Asset Based Ltc Vs Life With Ltc Rider Fortify Insurance Group

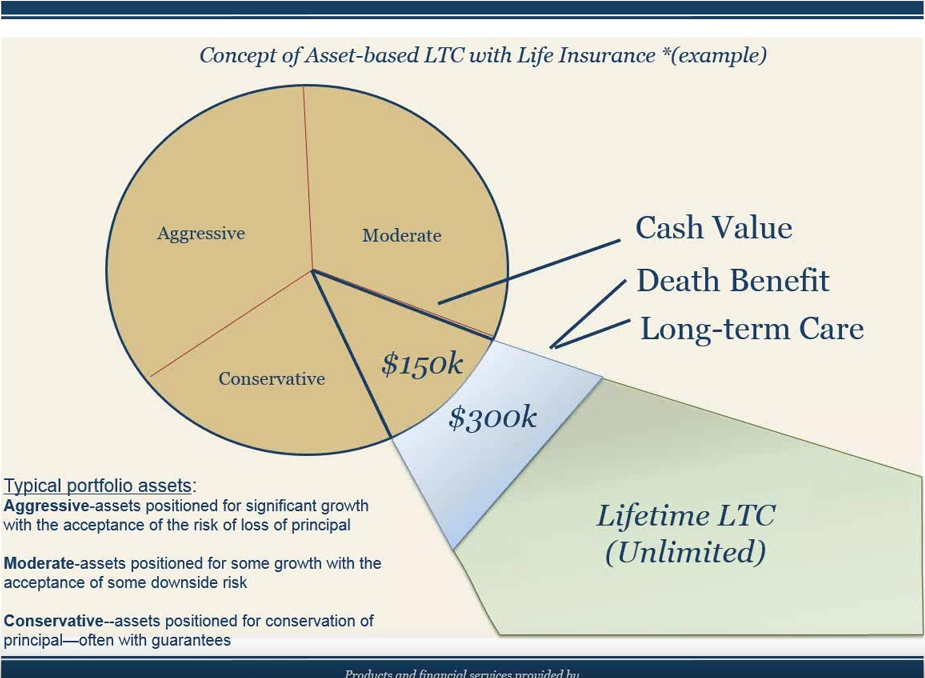

Asset Based Ltc Vs Life With Ltc Rider Fortify Insurance Group Asset based ltc vs life with ltc rider posted on may 23, 2023 by developer a discussion about the pros and cons of different options and how they accomplish different objectives. Abltc policies are right in the middle of the spectrum. the primary focus of the plan is on ltc, but it’s built on an asset (usually life insurance or an annuity) so that it’s not “use it or lose it.”. asset based plans have a guaranteed premium and either guaranteed return of premium (rop) or cash surrender value (csv).

Ltc Insurance Vs Life Insurance With Ltc Rider Altcp Org A long term care (ltc) rider is an add on to a life insurance policy that allows the policyholder to use a portion of the death benefit to cover long term care expenses. this rider transforms a traditional life insurance policy into a dual purpose product, offering both a death benefit and coverage for long term care needs. To date, the proposed state ltc programs would provide a lifetime maximum benefit of $36,500 creating a coverage gap when the national cost average is more than $108,000 per year. this underscores the financial risk employees may face – and the need for adequate ltc coverage. in today’s market, group life insurance with ltc – “life with. However, if the policy is eventually surrendered or lapses, any gains would then become taxable. by using a 1035 exchange to switch this policy for an asset based life insurance long term care policy, the individual eliminates the tax risk associated with the policy lapsing after withdrawals for ltc expenses. The typical cost of a single premium combination policy is $71,700 for men and $76,740 for women, according to the american association for long term care insurance. american association for long.

Ltc Insurance Vs Life Insurance With Ltc Rider Altcp Org However, if the policy is eventually surrendered or lapses, any gains would then become taxable. by using a 1035 exchange to switch this policy for an asset based life insurance long term care policy, the individual eliminates the tax risk associated with the policy lapsing after withdrawals for ltc expenses. The typical cost of a single premium combination policy is $71,700 for men and $76,740 for women, according to the american association for long term care insurance. american association for long. Life insurance. call (855) 596 3655 to speak with a licensed insurance agent and get quotes for car, home, or renters insurance. long term care riders are policy additions that can be used to pay for assisted living expenses, such as caregivers or nursing homes. with the rising cost of long term care insurance, options such as long term care. Asset based long term care insurance policies work by combining long term care coverage with an investment component. policyholders pay premiums into the policy, which can be used to cover the costs of long term care services or to build cash value over time. the investment component of the policy typically involves investing the premiums in a.

Understanding The Life Insurance Long Term Care Rider Ltc Life insurance. call (855) 596 3655 to speak with a licensed insurance agent and get quotes for car, home, or renters insurance. long term care riders are policy additions that can be used to pay for assisted living expenses, such as caregivers or nursing homes. with the rising cost of long term care insurance, options such as long term care. Asset based long term care insurance policies work by combining long term care coverage with an investment component. policyholders pay premiums into the policy, which can be used to cover the costs of long term care services or to build cash value over time. the investment component of the policy typically involves investing the premiums in a.

American Independent Marketingconcept Of Asset Based Ltc With Life

Partners In Planning Are Your Clients Prepared Ppt Download

Comments are closed.