Bed Bath Beyond Bbby Stock Is High Risk Money Markets

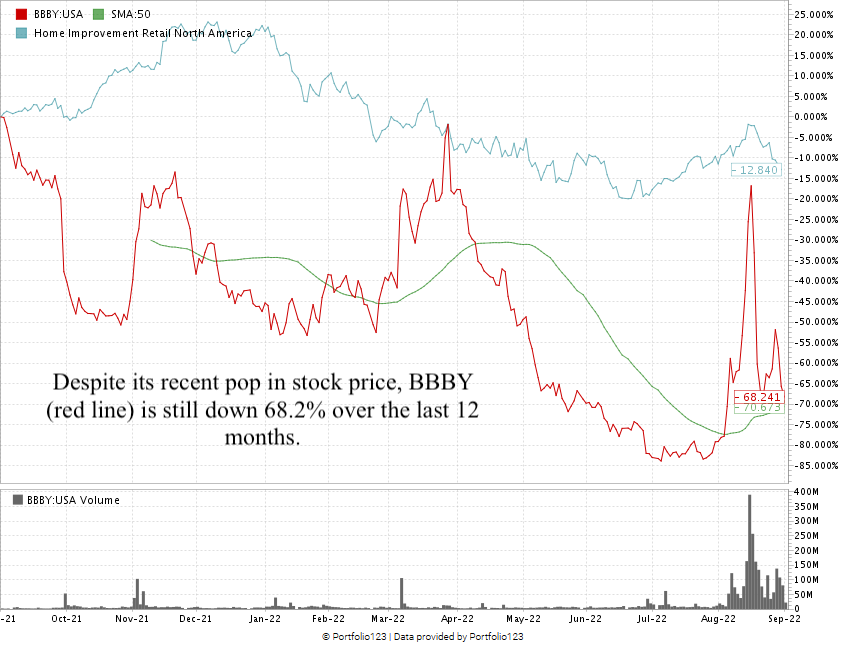

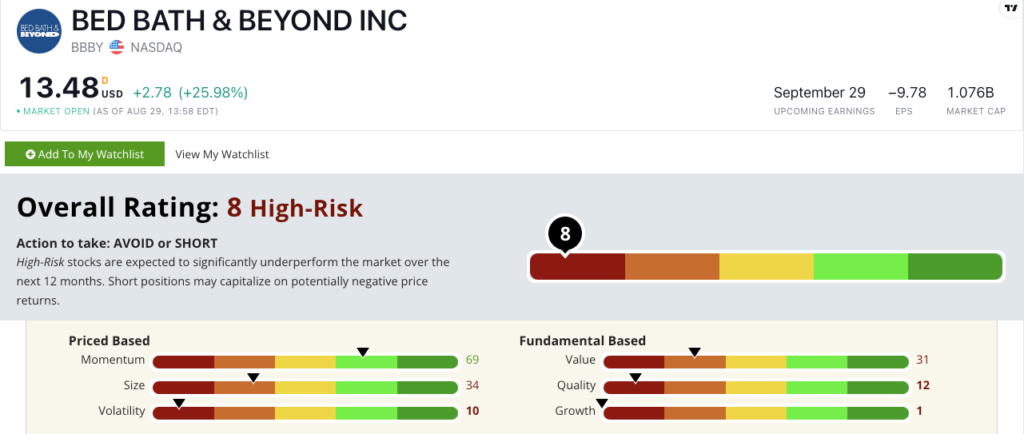

Bed Bath Beyond Bbby Stock Is High Risk Money Markets From its high in september 2021 to its low in july 2022, the stock lost 84.5%. despite its reddit push, it’s still down 68.2% for the year. bed bath & beyond stock scores an 8 overall on our proprietary stock power ratings system. that means we consider it “high risk” and expect it to underperform the broader market. Bbby’s 390% pump … and dump. in august 2022, bed bath & beyond inc. (nasdaq: bbby) surged 120% in just seven days. bbby was one of the most shorted stocks on the market. big money investors were betting against it. fomo led retail investors to pour cash into the stock, pushing the price up. its price soared, which forced those institutional.

Bed Bath Beyond Bbby Stock Is High Risk Money Markets But bankruptcy is normally a slow moving process that drags on and on only at the very end will it speed up dramatically. there were signs of bed bath & beyond's increasing bankruptcy risk well. But then, after market trading ended aug. 16, cohen's rc ventures filed its intention to sell all 9.45 million shares of its bed bath & beyond stock. bbby stock tumbled more than 20% thursday. Bear case: there's a very real risk of bankruptcy. bed bath & beyond's business is in dire straits. revenue fell 27% year over year in the second quarter to land at $1.43 billion, and the company. Real time bed bath & beyond (bbby) stock price quote, stock graph, news & analysis. best money market accounts skip the risk and opt for high growth potential.

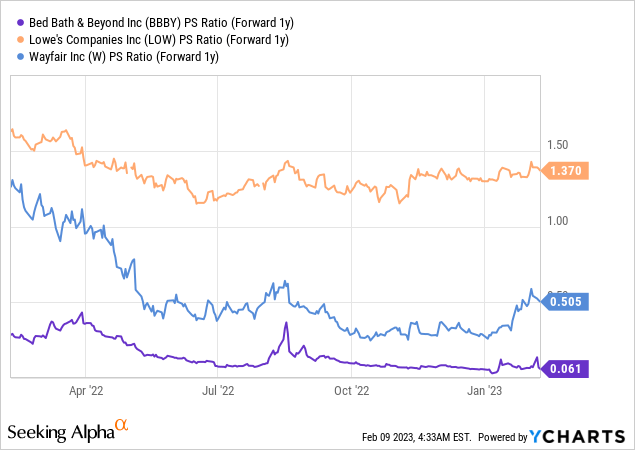

Bbby Stock Why Bed Bath Beyond Is A Risky Investment Alphastreet Bear case: there's a very real risk of bankruptcy. bed bath & beyond's business is in dire straits. revenue fell 27% year over year in the second quarter to land at $1.43 billion, and the company. Real time bed bath & beyond (bbby) stock price quote, stock graph, news & analysis. best money market accounts skip the risk and opt for high growth potential. This was followed up by another $40.4 million worth of stock buybacks in the first six months of the company's 2022 fiscal year. bed bath & beyond is no stranger to share repurchases. since. Bbby, however, is a very high risk stock and investors should be aware that they could lose all of their money if the retailer can't be turned around! $1.0b equity offering indicates that.

Bed Bath Beyond Bbby Stock Major Short Squeeze Potential Seeking This was followed up by another $40.4 million worth of stock buybacks in the first six months of the company's 2022 fiscal year. bed bath & beyond is no stranger to share repurchases. since. Bbby, however, is a very high risk stock and investors should be aware that they could lose all of their money if the retailer can't be turned around! $1.0b equity offering indicates that.

Comments are closed.