Are You Saving Enough To Retire The Big Picture

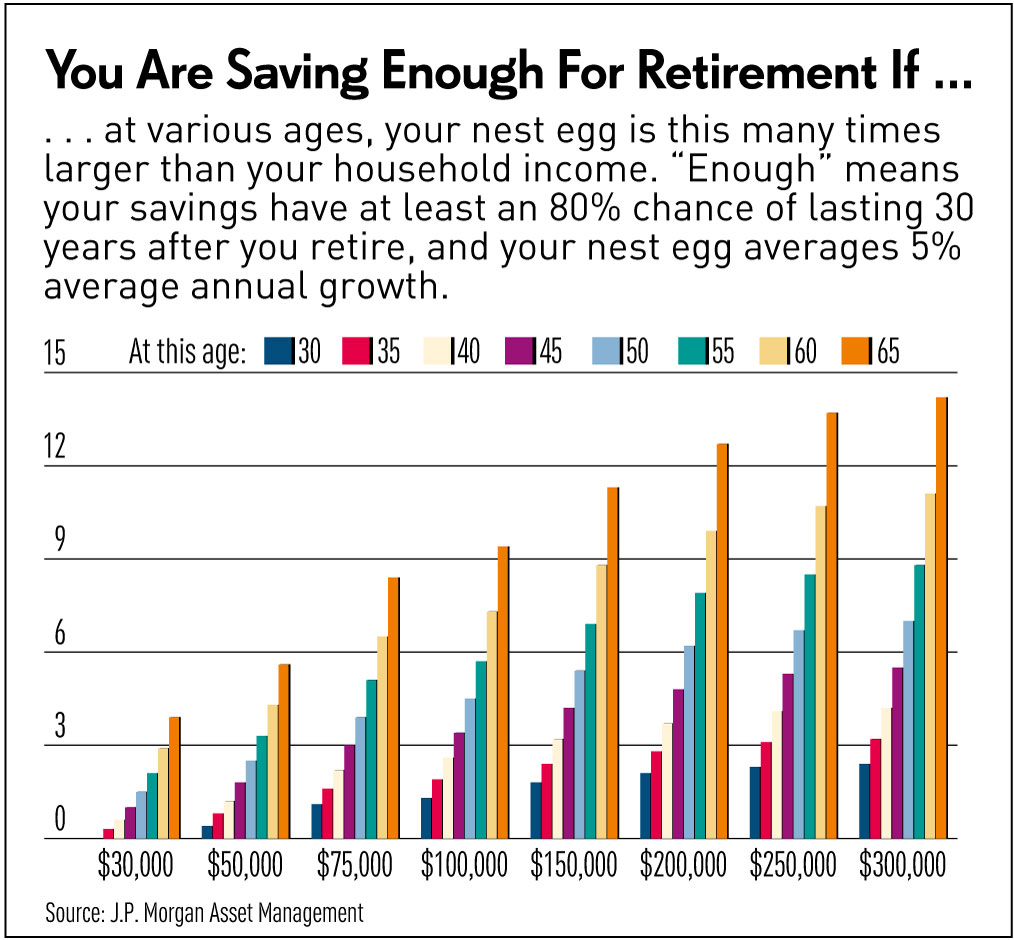

Are You Saving Enough To Retire The Big Picture You take $4,000 per year of income for each $100,000 you have (that’s 4% of $100,000). if you have $500,000 saved for retirement, that’s $20,000 of annual income from your investments. if you have $1 million, that’s $40,000 per year. that may not sound like much, but this might make more sense when we look closer. 1. you can save more for retirement. a few extra years to save can make a big difference. time is one of the most critical elements in saving for retirement thanks to the magic of compounding. consider the hypothetical example below in the illustration, the power of time. delaying withdrawals and continuing to contribute to their retirement.

Are You Saving Enough For Retirement Ellis Bates Financial Advisers 4. size up your debt & make a plan to wipe it out. having debt is no reason to put off retirement savings, especially if your debt is relatively low cost. however, in some cases, student or consumer debt may stand in the way of savings that you need for your life goals and retirement vision. luckily, you have options. American adults say on average they now need $1.46 million to retire, according to the northwestern northwestern 0.0% mutual 2024 planning & progress study. that’s 15% higher than a year earlier. How this retirement calculator works. to estimate how much you'll save by retirement age ("what you'll have"), start with your current age and how much you've saved so far. add your income and. Here are five steps to help clients retire on their schedule, both when and how they envision it: help clients visualize retirement plans and progress. focus on big picture goals for retirement.

How Much Do You Need To Retire The Big Picture How this retirement calculator works. to estimate how much you'll save by retirement age ("what you'll have"), start with your current age and how much you've saved so far. add your income and. Here are five steps to help clients retire on their schedule, both when and how they envision it: help clients visualize retirement plans and progress. focus on big picture goals for retirement. Yes. financial goals software do not give you a yes or no answer. most use a process that yields a probability of success percentage. based on your age you’ll want a percentage that’s. It also assumes that you need an annual income in retirement equivalent to 55% to 80% of your pre retirement income to live comfortably. depending on your spending habits and medical expenses.

Are You Saving Enough To Retire Yes. financial goals software do not give you a yes or no answer. most use a process that yields a probability of success percentage. based on your age you’ll want a percentage that’s. It also assumes that you need an annual income in retirement equivalent to 55% to 80% of your pre retirement income to live comfortably. depending on your spending habits and medical expenses.

Are You Saving Enough To Retire

Comments are closed.