Az State Tax Brackets 2024 Dacie Dorothy

Az State Tax Brackets 2024 Dacie Dorothy The federal standard deduction for a married (separate) filer in 2024 is $ 14,600.00. the federal federal allowance for over 65 years of age married (separate) filer in 2024 is $ 1,550.00. arizona residents state income tax tables for married (separate) filers in 2024. personal income tax rates and thresholds (annual). Arizona has a flat income tax rate of 2.5%. this rate applies to taxable income earned in 2023, which is reported on 2024 state tax returns. state income tax return due dates typically follow the.

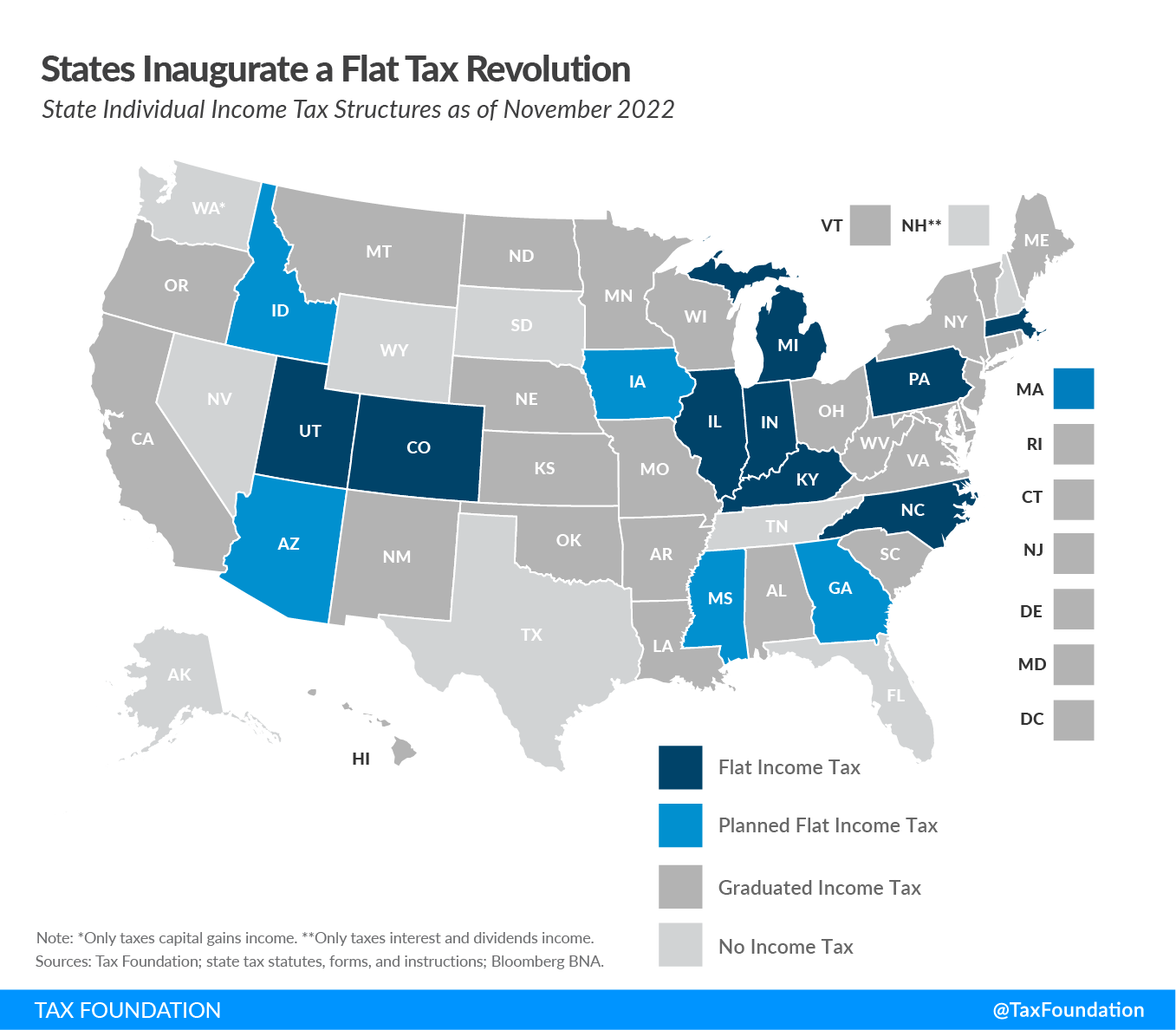

Az State Tax Brackets 2024 Dacie Dorothy Arizona’s income tax structure is a flat rate of 2%. the state eschews a distinct payroll tax, but employers aren’t entirely free from obligations. they contribute to a state unemployment insurance tax, providing a safety net for individuals facing job loss. arizona’s approach to standard deductions and exemptions is an exercise in. 2023 arizona standard deduction amounts adjusted. the 2023 arizona standard deduction amounts are: $ 13,850 for a single taxpayer or a married taxpayer filing a separate return; $ 27,700 for a married couple filing a joint return; and. $ 20,800 for individuals filing a head of household return. 2.5%. arizona married filing jointly tax brackets. tax bracket. tax rate. $0.00 . 2.5%. arizona has a flat income tax of 2.5% — all earnings are taxed at the same rate, regardless of total income level. on this page: arizona tax calculator. As mentioned above, income earned in arizona is taxed at one flat rate. and, among states with a flat tax rate, arizona’s is the lowest. file with h&r block to get your max refund. file online. file with a tax pro. the flat arizona income tax rate of 2.5% applies to taxable income earned in 2023, which is reported on your 2024 state tax return.

Az 2024 Tax Brackets Colene Melosa 2.5%. arizona married filing jointly tax brackets. tax bracket. tax rate. $0.00 . 2.5%. arizona has a flat income tax of 2.5% — all earnings are taxed at the same rate, regardless of total income level. on this page: arizona tax calculator. As mentioned above, income earned in arizona is taxed at one flat rate. and, among states with a flat tax rate, arizona’s is the lowest. file with h&r block to get your max refund. file online. file with a tax pro. the flat arizona income tax rate of 2.5% applies to taxable income earned in 2023, which is reported on your 2024 state tax return. Click calculate to see your tax, medicare and take home breakdown federal tax made simple; 2024 25 arizona state tax refund calculator. calculate your total tax due using the az tax calculator (update to include the 2024 25 tax brackets). deduct the amount of tax paid from the tax calculation to provide an example of your 2024 25 tax refund. Arizona annual salary after tax calculator 2024. the annual salary calculator is updated with the latest income tax rates in arizona for 2024 and is a great calculator for working out your income tax and salary after tax based on a annual income. the calculator is designed to be used online with mobile, desktop and tablet devices.

Az State Tax Brackets 2024 Dacie Dorothy Click calculate to see your tax, medicare and take home breakdown federal tax made simple; 2024 25 arizona state tax refund calculator. calculate your total tax due using the az tax calculator (update to include the 2024 25 tax brackets). deduct the amount of tax paid from the tax calculation to provide an example of your 2024 25 tax refund. Arizona annual salary after tax calculator 2024. the annual salary calculator is updated with the latest income tax rates in arizona for 2024 and is a great calculator for working out your income tax and salary after tax based on a annual income. the calculator is designed to be used online with mobile, desktop and tablet devices.

Comments are closed.