An Energy Crisis Is Here And The Impact On Uranium Could Everyone Run At Uranium

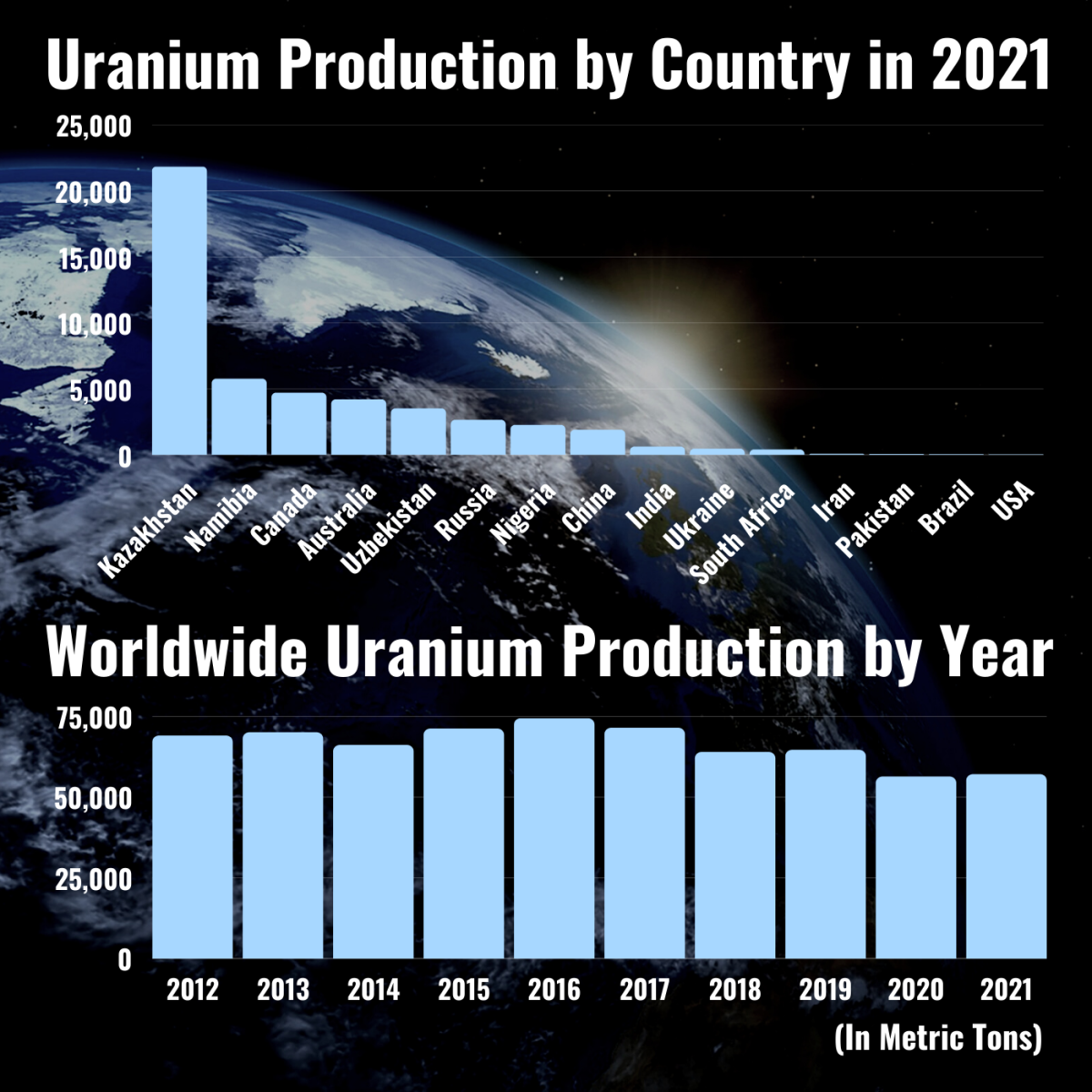

Global Mining Review Article The Power Of Uranium Thor Energy Plc Uranium was on a tear last year, rising more than 30 per cent as investors wagered on nuclear energy becoming a central feature of the shift away from fossil fuels and the electrification of the. The surge was due to rising demand from china and india and supply disruptions at major production centers. for example, there was flooding at cameco’s (cco ca) cigar lake mine in canada and disruption at rio tinto’s (rio gb) ranger mine due to cyclone monica. however, the financial crisis halted the uranium bull market as prices fell to.

How Uranium Stocks Are Benefitting From The Global Energy Crisis Youtube Uranium has its "own setbacks because no energy source is perfect, or that silver bullet to solve all the world's woes. nonetheless, it is a stable, reliable energy source which we have multiple. The good news is the pivot is already underway as the energy crisis in 2022 galvanized political will and unleashed market forces to break a lost decade of inertia. the uranium price is responding, with spot rising from $48 per pound to $91 in 2023,2 and the term contracting price approaching $100 caps. Washington, d.c. — in support of president biden’s investing in america agenda, today the u.s. department of energy (doe) issued a request for proposals (rfp) for uranium enrichment services to help establish a reliable domestic supply of fuels using high assay low enriched uranium (haleu)—a crucial material needed to deploy advanced nuclear reactors, which will help reach president. As the sector grows and recapitalizes, it will attract ever larger institutions, drawn by a compelling investment thesis and improving liquidity. while 2023 was a momentous and rewarding year for nuclear energy, uranium and the miners, we remain bullish on the long term prospects for the sector. figure 4. uranium bull market continues (1968 2023).

How To Invest In Nuclear Energy Adding Uranium To Your Portfolio Washington, d.c. — in support of president biden’s investing in america agenda, today the u.s. department of energy (doe) issued a request for proposals (rfp) for uranium enrichment services to help establish a reliable domestic supply of fuels using high assay low enriched uranium (haleu)—a crucial material needed to deploy advanced nuclear reactors, which will help reach president. As the sector grows and recapitalizes, it will attract ever larger institutions, drawn by a compelling investment thesis and improving liquidity. while 2023 was a momentous and rewarding year for nuclear energy, uranium and the miners, we remain bullish on the long term prospects for the sector. figure 4. uranium bull market continues (1968 2023). The u.s. is home to just 1% of the world’s available uranium resources, according to the world nuclear association; uranium is “more abundant and cheaper to produce in other countries,” the. The world's conventional identified uranium resources amounted to 8 070 400 tonnes of uranium metal (tu) as of 1 january 2019. these represent all reasonably assured and inferred uranium resources that could be recovered at market prices ranging from 40 to 260 usd kgu (equivalent to 15 to 100 usd lb u 3 o 8). compared to the total reported in.

Why Uranium Has Rallied Defying A Drop In The Energy Sector Marketwatch The u.s. is home to just 1% of the world’s available uranium resources, according to the world nuclear association; uranium is “more abundant and cheaper to produce in other countries,” the. The world's conventional identified uranium resources amounted to 8 070 400 tonnes of uranium metal (tu) as of 1 january 2019. these represent all reasonably assured and inferred uranium resources that could be recovered at market prices ranging from 40 to 260 usd kgu (equivalent to 15 to 100 usd lb u 3 o 8). compared to the total reported in.

Uranium Mining

Uranium Supply Shortages And Nuclear Adoption Crystal Capital Partners

Comments are closed.