Annual Deductible Vs Out Of Pocket Maximum

Calendar Year Deductible Explained Row Leonie Getty. a deductible is what you pay for healthcare services before your health insurance plan begins paying for care. the out of pocket maximum is the most you can pay for in network care during a. Updated oct 18, 2024. a deductible is the amount you'll have to pay for medical care at the beginning of your insurance policy. the out of pocket max is the most you'll pay for medical expenses in a year. for each policy year, you'll pay the full cost of most medical care until your total spending reaches the deductible amount.

Deductible Versus Out Of Pocket Difference Between Deductible In 2016, your out of pocket maximum can be no more than: $6,850 for an individual plan. $13,700 for a family plan. starting in 2016, individual limits apply to everyone with coverage, even those. A deductible is what you pay for healthcare before your insurance kicks in. your out of pocket maximum is the most you will pay during the year. a higher premium often comes with a lower deductible and out of pocket max. health insurance terms can often be confusing. you might be among the many looking for clarity on the difference between. Jane’s marketplace plan coverage starts on january 1. the plan’s deductible is $1,500, the coinsuranceis 20%, and the plan’s out of pocket maximum is $5,000. (jane’s plan has a different deductible, coinsurance, and out of pocket maximum for prescription drugs. this example only shows costs for health services.) deductible:. Deductible vs. out of pocket maximum. a deductible is usually more relevant at the beginning of the plan year and an out of pocket maximum at the end. this is because, as a policyholder, you’ll first pay toward the deductible for any covered healthcare. then, once the deductible is met, you’ll continue to pay the copay and coinsurance.

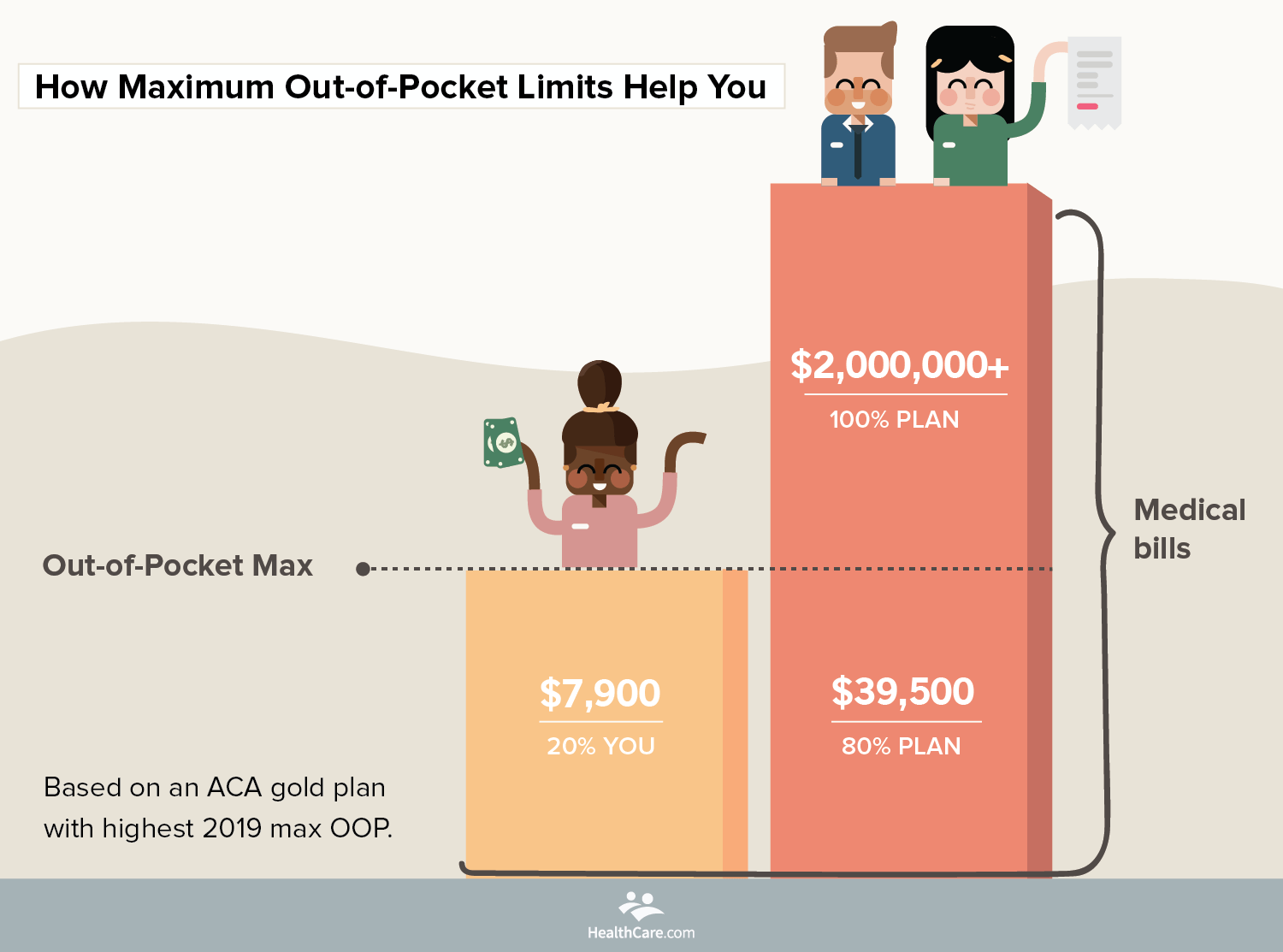

What You Need To Know About Your Out Of Pocket Maximum Jane’s marketplace plan coverage starts on january 1. the plan’s deductible is $1,500, the coinsuranceis 20%, and the plan’s out of pocket maximum is $5,000. (jane’s plan has a different deductible, coinsurance, and out of pocket maximum for prescription drugs. this example only shows costs for health services.) deductible:. Deductible vs. out of pocket maximum. a deductible is usually more relevant at the beginning of the plan year and an out of pocket maximum at the end. this is because, as a policyholder, you’ll first pay toward the deductible for any covered healthcare. then, once the deductible is met, you’ll continue to pay the copay and coinsurance. Monthly premium: $475. deductible: $2,500. co insurance: 20%. out of pocket max: $8,000. based on that information, you know that you spend $475 each month on your health plan. you’ll continue to pay for all medical expenses your policy covers out of pocket until you’ve spent $2,500. Coinsurance. a fixed percentage you pay for medical expenses after the deductible is met. for example, if your coinsurance is 80 20, it means that your insurance pays 80% and you pay 20% of the bill after you’ve met your annual deductible. in september, you break your arm. total bill for emergency room visit, doctors, x ray, and cast = $2,500.

What Are Deductibles And Out Of Pocket Maximums Youtube Monthly premium: $475. deductible: $2,500. co insurance: 20%. out of pocket max: $8,000. based on that information, you know that you spend $475 each month on your health plan. you’ll continue to pay for all medical expenses your policy covers out of pocket until you’ve spent $2,500. Coinsurance. a fixed percentage you pay for medical expenses after the deductible is met. for example, if your coinsurance is 80 20, it means that your insurance pays 80% and you pay 20% of the bill after you’ve met your annual deductible. in september, you break your arm. total bill for emergency room visit, doctors, x ray, and cast = $2,500.

Annual Deductible Vs Out Of Pocket Maximum Youtube

Definitions And Meanings Of Health Care And Health Insurance Terms

Comments are closed.