Advanced Markets Drive Non Life Re Insurance Growth In 2015 Swiss Re

Advanced Markets Drive Non Life Re Insurance Growth In 2015 Swiss Re Reinsurance non life market overview. global non life reinsurance premiums in 2015 totalled about usd 170 billion, 26% of which stemmed from ceding companies in emerging markets. in general, reinsurance demand is a function of the size and capital resources of primary insurance companies, as well as of the risk profile of the insurance products. Global non life insurance and reinsurance premiums were up by 3.6% during 2015 to $2.02 trillion, driven by advanced market movements as emerging market.

Non Life Reinsurance Market To See Continued Growth Swiss Re Sigma 3 2024: world insurance: strengthening global resilience with a new lease of life. prevailing economic conditions have given insurance business a new lease of life. economic resilience, reflected in slowing but still robust economic growth, and high interest rates are driving much improved industry profitability. We forecast an improvement in investment yields to 3.6% in 2024 and 3.9% in 2025 as bond portfolios move away from pre pandemic compositions. life insurance sector growth 2023, by market. life insurance premium volumes in advanced markets were down 1.1% in real terms last year, an improvement from the 4.7% slump in 2022. In spite of a challenging environment in 2015 with moderate global economic growth of 2.5%, direct premiums written grew 3.8% in real terms, up from 3.5% growth in 2014. however, in nominal us dollar (usd) terms, global premiums were down by 4.2%, due to currency depreciation against the usd, particularly in the advanced markets. there was a slight slowdown in the life sector in 2015, with. Real premium growth in the non life reinsurance sector is expected to increase in 2017, based on higher cessions from emerging markets. advanced markets’ premium growth will reflect a moderation in rate pressures and slowing growth in the primary market. demand will likely be supported by new and stronger solvency regulations.

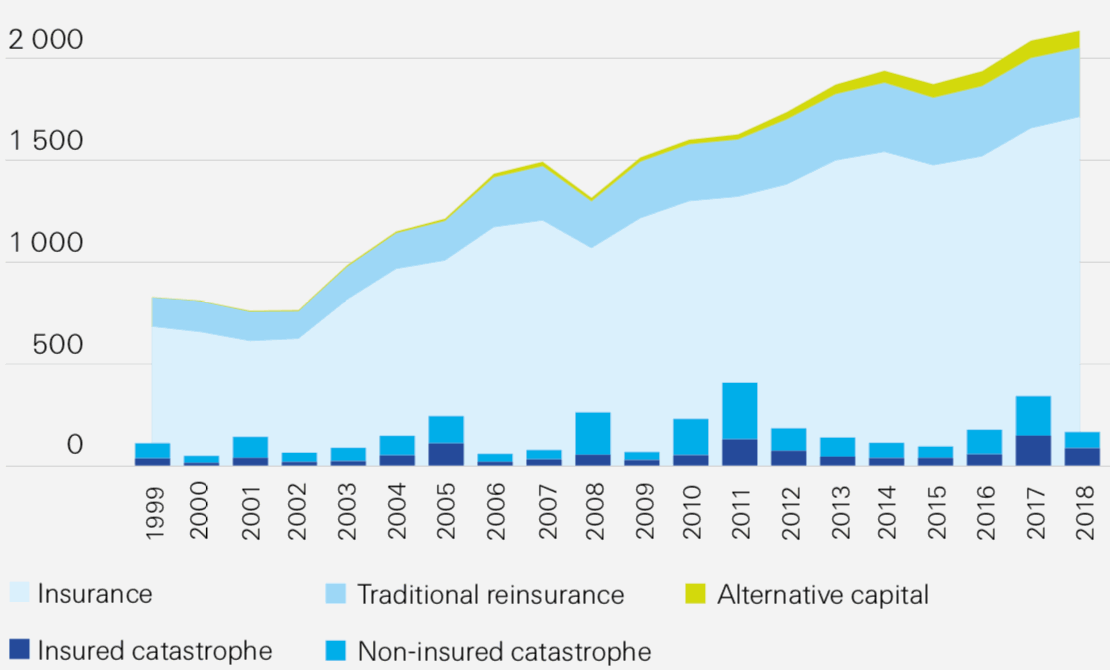

Switzerland Non Life Insurance Market Summary Competitive Analysis And In spite of a challenging environment in 2015 with moderate global economic growth of 2.5%, direct premiums written grew 3.8% in real terms, up from 3.5% growth in 2014. however, in nominal us dollar (usd) terms, global premiums were down by 4.2%, due to currency depreciation against the usd, particularly in the advanced markets. there was a slight slowdown in the life sector in 2015, with. Real premium growth in the non life reinsurance sector is expected to increase in 2017, based on higher cessions from emerging markets. advanced markets’ premium growth will reflect a moderation in rate pressures and slowing growth in the primary market. demand will likely be supported by new and stronger solvency regulations. Market performance. global premiums in non life reinsurance are estimated to have grown by around 5% in 2018 in real terms, mainly based on rapidly increasing cessions from emerging markets. the impact from natural catastrophe losses is less severe after last year’s record global insured of usd 144 billion disaster related losses. The global insurance industry gained momentum in 2014, even though the economic environment improved only marginally, says swiss re's latest sigma study. total direct premiums written were up 3.7% to usd 4 778 billion after having stagnated the previous year. the life sector returned to positive growth, with premiums up 4.3% after a 1.8% decline in 2013, and non life premium growth accelerated.

Swiss Re Expects Growth For Non Life Reinsurance Market Market performance. global premiums in non life reinsurance are estimated to have grown by around 5% in 2018 in real terms, mainly based on rapidly increasing cessions from emerging markets. the impact from natural catastrophe losses is less severe after last year’s record global insured of usd 144 billion disaster related losses. The global insurance industry gained momentum in 2014, even though the economic environment improved only marginally, says swiss re's latest sigma study. total direct premiums written were up 3.7% to usd 4 778 billion after having stagnated the previous year. the life sector returned to positive growth, with premiums up 4.3% after a 1.8% decline in 2013, and non life premium growth accelerated.

Alternative Capital Now 4 Of 2 Trillion Non Life Insurance Market

Analyzing Swiss Re S Growth Strategy How The Reinsurance Giant Is

Comments are closed.