Americans Average Retirement Savings By Age And What They Think They

Americans Average Retirement Savings By Age And What They Think They 55 64. $537,560. 65 74. $609,230. 75 or older. $462,410. of course, averages can be skewed by those who have large nest eggs, and median numbers are significantly lower, according to the federal. The median retirement savings for american households is $87,000. median retirement savings for americans younger than 35 is $18,800. 67% of americans have a retirement account but only 34% feel.

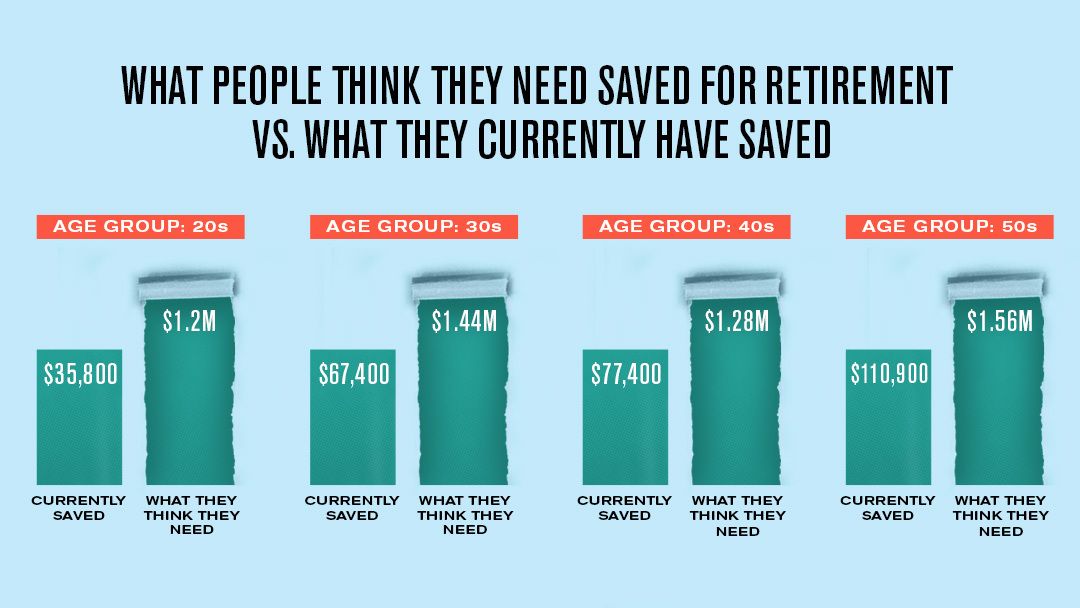

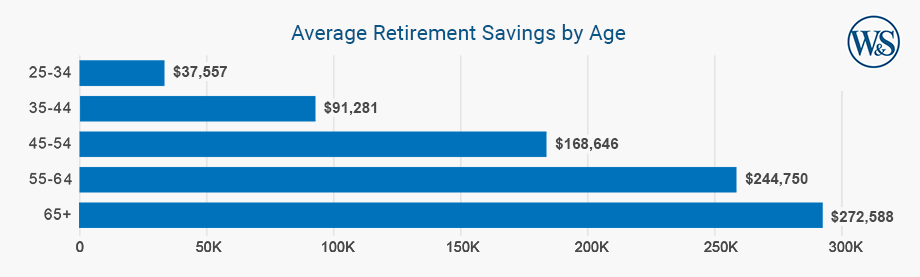

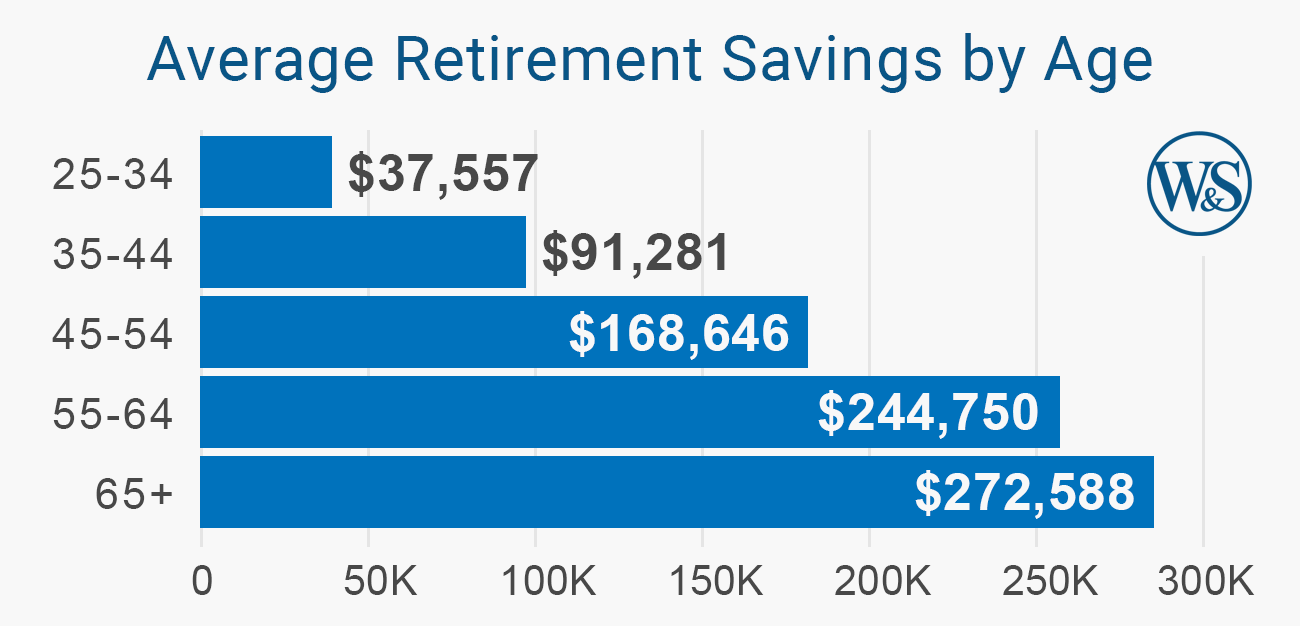

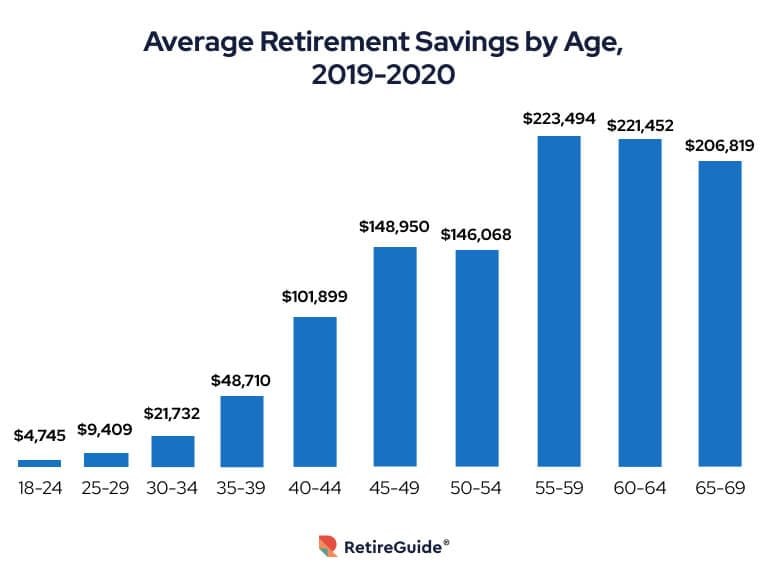

Average Retirement Savings By Age On average, americans have less than $89,000 saved for retirement. they think they’ll need $1.46 million. the 2024 northwestern mutual planning & progress study finds a widening gap between what people have and what they think they will need. “people’s ‘magic number’ to retire comfortably has exploded to an all time high, and the gap. Americans reported a median retirement account value of $87,000 in the most recent scf, but the median balance varied substantially between different age groups. retirement savings may also. Average household retirement savings: $537,560. median household retirement savings: $185,000. this age range is close to social security’s definition of full retirement age, which ranges from. The data shows average retirement savings amounts of $112,572. this varies significantly by age, with those in their late 20s to early 30s saving an average of over $30,000 to date compared to those in their mid 30s to early 40s who save over $70,000 so far. of course, the younger groups have had less time to accrue funds and still have 20, 30.

Average Retirement Savings By Age Average household retirement savings: $537,560. median household retirement savings: $185,000. this age range is close to social security’s definition of full retirement age, which ranges from. The data shows average retirement savings amounts of $112,572. this varies significantly by age, with those in their late 20s to early 30s saving an average of over $30,000 to date compared to those in their mid 30s to early 40s who save over $70,000 so far. of course, the younger groups have had less time to accrue funds and still have 20, 30. Average retirement savings by age. the above chart shows that u.s. residents under 35 have an average of $49,130 in retirement savings; those 35 to 44 have an average $141,520; those 45 to 54 have an average $313,220; those 55 to 64 have an average $537,560; those 65 to 74 have an average $609,230; and those 75 or older have an average $462,410. Below, we show the average and median retirement savings in the u.s. by age group: for people aged 35 and under, the median savings were $18,880, while this amount increased to $200,000 for those aged 65 to 74. at current rates, this means that older generations are living on a mere $10,000 per year in retirement based on these savings alone.

Best Retirement Age Full Age For Benefits Average Savings Needed Average retirement savings by age. the above chart shows that u.s. residents under 35 have an average of $49,130 in retirement savings; those 35 to 44 have an average $141,520; those 45 to 54 have an average $313,220; those 55 to 64 have an average $537,560; those 65 to 74 have an average $609,230; and those 75 or older have an average $462,410. Below, we show the average and median retirement savings in the u.s. by age group: for people aged 35 and under, the median savings were $18,880, while this amount increased to $200,000 for those aged 65 to 74. at current rates, this means that older generations are living on a mere $10,000 per year in retirement based on these savings alone.

Comments are closed.