Big Banks Big Complaints Cfpb S Database Reveals Trends

Big Banks Big Complaints Cfpb S Database Reveals Trends Twenty five u.s. banks account for more than 90% of all complaints to the cfpb. the banks that generated the most complaints nationally are also the largest banks in terms of billions of dollars deposited: wells fargo, bofa, and jp morgan chase. but on a per dollar basis, the banks that generated the most complaints are tcf national bank. About the data. complaints that the cfpb sends to companies for response are published in the consumer complaint database after the company responds, confirming a commercial relationship with the consumer, or after 15 days, whichever comes first. learn how the complaint process works.

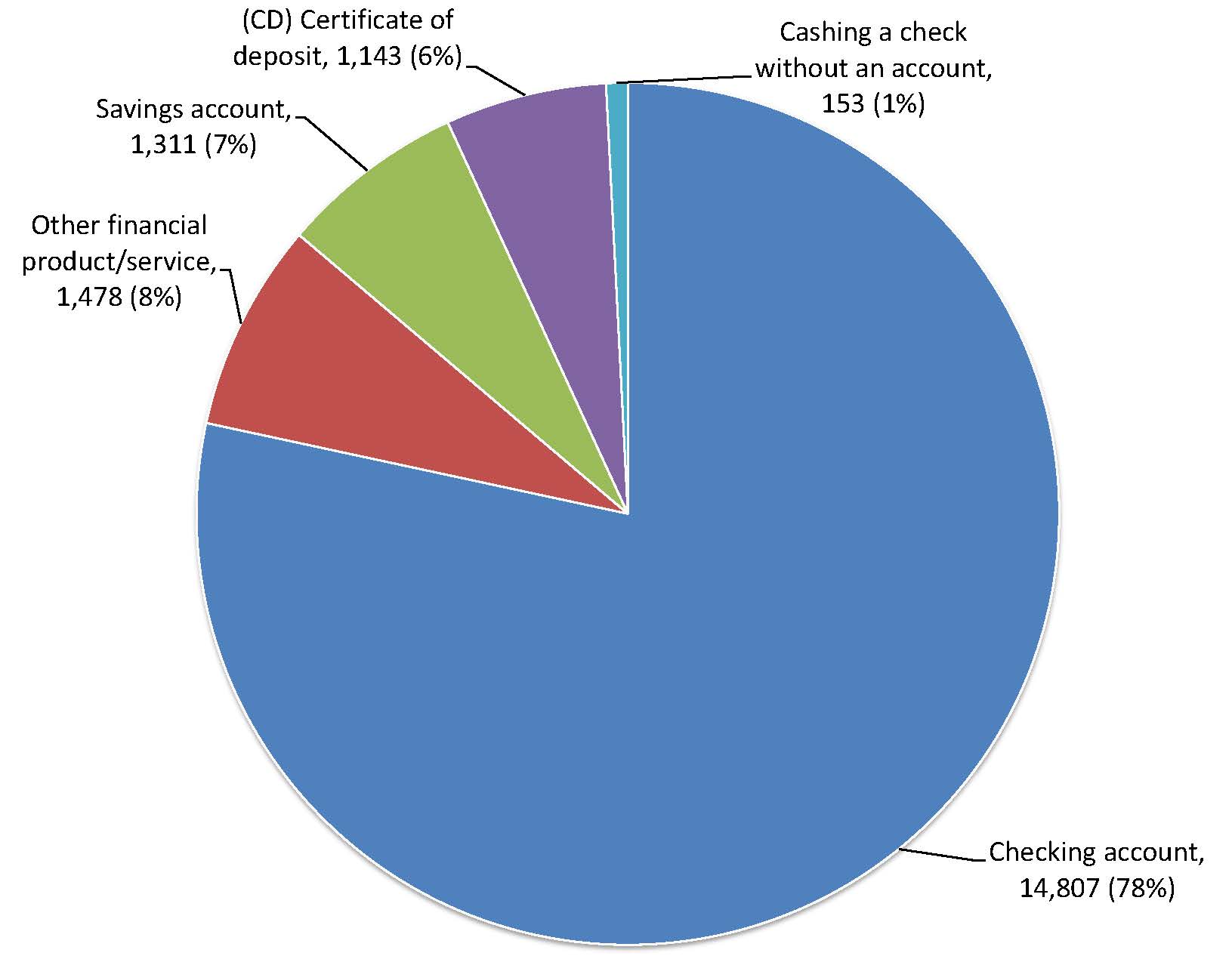

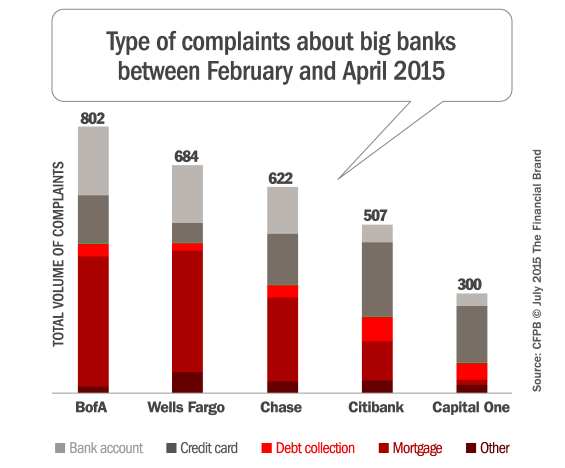

Big Banks Big Complaints Cfpb S Database Reveals Trends Figure 3. breakdown of complaints by service. problems with confusing marketing, denial of an account, fees, statements, interest, account closure and joint accounts).12 prob lems with account opening, closing or man agement were cited in 7,683 complaints, or 41 percent of all complaints. Washington, d.c. – the consumer financial protection bureau (cfpb) today reported on the first set of results from the newly updated terms of credit card plans survey. the survey data reveal that large banks are offering worse credit card terms and interest rates than small banks and credit unions, regardless of credit risk. The report calls specific attention to the financial institutions consumers complained about most between february and april 2015, with equifax, experian and bofa topping the cfpb’s inaugural “top 10” list. in the retail consumer banking category, bank of america has generated 47,732 complaints since july 2011, wells fargo has 33,214. The consumer credit trends tool tracks originations for mortgages, credit cards, auto loans, and student loans. it also tracks inquiries for mortgages, credit cards, and auto loans. for originations, the tool charts how specific groups of consumers are faring in financial markets. by tracking trends over time, it should help warn of potential.

Big Banks Big Complaints Cfpb S Database Reveals Trends The report calls specific attention to the financial institutions consumers complained about most between february and april 2015, with equifax, experian and bofa topping the cfpb’s inaugural “top 10” list. in the retail consumer banking category, bank of america has generated 47,732 complaints since july 2011, wells fargo has 33,214. The consumer credit trends tool tracks originations for mortgages, credit cards, auto loans, and student loans. it also tracks inquiries for mortgages, credit cards, and auto loans. for originations, the tool charts how specific groups of consumers are faring in financial markets. by tracking trends over time, it should help warn of potential. Established in 2010, the consumer financial protection bureau (cfpb) helps protect consumers from dangerous and unfair practices in the marketplace for financial services. addressing consumer complaints is a major part of the cfpb's mission, and the agency's consumer complaint database is a rich source of information about the challenges consumers face in the financial marketplace. big banks. With the signing of the dodd frank wall street and consumer protection act in 2011, and the accompanying consumer financial protection bureau, there is now a public database filled with us bank complaints and their resolution process. while the disclosure created ripples in the news media, research on the reaction to this disclosure by consumers, banks, and the stock market was scant. this.

Big Banks Big Complaints Established in 2010, the consumer financial protection bureau (cfpb) helps protect consumers from dangerous and unfair practices in the marketplace for financial services. addressing consumer complaints is a major part of the cfpb's mission, and the agency's consumer complaint database is a rich source of information about the challenges consumers face in the financial marketplace. big banks. With the signing of the dodd frank wall street and consumer protection act in 2011, and the accompanying consumer financial protection bureau, there is now a public database filled with us bank complaints and their resolution process. while the disclosure created ripples in the news media, research on the reaction to this disclosure by consumers, banks, and the stock market was scant. this.

Big Banks Take Beating In Cfpb S 10 Most Wanted List

Cfpb Consumer Complaints Enforcement Actions And Compliance Trends

Comments are closed.