound opportunities expected above $36,000. bitcoin dominance shows mixed signals, with resistance at 60.5% and significant fib support around 49%. the bitcoin. Figure 5: btc usd, gdax, 4 hr candles, fibonacci retracement of bear run. after our initial market high around $2,700, multiple momentum indicators began to reveal that, although the price was increasing, the market was beginning to lose upward momentum — this type of price activity is called “divergence” and can be seen across the rsi, macd and volume. Bitcoin heating up above 200 day moving average, but facing a crucial resistance to break if it wants to btc usd 1 day chart. the critical resistance for bitcoin’s price is found between.

Bitcoin Price Analysis After Correction Btc Facing The Critical 200 Figure 5: btc usd, gdax, 4 hr candles, fibonacci retracement of bear run. after our initial market high around $2,700, multiple momentum indicators began to reveal that, although the price was increasing, the market was beginning to lose upward momentum — this type of price activity is called “divergence” and can be seen across the rsi, macd and volume. Bitcoin heating up above 200 day moving average, but facing a crucial resistance to break if it wants to btc usd 1 day chart. the critical resistance for bitcoin’s price is found between. The crucial levels on the downside are found at $38,500, as well as at $36,500 and $35,000. finally, the crucial resistance to breaking bitcoin’s price is found at $40,600–$41,000. if that. After recently breaching the $65,000 mark, bitcoin’s (btc) price may have hit a brick wall. while this recent price increase indicates strong bullish momentum, historical patterns suggest that btc could pull back before the rally continues. this on chain analysis highlights the indicators affirming this forecast and what investors should.

Bitcoin Price Analysis After Correction Btc Facing The Critical 200 The crucial levels on the downside are found at $38,500, as well as at $36,500 and $35,000. finally, the crucial resistance to breaking bitcoin’s price is found at $40,600–$41,000. if that. After recently breaching the $65,000 mark, bitcoin’s (btc) price may have hit a brick wall. while this recent price increase indicates strong bullish momentum, historical patterns suggest that btc could pull back before the rally continues. this on chain analysis highlights the indicators affirming this forecast and what investors should.

Bitcoin Price Analysis After Correction Btc Facing The Critical 200

Comments are closed.