Bank Statements During Bankruptcy Bankruptcy Ontario

Bank Statements During Bankruptcy Bankruptcy Ontario Answer: no, you are not required to submit bank statements and receipts for all transactions unless requested by your trustee. you are required to prove your income to your trustee each month, so that your trustee can calculate your surplus income. the more you earn, the more you are required to pay, which is why your trustee will calculate. Ongoing obligations during a bankruptcy in ontario. during your bankruptcy, you will provide your trustee with monthly income and expense statements. these will be used to calculate any surplus income as defined by the office of the superintendent of bankruptcy (osb). surplus income payments are based on a calculation set by the osb, with your.

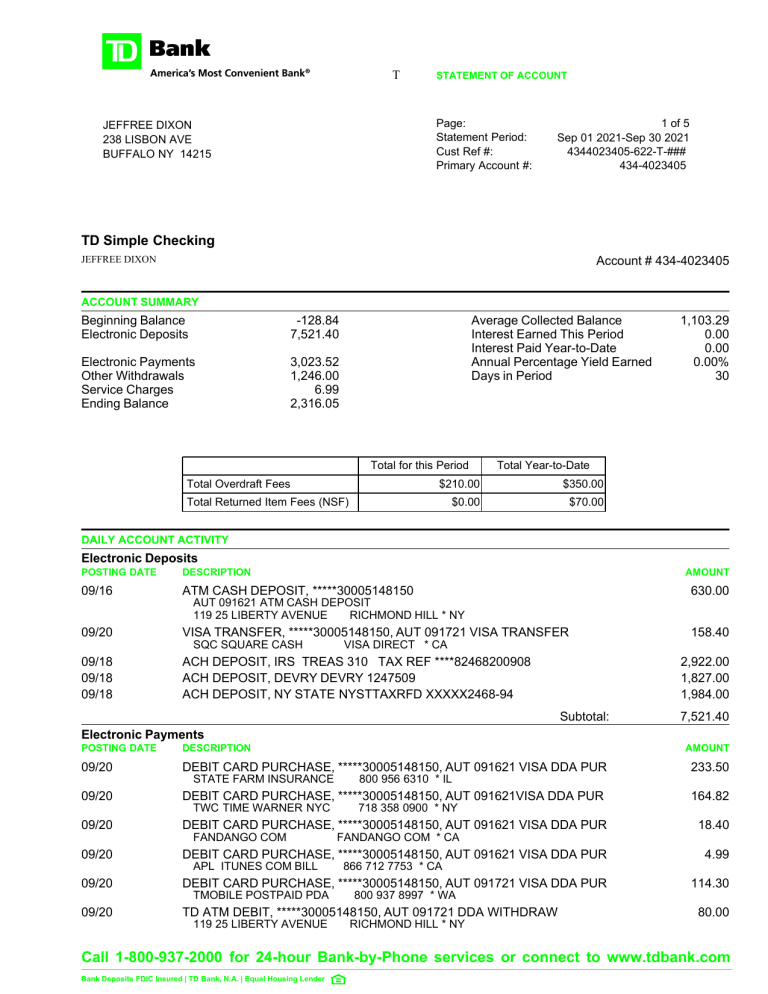

Td Bank Bank Statement Template What are your duties during bankruptcy. the most important duties you’ll do during the actual bankruptcy process are: report income – during the time you are bankrupt, you are required to submit an income and expense report to the trustee each month and provide proof of your income by submitting pay stubs or a bank statement. good budgeting. 1.1 what does filing for bankruptcy mean? declaring bankruptcy is a legal procedure overseen by a licensed insolvency trustee (lit). it involves a comprehensive review of your financial status, preparation and filing of requisite documents, and provision of financial counselling to prevent future financial mishaps. Question: are you required to submit bank statements and receipts for all transactions during bankruptcy? answer: no, you are not required to submit bank statements and receipts for all transactions unless requested by your trustee. you are required to prove your income to your trustee each month, so that your…. 8. protecting assets during bankruptcy. it is natural to be concerned about losing assets when filing for bankruptcy. however, ontario bankruptcy law provides exemptions to protect certain assets from seizure by the lit. these exemptions cover items such as employer pension plans, rrsps, personal effects, household furniture, and tools of the.

Bankruptcy Ontario Question: are you required to submit bank statements and receipts for all transactions during bankruptcy? answer: no, you are not required to submit bank statements and receipts for all transactions unless requested by your trustee. you are required to prove your income to your trustee each month, so that your…. 8. protecting assets during bankruptcy. it is natural to be concerned about losing assets when filing for bankruptcy. however, ontario bankruptcy law provides exemptions to protect certain assets from seizure by the lit. these exemptions cover items such as employer pension plans, rrsps, personal effects, household furniture, and tools of the. Ontario bankruptcy and insolvency statistics. 30,327 consumers in ontario were insolvent in 2021 [4] 25% of those consumers went on to declare bankruptcy (7,580) average assets at the time of filing: $21,907.90. average liabilities (debts) at the time of filing: $89,758.27. with an average household income of $80,322 in ontario, [5] the average. 1.book a free consultation with one of our licensed insolvency trustees. in ontario (and everywhere else in canada), you can only file for bankruptcy through a licensed insolvency trustee (lit). an lit is the only professional with the qualifications and authority to administer a bankruptcy on your behalf. they’re experts bound by a strict.

What Are My Duties In An Ontario Bankruptcy Bankruptcy Ontario Ontario bankruptcy and insolvency statistics. 30,327 consumers in ontario were insolvent in 2021 [4] 25% of those consumers went on to declare bankruptcy (7,580) average assets at the time of filing: $21,907.90. average liabilities (debts) at the time of filing: $89,758.27. with an average household income of $80,322 in ontario, [5] the average. 1.book a free consultation with one of our licensed insolvency trustees. in ontario (and everywhere else in canada), you can only file for bankruptcy through a licensed insolvency trustee (lit). an lit is the only professional with the qualifications and authority to administer a bankruptcy on your behalf. they’re experts bound by a strict.

Bankruptcy Ontario

Comments are closed.