Auto Body Shop Insurance What You Need To Know

Auto Body Shop Insurance What You Need To Know Youtube At the core of auto body shop insurance lies general liability coverage, shielding businesses against third party claims stemming from bodily injury or property damage transpiring either on site or as a result of the shop's operations. for instance, if a patron sustains an injury due to a slip and fall incident or if a vehicle suffers damage. Auto body shop. get quotes. or call us at (800) 688 1984. call (800) 688 1984 8 a.m. 5:30 p.m. ct, monday friday. find auto body shop insurance coverage that meets the needs of your business and budget. insureon makes it easy to shop policies and get quotes online from leading insurance companies.

Auto Body Shop Insurance Process Germain Body Shop Of Beavercreek We’re going to go over the following insurance coverages for auto body shops: general liability. property. workers’ comp. garagekeepers. umbrella. 1. general liability. when you run an auto body shop, you’ve got customers coming onto your premises and into your shop. An insurance company cannot stop you from having your car repaired at the auto body shop of your choice, but they will probably try to convince you to go to one of “their” shops by making claims that outside network shops “charge more” or “take longer.”. the true long and short of it is that if you’re insured, then your insurer. We’ve created this guide to help you better understand the auto body repair process, working with your (or the at fault driver’s) insurance company, and achieving your ultimate goal – getting your car back to pre accident condition. important note: auto accidents and the repairs of cars involved in auto accidents are governed by the laws. Umbrella or excess liability insurance to provide an extra layer of liability protection over and above your other liability policy forms. this is really critical today when you consider how litigious society is today. we’re seeing a lot of claims blowing through the primary general or auto liability limits of coverage – usually $1,000,000.

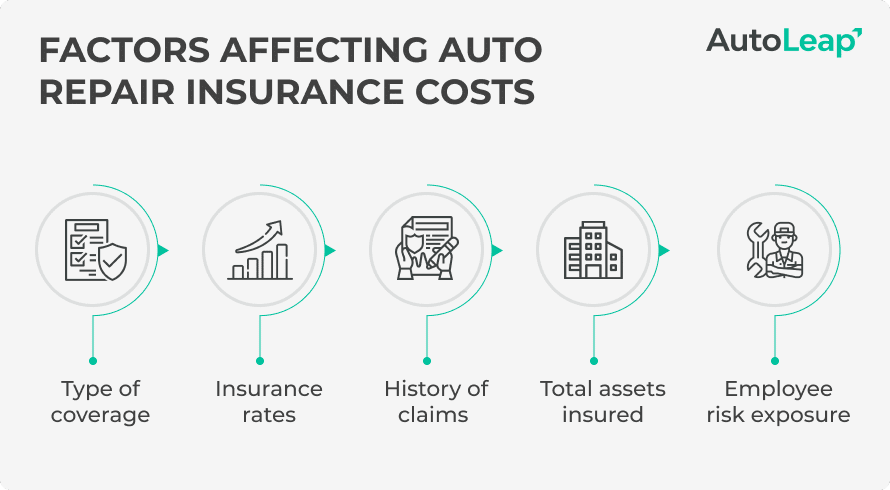

Auto Repair Shop Insurance What You Need To Know The Coyle Group We’ve created this guide to help you better understand the auto body repair process, working with your (or the at fault driver’s) insurance company, and achieving your ultimate goal – getting your car back to pre accident condition. important note: auto accidents and the repairs of cars involved in auto accidents are governed by the laws. Umbrella or excess liability insurance to provide an extra layer of liability protection over and above your other liability policy forms. this is really critical today when you consider how litigious society is today. we’re seeing a lot of claims blowing through the primary general or auto liability limits of coverage – usually $1,000,000. Independent auto body shop. location: you may have better luck finding an independent shop than a dealer collision repair center near you. cost: independent shops may use aftermarket parts, which tend to cost less than factory authorized parts, so you might pay less for repairs. timing: “if a dealership repair collision center is backed up. Types of coverage. some common types of coverage found in personal auto policies include: collision: damage to the insured vehicle(s) involving an impact with another object. comprehensive: pays.

6 Types Of Insurance For Auto Repair Shops Independent auto body shop. location: you may have better luck finding an independent shop than a dealer collision repair center near you. cost: independent shops may use aftermarket parts, which tend to cost less than factory authorized parts, so you might pay less for repairs. timing: “if a dealership repair collision center is backed up. Types of coverage. some common types of coverage found in personal auto policies include: collision: damage to the insured vehicle(s) involving an impact with another object. comprehensive: pays.

Do Auto Body Shops Report Damages To Insurance Start2finish

Comments are closed.