Bank Statements And Bankruptcy How They Are Used And What You Need To Know

Bank Statements And Bankruptcy How They Are Used And What You Need To The trustee will look at your statements to verify your monthly payments to make sure they match the expenses you put on your bankruptcy forms. for example, if you listed your car loan as $500 a month, the trustee will use your bank statements to ensure that amount is being reflected on your bank statements. the trustee will also want to look. Understanding how bank statements are used by the trustee in a georgia bankruptcy case. when facing bankruptcy in georgia, one of the critical aspects to consider is the role of bank statements in the proceedings. the bankruptcy trustee plays a vital role in evaluating your financial situation, and bank statements are a primary source of.

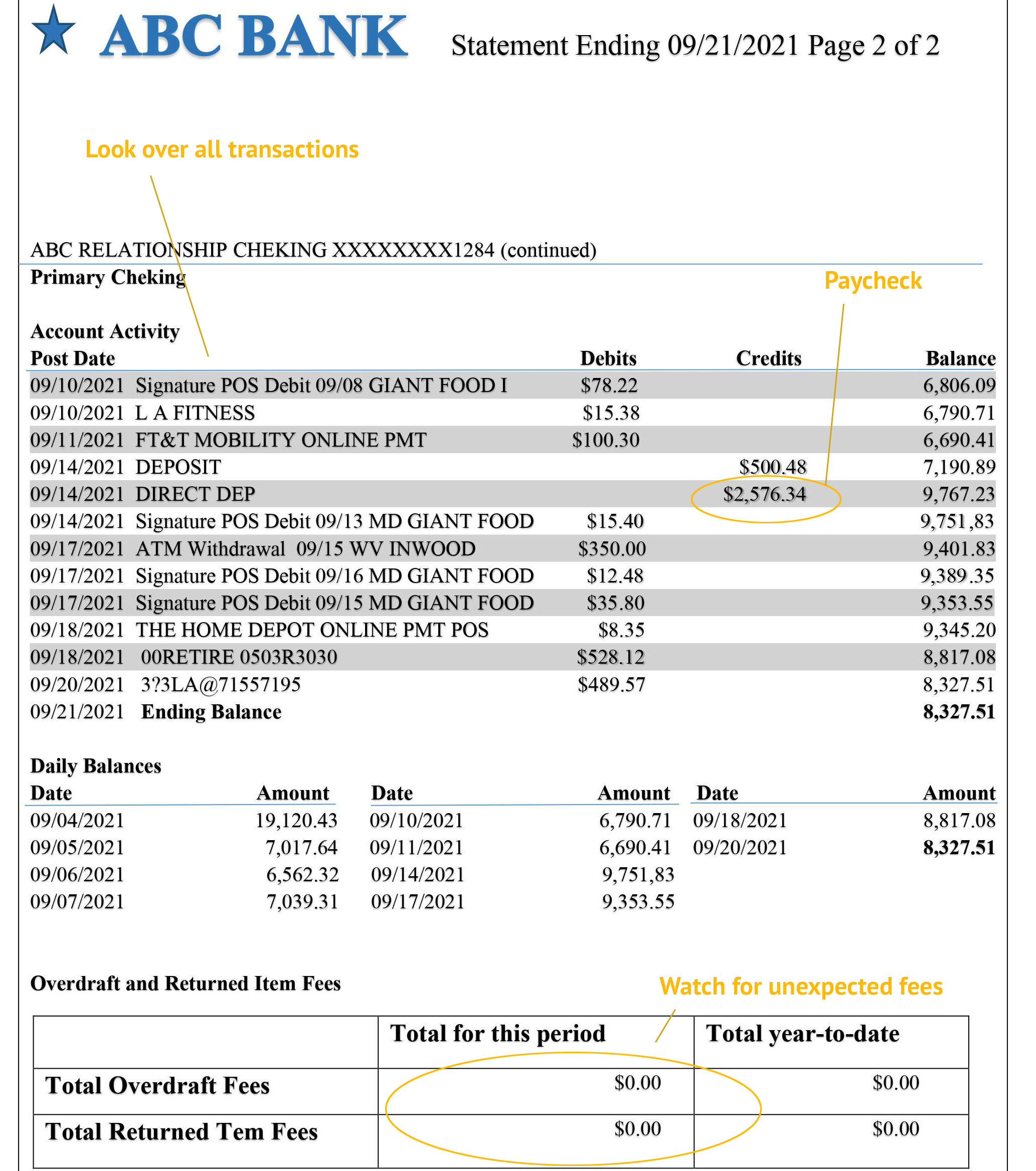

What Is Bankruptcy The Most Common Types Of Bankruptcy The trustee will also use bank statements to look for evidence of how much you spend on expenses and question you about any significant transactions. for instance, suppose you claim you spend $1,200 monthly on groceries, but your bank statements show $400 monthly. the trustee could claim you have $800 monthly to pay creditors through a chapter. Excessive expenses. the trustee will also examine the expenses disclosed on schedule j and the bankruptcy means test. the trustee is checking for reasonability. a trustee who thinks your expenses are too high will object to your chapter 7 bankruptcy or argue that you can afford to pay more in chapter 13 bankruptcy. The court appointed trustee in charge of your bankruptcy has broad powers to review all of your financial records, including your bank accounts, while your bankruptcy is in process. the trustee may choose to check your bank accounts whenever he feels a need, though there are several key points in your bankruptcy when the accounts will. When you fill out your bankruptcy paperwork, you'll be asked to disclose information regarding your financial affairs, such as your income and expenses, assets and debts, and property transfers. also, you'll need to provide certain documents to the bankruptcy trustee to prove the accuracy of the information provided.

Understanding The Impact Of Bankruptcy On Financial Statements And The court appointed trustee in charge of your bankruptcy has broad powers to review all of your financial records, including your bank accounts, while your bankruptcy is in process. the trustee may choose to check your bank accounts whenever he feels a need, though there are several key points in your bankruptcy when the accounts will. When you fill out your bankruptcy paperwork, you'll be asked to disclose information regarding your financial affairs, such as your income and expenses, assets and debts, and property transfers. also, you'll need to provide certain documents to the bankruptcy trustee to prove the accuracy of the information provided. Suppose you have a credit card, car loan, and checking account with bank a when you file for bankruptcy. even though the bank can't demand further credit card and car loan payments, it can use its set off rights to dip into your bank balance when you file for bankruptcy and use the money to pay down the credit card and car loan balances owed to. If you can't protect your bank account balance when you file your case, the chapter 7 bankruptcy trustee appointed to administer your matter will take the funds to repay creditors. unfortunately, most states don't offer much protection when it comes to cash and bank accounts. the average exemption is around $300 if that.

What Is The Bankruptcy Process Bankruptcy Fixes Debt Suppose you have a credit card, car loan, and checking account with bank a when you file for bankruptcy. even though the bank can't demand further credit card and car loan payments, it can use its set off rights to dip into your bank balance when you file for bankruptcy and use the money to pay down the credit card and car loan balances owed to. If you can't protect your bank account balance when you file your case, the chapter 7 bankruptcy trustee appointed to administer your matter will take the funds to repay creditors. unfortunately, most states don't offer much protection when it comes to cash and bank accounts. the average exemption is around $300 if that.

Bank Statements How And Why To Read Yours Wealth Meta

Everything You Need To Know About Chapter 11 Bankruptcy Laws

Comments are closed.