Axa Cooperative Insurance Co Strategy Swot And Corporate Finance Report

Axa Cooperative Insurance Co Strategy Swot And Corporate Finance Report The axa cooperative insurance co strategy, swot and corporate finance report is a source of comprehensive company data and information. the report covers. Axa cooperative insurance co strategy, swot and corporate finance report, is a source of comprehensive company data and information. the report covers the company's structure, operation, swot analysis, product and service offerings and corporate actions, providing a 360˚ view of the company.

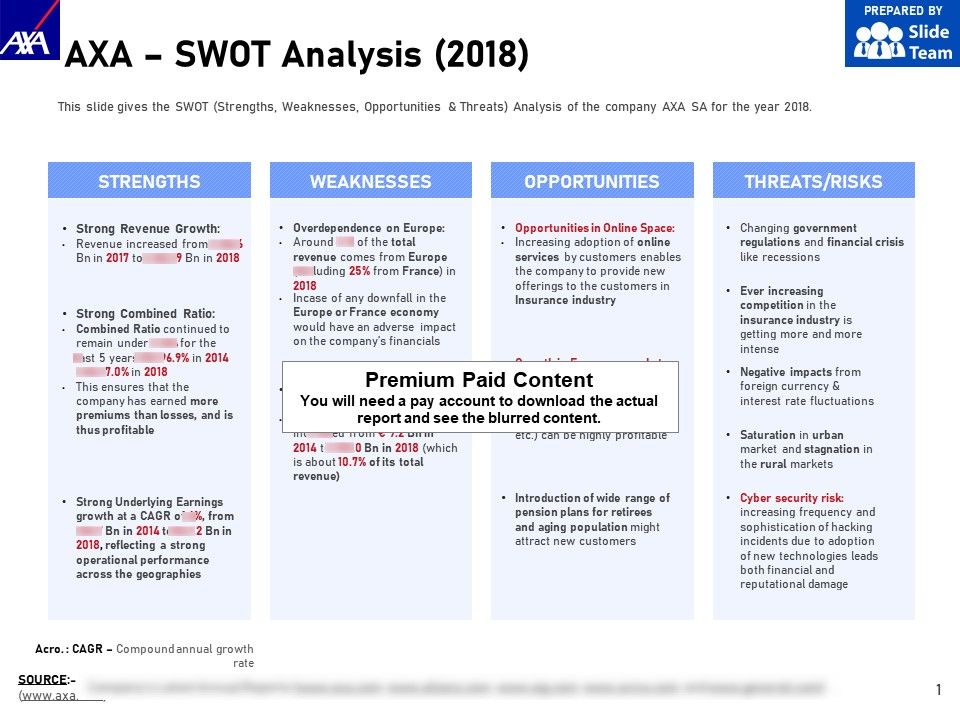

Complete Swot Analysis Of Axa 2023 Study Iide Pestle. the swot analysis report of axa presents the internal analysis and external analysis of the company with insightful details of the current market position and future growth strategy of this international insurance player. the swot analysis essays the detailed business case of axa covering strengths, weaknesses, opportunities and threats. Find here the latest financial publications issued by axa. axa. 30.570 ( 0.66 %) axa worldwide latest half year financial report. latest annual report. The new plan is focused on growing and strengthening axa’s core businesses, with continued disciplined execution, following strong delivery of driving progress 2023. increased main financial targets for 2024 2026. underlying earnings per share* cagr** 2023 2026e between 6% and 8%. underlying return on equity* between 14% and 16% over. By conducting a thorough swot analysis, axa can identify its internal strengths and weaknesses and external opportunities and threats. this analysis helps the company develop strategies to leverage its strengths, address weaknesses, exploit opportunities, and mitigate potential threats. it allows axa to stay competitive in the insurance.

Axa Swot Analysis 2018 Graphics Presentation Background For The new plan is focused on growing and strengthening axa’s core businesses, with continued disciplined execution, following strong delivery of driving progress 2023. increased main financial targets for 2024 2026. underlying earnings per share* cagr** 2023 2026e between 6% and 8%. underlying return on equity* between 14% and 16% over. By conducting a thorough swot analysis, axa can identify its internal strengths and weaknesses and external opportunities and threats. this analysis helps the company develop strategies to leverage its strengths, address weaknesses, exploit opportunities, and mitigate potential threats. it allows axa to stay competitive in the insurance. Axa sa strategy, swot and corporate finance report, is a source of comprehensive company data and information. the report covers the company's structure, operation, swot analysis, product and service offerings and corporate actions, providing a 360˚ view of the company. key highlights axa sa (axa) is an insurance company, that offers both. Swot analysis of axa. swot analysis of axa is a study which is undertaken by the company to determine its core strengths, weaknesses, opportunities and threats. it is a framework that is used to evaluate a company’s competitive position which later helps in strategic planning. swot analysis can be conducted by any popular brand or any brand.

Comments are closed.