Banks Vs Credit Unions Whats The Difference And Better Choice Nerdwallet

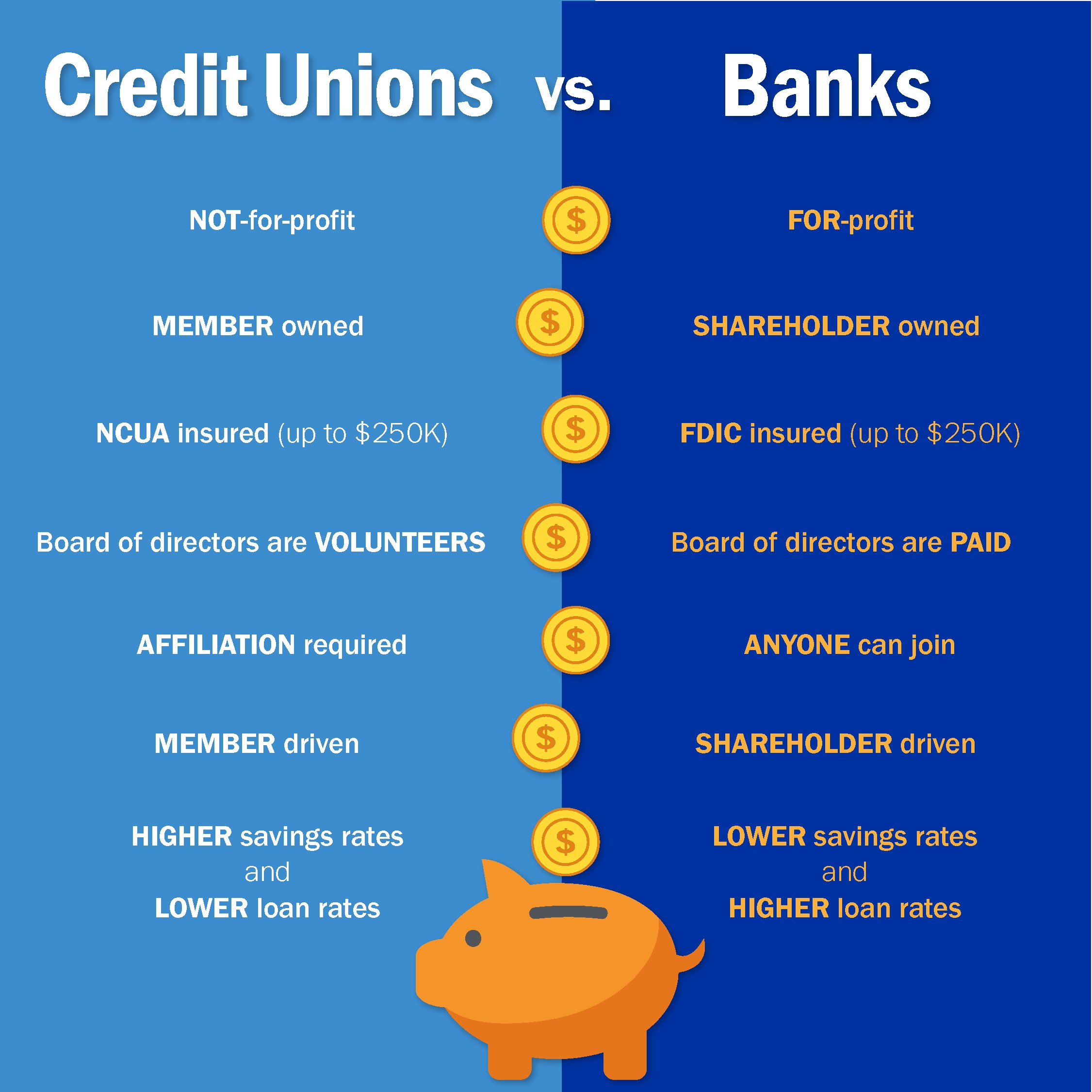

Banks Vs Credit Unions What S The Difference And Better Choice If you’re weighing the choice between a credit union versus a bank, there are a few important things to consider about the two types of financial institutions. the main difference between a. Bank vs. credit union: how to make the right choice. credit unions are not for profit and may offer fewer products, but better rates. banks are for profit institutions and may offer more products.

Credit Unions And Banks The Differences The most common options for money storage are banks and credit unions. nikita turk breaks down the similarities and differences between the two, helping you. Better rates on savings accounts and loans: credit unions offer higher interest rates on savings accounts and lower rates on loans—exactly what consumers want. higher interest rates on bank. Lower fees: credit union products may come at a lower price than what banks offer and some credit unions even waive certain fees on bank accounts and credit cards. competitive rates on deposits. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Credit Unions Vs Banks What S The Difference Lower fees: credit union products may come at a lower price than what banks offer and some credit unions even waive certain fees on bank accounts and credit cards. competitive rates on deposits. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022. Average credit union vs. bank fees ; credit union: bank average share draft checking nsf fee $23.86: $31.24: average credit card late fee: $24.56: $34.18: average mortgage closing costs: $1,151. The key differences between credit unions and banks lie in their organizational structure, purpose, customer service approach, and the range of products and services they offer. to help you better understand which option may be more suitable for your financial needs, we'll discuss the main distinctions between credit unions and banks, along.

Comments are closed.