Are High Deductible Health Insurance Plans A Better Choice

Pros Cons Of High Deductible Health Insurance Plans Alliance Health The amount you pay out of pocket is called the deductible. according to the irs, an hdhp is defined as the following in 2022: any health plan carrying a deductible of at least $1,400 for an. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles.

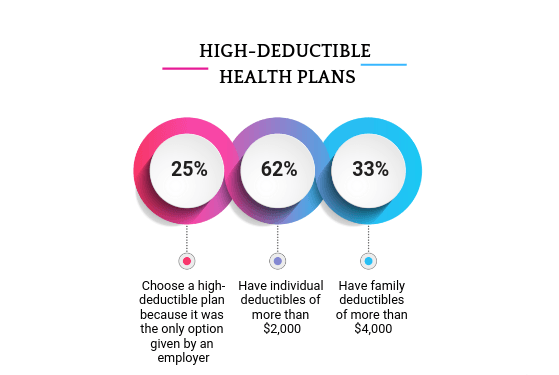

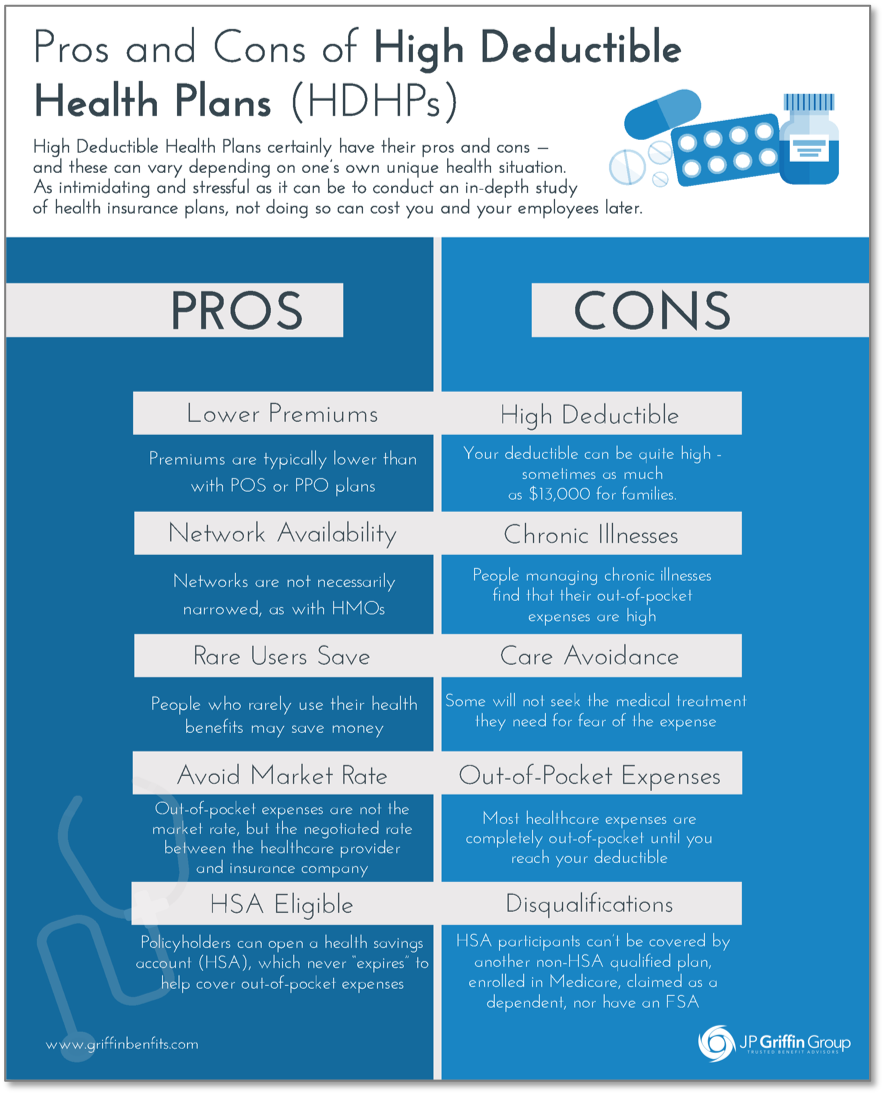

What Is A High Deductible Health Plan Insurance Noon Cons. higher deductible: if your deductible is higher, it means you are required to pay for your medical care out of pocket up to that amount before your health plan begins to help pay for covered costs. the exception is for preventive care, which is covered at 100% under most health plans when you stay in network. 1. Key takeaways: a high deductible health plan (hdhp) is a health insurance policy that has a lower monthly premium and a higher deductible. hdhps typically cover all preventive, in network care in full, even before the deductible is met. if a person needs any medical services beyond that, they must pay the full deductible before they receive. High deductible health plans are also called hsa eligible plans. they’re the only type of health insurance you can pair with a health savings account. hdhps and hsas go together for a good reason. hsas can be used to help pay for certain out of pocket health care costs and get you closer to reaching your deductible. But the average deductible for a silver plan this year is $3,572 for an individual and $7,474 for a family, according to the health insurance data website healthpocket. those are eye popping.

Pros And Cons Of High Deductible Health Plans Ferencearison Insurance High deductible health plans are also called hsa eligible plans. they’re the only type of health insurance you can pair with a health savings account. hdhps and hsas go together for a good reason. hsas can be used to help pay for certain out of pocket health care costs and get you closer to reaching your deductible. But the average deductible for a silver plan this year is $3,572 for an individual and $7,474 for a family, according to the health insurance data website healthpocket. those are eye popping. A high deductible health plan (hdhp) is a type of health insurance that requires the policyholder to pay a higher deductible before the insurance company starts covering medical expenses. in exchange for these higher deductibles, hdhps typically offer lower monthly premiums compared to traditional health plans, making them an attractive option. A high deductible health plan (hdhp) is a type of health insurance that requires you to pay more of your medical bills before your coverage starts. because you pay for more of your health care costs, these plans are usually cheaper than other types of health insurance. the internal revenue service (irs) creates the requirements that hdhps have.

High Deductible Health Plan Hdhp Meaning How It Works Pros Cons A high deductible health plan (hdhp) is a type of health insurance that requires the policyholder to pay a higher deductible before the insurance company starts covering medical expenses. in exchange for these higher deductibles, hdhps typically offer lower monthly premiums compared to traditional health plans, making them an attractive option. A high deductible health plan (hdhp) is a type of health insurance that requires you to pay more of your medical bills before your coverage starts. because you pay for more of your health care costs, these plans are usually cheaper than other types of health insurance. the internal revenue service (irs) creates the requirements that hdhps have.

The Pros And Cons Of High Deductible Health Plans Hdhps

Comments are closed.