Arm Calculator Adjustable Rate Home Loan Calculator Estimate 3 1 5 1

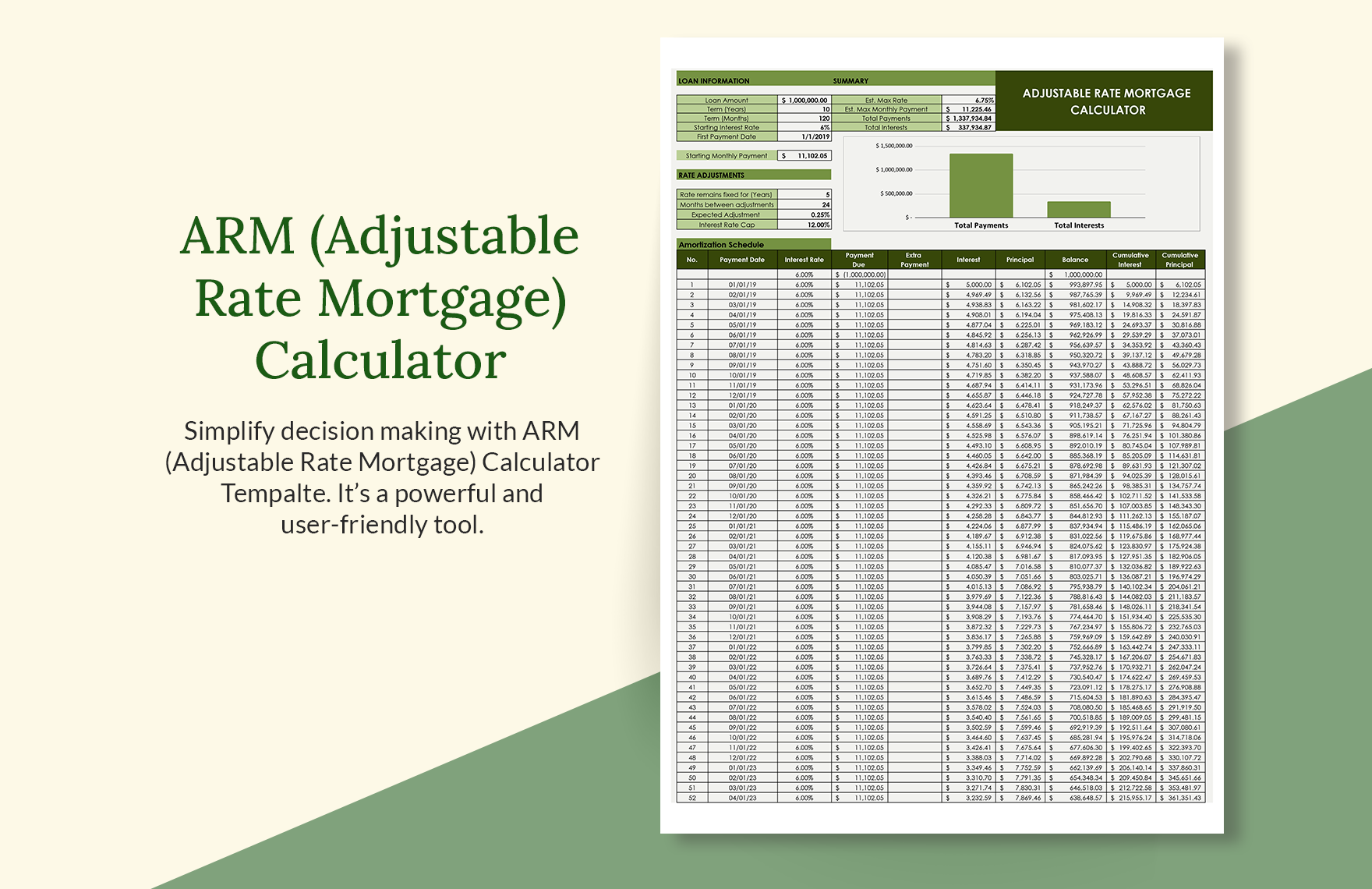

Arm Adjustable Rate Mortgage Calculator In Excel Google Sheets A hybrid arm has a honeymoon period where rates are fixed. typically it is 5 or 7 years, though in some cases it may last either 3 or 10 years. some hybrid arm loans also have less frequent rate resets after the initial grace period. for example a 5 5 arm would be an arm loan which used a fixed rate for 5 years in between each adjustment. Margin. this percent is added to the index rate to determine the interest rate charged on the arm loan. if a loan is indexed against cofi with a margin of 3% then if cofi goes from 1.9% to 2.7% the arm's interest rate would shift from 4.9% to 5.7% apr.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel 6.125%. term. 20 years. paid interest. $162,983.32. total payments. $412,983.32. with the arm mortgage calculator you can model and estimate the repayment and interest costs of a given adjustable rate mortgage. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. this adjustable rate mortgage calculator helps you to approximate your possible adjustable mortgage. Estimate 3 1, 5 1, 7 1 & 10 1 interest only adjustable rate mortgage payments interest only adjustable rate home loans this calculator enables you to quickly calculate the intial and maximum monthly loan payments for any i o adjustable rate loan & see how those payments compare against a conforming 30 year fixed rate mortgage payment. The following table shows the loan amortization for a $200,000 5 1 arm loan. while interest rates may fluctuate & future market conditions are unknown, the following assumptions were made for the calculation: initial apr: 4%. initial rate adjustment after 5 years: 2.5%. subsequent annual adjustments: 0.125%.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel Estimate 3 1, 5 1, 7 1 & 10 1 interest only adjustable rate mortgage payments interest only adjustable rate home loans this calculator enables you to quickly calculate the intial and maximum monthly loan payments for any i o adjustable rate loan & see how those payments compare against a conforming 30 year fixed rate mortgage payment. The following table shows the loan amortization for a $200,000 5 1 arm loan. while interest rates may fluctuate & future market conditions are unknown, the following assumptions were made for the calculation: initial apr: 4%. initial rate adjustment after 5 years: 2.5%. subsequent annual adjustments: 0.125%. Conforming arm loans: adjustable rate loans and rates are subject to change during the loan term. that change can increase or decrease your monthly payment. the annual percentage rate (apr) calculation assumes a $464,000 loan with a 25% down payment and borrower paid finance charges of 0.862% of the loan amount, plus origination fees if. Use our adjustable rate mortgage (arm) calculator to see how interest rate assumptions will impact your monthly payments and the total interest paid over the life of the loan. loan amount ($) initial interest rate (0% to 40%) number of months (30yrs=360) (1 to 480) absolute minimum rate over term of loan (0% to 40%).

Adjustable Rate Mortgage Arm Calculator Herring Bank Conforming arm loans: adjustable rate loans and rates are subject to change during the loan term. that change can increase or decrease your monthly payment. the annual percentage rate (apr) calculation assumes a $464,000 loan with a 25% down payment and borrower paid finance charges of 0.862% of the loan amount, plus origination fees if. Use our adjustable rate mortgage (arm) calculator to see how interest rate assumptions will impact your monthly payments and the total interest paid over the life of the loan. loan amount ($) initial interest rate (0% to 40%) number of months (30yrs=360) (1 to 480) absolute minimum rate over term of loan (0% to 40%).

How To Calculate Your Monthly Adjustable Rate Mortgage Loan Payment

Comments are closed.