Benefits Of Financial Advice In Retirement Planning

7 Benefits Of Retirement Planning Pure Financial Advisors There are several factors to consider when deciding whether or not to hire an advisor, such as: the complexity of your financial situation. whether you have a pension or other retirement income. A financial advisor can help you plan for retirement and provide investment advice to grow your wealth. but working with an advisor is a long term commitment that requires time and money. before.

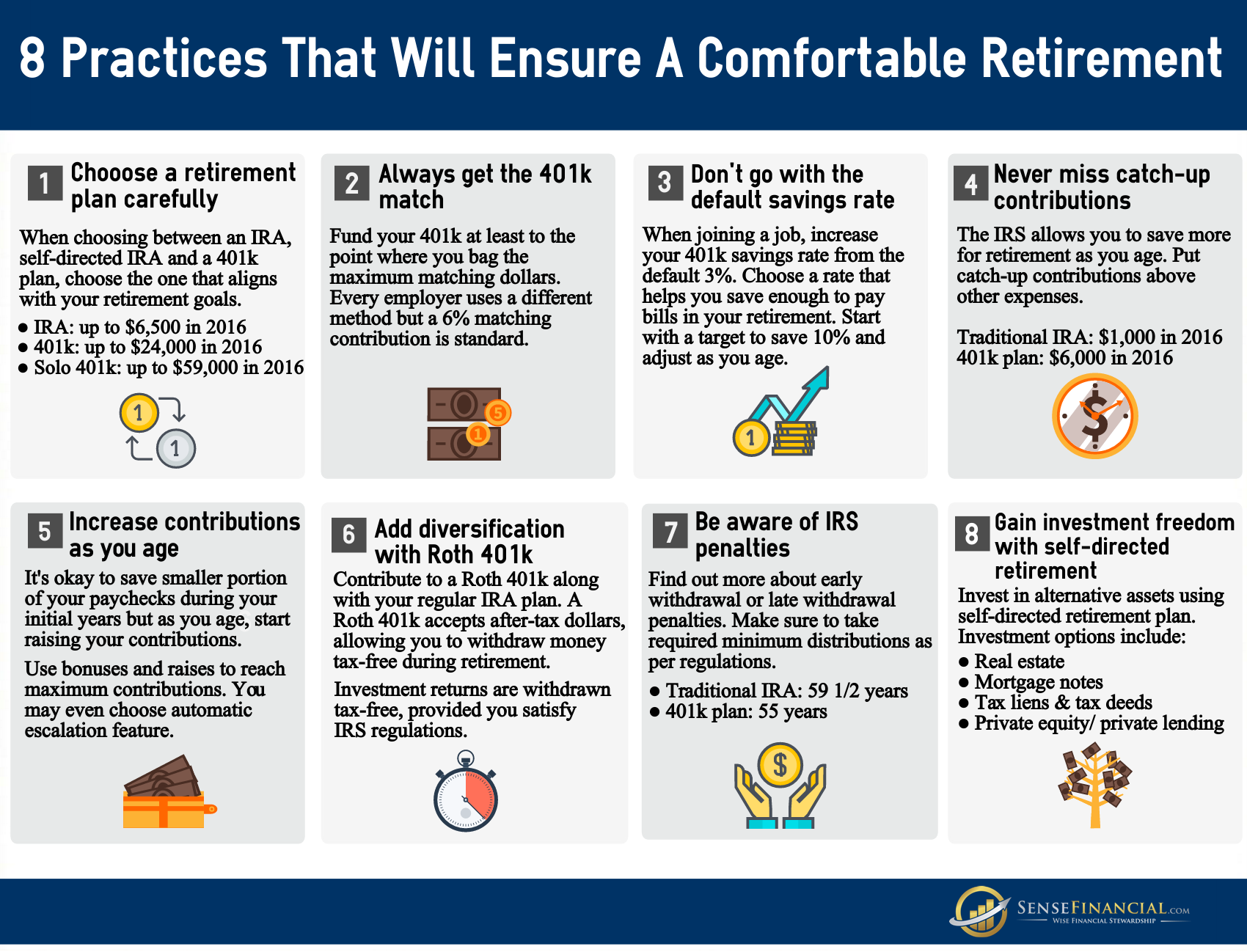

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement Retirement planning is the process of preparing and organizing your finances to ensure a secure and comfortable lifestyle after you stop working. it involves setting financial goals, estimating. This is likely the most obvious benefit of hiring a financial advisor for retirement planning. an advisor who is properly educated, trained and experienced possesses a considerable amount of. One benefit of this retirement planning stage is catch up contributions. from age 50 on, you can contribute an additional $1,000 a year to your traditional or roth ira and an additional $7,500 a. Financial advisors focus on retirement planning work with their clients to create long term goals and outline what steps they need to take to meet those goals. as a result, financial advisors can.

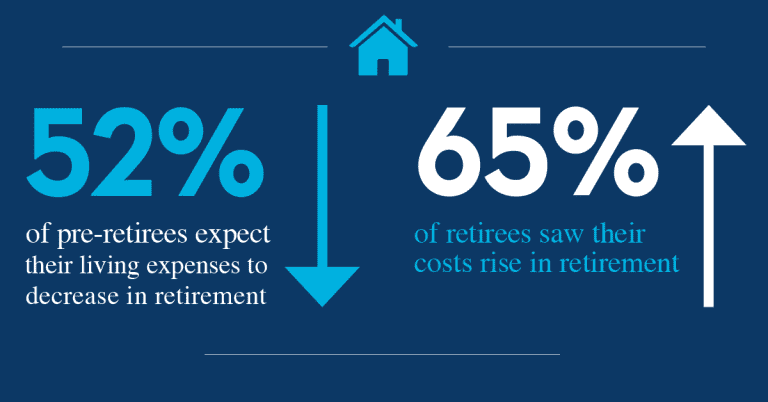

7 Benefits Of Early Retirement Planning In India 2021 One benefit of this retirement planning stage is catch up contributions. from age 50 on, you can contribute an additional $1,000 a year to your traditional or roth ira and an additional $7,500 a. Financial advisors focus on retirement planning work with their clients to create long term goals and outline what steps they need to take to meet those goals. as a result, financial advisors can. The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. In fact, financial planning can have a profound impact on lower income households by helping people improve their saving and budgeting habits. a written plan helps savers prioritize their goals and, as mentioned earlier, provides a way to gauge success. 3. a financial plan can help you create an investment portfolio.

Ppt Benefits Of Retirement Financial Planning Powerpoint Presentation The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. In fact, financial planning can have a profound impact on lower income households by helping people improve their saving and budgeting habits. a written plan helps savers prioritize their goals and, as mentioned earlier, provides a way to gauge success. 3. a financial plan can help you create an investment portfolio.

5 Essential Investment Options For A Comfortable Retirement

Comments are closed.