Between Hmo And Ppo Which One Should You Choose

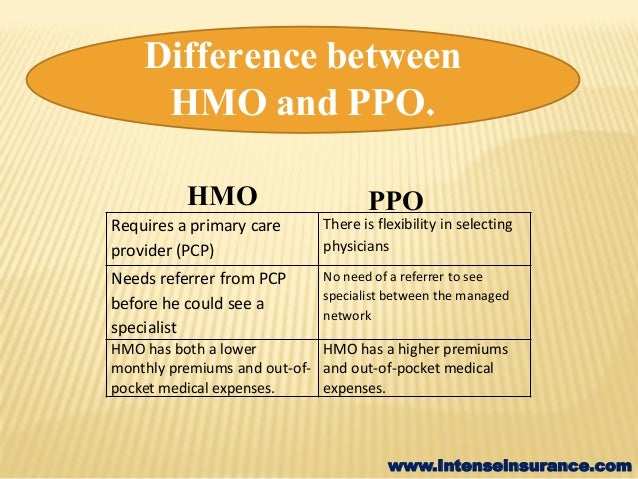

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Ppo health insurance and hmo health insurance differ in multiple ways, but one area in which they are the same is their levels of coverage. whether you choose an hmo or a ppo, each plan covers the. Key takeaways: hmos and ppos have different rules about covering healthcare services delivered by out of network providers. hmos limit your choice of providers but often have a lower deductible and premiums. ppos offer you more flexibility than hmos in choosing doctors and hospitals. lpettet istock via getty images.

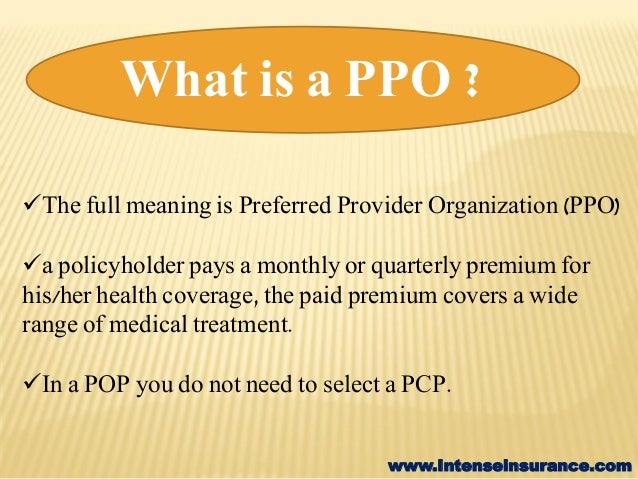

Between Hmo And Ppo Which One Should You Choose Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. “the maximum out of pocket amount an hmo plan can set is $8,850, while a ppo can set one as high as $13,300.” are there better supplemental benefits in an hmo vs. a ppo plan?. Hmos offered by employers often have lower cost sharing requirements (i.e., lower deductibles, copays, and out of pocket maximums) than ppo options offered by the same employer. however, hmos sold in the individual insurance market often have out of pocket costs that are just as high as the available ppos. how hmos work. The costs of a ppo plan. ppo plans often have higher monthly premiums and out of pocket costs than hmo plans. you may also need to pay a deductible before your benefits begin. if you see an out of network doctor, you’ll typically have to pay the full cost of your visit and then file a claim to get money back from your ppo plan.

Between Hmo And Ppo Which One Should You Choose Hmos offered by employers often have lower cost sharing requirements (i.e., lower deductibles, copays, and out of pocket maximums) than ppo options offered by the same employer. however, hmos sold in the individual insurance market often have out of pocket costs that are just as high as the available ppos. how hmos work. The costs of a ppo plan. ppo plans often have higher monthly premiums and out of pocket costs than hmo plans. you may also need to pay a deductible before your benefits begin. if you see an out of network doctor, you’ll typically have to pay the full cost of your visit and then file a claim to get money back from your ppo plan. Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network. Pos plans. a point of service (pos) plan is a health insurance plan that partners with a group of clinics, hospitals and doctors to provide care. with this type of plan, you’ll pay less out of pocket when you get care within the plan's network. pos plans often require coordination with a primary care provider (pcp) for treatment and referrals.

Between Hmo And Ppo Which One Should You Choose Health maintenance organization (hmo) and preferred provider organization (ppo) are two of the most popular types of major medical health insurance plans. the major differences between hmo vs ppo plans can be found in the: size of the network. the cost of the plan. the ability to see specialists without referrals. the size of the in network. Pos plans. a point of service (pos) plan is a health insurance plan that partners with a group of clinics, hospitals and doctors to provide care. with this type of plan, you’ll pay less out of pocket when you get care within the plan's network. pos plans often require coordination with a primary care provider (pcp) for treatment and referrals.

Comments are closed.