Best Dividend Stock To Buy Coca Cola Vs Pepsi Vs Dr Pepper

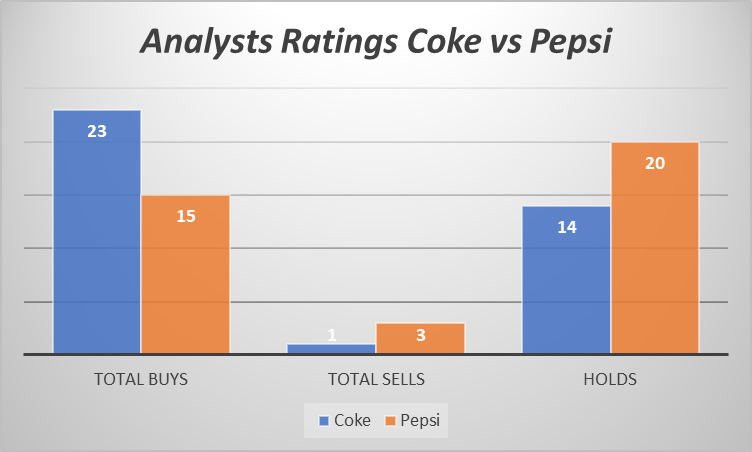

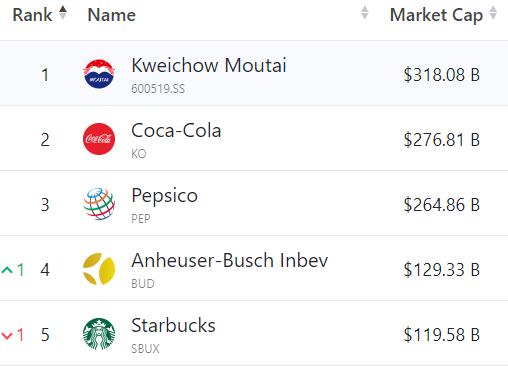

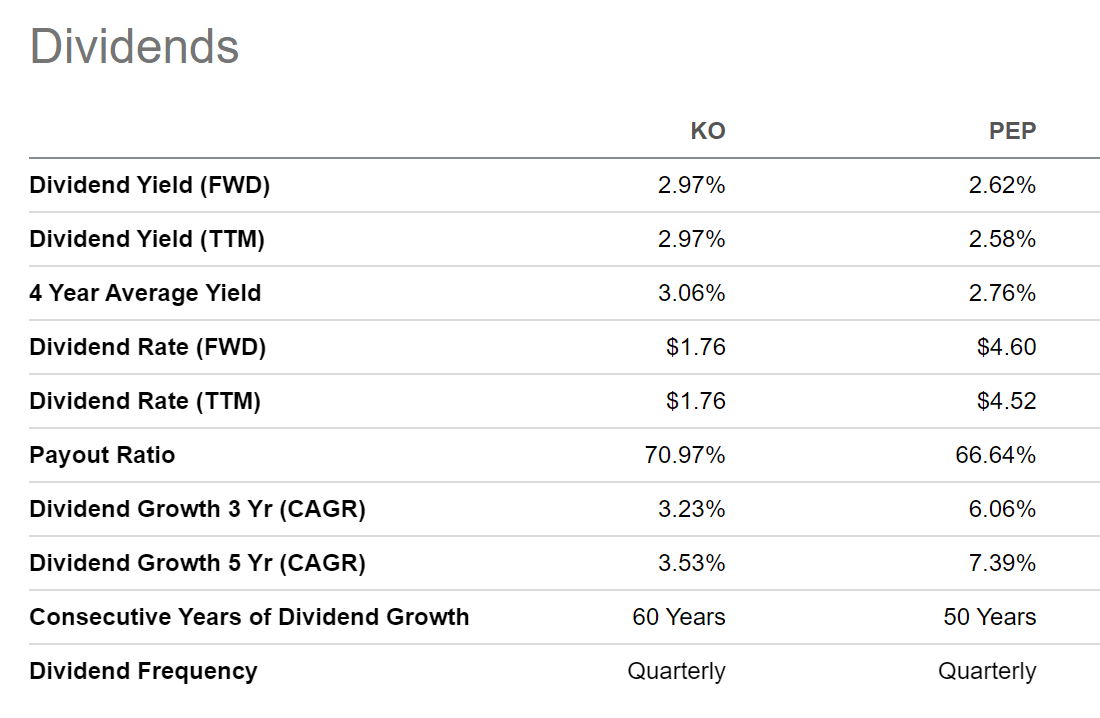

Best Dividend Stock To Buy Coca Cola Vs Pepsi Vs Dr Pepper Pitting three beverage giants against each other to determine the best dividend stock to buy. coca cola (ko 1.67%), pepsi (pep 1.38%), and keurigdrpepper (kdp 2.89%) all pay investors a. Coca cola and pepsico offer investors above average yields of around 3%. these stocks are both dividend kings that have grown their payouts for 50 plus years. they have both performed well over.

Coke Vs Pepsi Which Is The Better Buy For Dividends Nasdaq Pep Coke has a yield of 3.10%, while that of pepsi is 2.89%. in fact, there are significant differences between the two businesses, and that even holds true regarding the areas in which they are most. In the same time, coca cola's stock went from $38.96 to 44.80 which is just a 14.99% increase. pepsico large rally has not cut much into its p e ratio as it is still at 32 times while coca cola. Currently, coca cola pays a quarterly dividend of $0.485 per share, representing a dividend yield of 2.7%. the stock is in the exclusive dividend kings club, having paid and increased its dividend. Pitting three beverage giants against each other to determine the best dividend stock to buy. coca cola company 33.02 0.48 1.48%: keurig dr pepper inc: most.

Best Beverage Stock To Buy Pepsi Vs Coca Cola Vs Dr Pepper Currently, coca cola pays a quarterly dividend of $0.485 per share, representing a dividend yield of 2.7%. the stock is in the exclusive dividend kings club, having paid and increased its dividend. Pitting three beverage giants against each other to determine the best dividend stock to buy. coca cola company 33.02 0.48 1.48%: keurig dr pepper inc: most. Or, put another way, both are reliable dividend payers. that said, if income is your goal, pepsico offers a dividend yield of 3.1% at the moment. coca cola's yield is 2.8%. both are well above the. Coca cola has raised its dividend for 62 consecutive years with pepsi at 52 years and counting. at the moment coca cola’s 3.08% annual dividend yield slightly tops pepsi’s 2.97%. image source.

Coke Vs Pepsi Which Is The Better Buy For Dividends Nasdaq Pep Or, put another way, both are reliable dividend payers. that said, if income is your goal, pepsico offers a dividend yield of 3.1% at the moment. coca cola's yield is 2.8%. both are well above the. Coca cola has raised its dividend for 62 consecutive years with pepsi at 52 years and counting. at the moment coca cola’s 3.08% annual dividend yield slightly tops pepsi’s 2.97%. image source.

Coca Cola Vs Pepsico Which Is The Better Buy For Dividend Income

Coca Cola Vs Pepsico Best Stock For Dividends Youtube

Comments are closed.