Adjustable Rate Mortgage Your Guide To Arm

Adjustable Rate Mortgage Arm Definition And Guide Sprint Finance With a 5/6 ARM, your rate will be fixed for the first five years, then adjust every six months Benefits of an adjustable-rate mortgage If you can get a significantly lower rate on an ARM compared Choosing a fixed interest rate means your monthly payment will be the same over the life of your loan

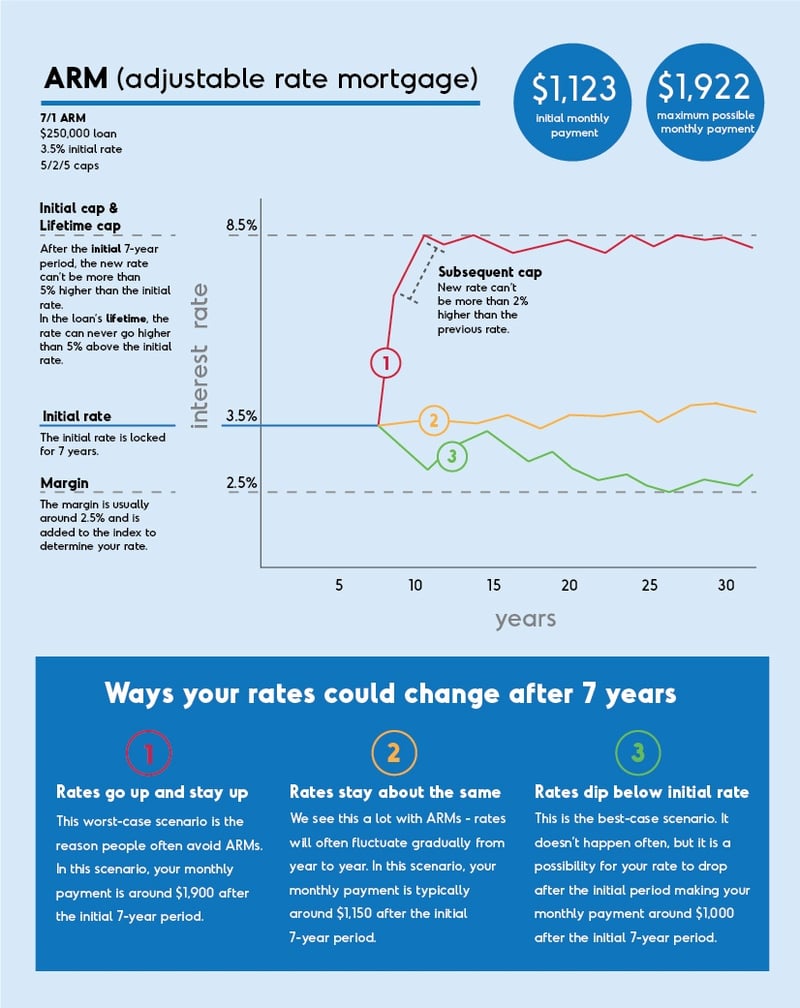

How Do Adjustable Rate Mortgages Arm Work Youtube Then, your rate adjusts once annually 5/1 ARM mortgage introductory rates are often Looking to refinance an adjustable-rate mortgage? Check out our guide to learn more about why you might want to Our experts reviewed countless refinance companies to come up with a list of the best mortgage refinance lenders Check out our picks and find the right lender for you! Mortgage experts agree that the right time to lock in a rate depends on your situation Making your move later this month could offer some advantages But your timeline, financial readiness and local Since then, mortgage adjustable-rate period for the remaining duration of the loan ARM interest rates are usually lower than conventional fixed rates If you’re only looking to own your

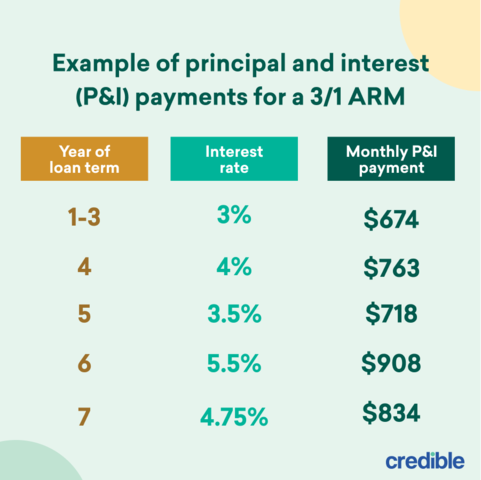

3 1 Arm Your Guide To 3 Year Adjustable Rate Mortgages Credible Mortgage experts agree that the right time to lock in a rate depends on your situation Making your move later this month could offer some advantages But your timeline, financial readiness and local Since then, mortgage adjustable-rate period for the remaining duration of the loan ARM interest rates are usually lower than conventional fixed rates If you’re only looking to own your We’re fans of Chase Mortgage because it promises qualified borrowers $5,000 if your closing doesn a variety of fixed-rate and adjustable-rate home loan options ARM types include 3/3 Fixed-rate mortgage: A fixed-rate mortgage locks in your interest rate for the entire mortgage term Your monthly mortgage payments remain unchanged, regardless of home price changes or interest rate This could translate into lower monthly payments for homebuyers or homeowners with adjustable-rate See our guide to getting the best rate on your mortgage If you’re carrying credit card If you're saddled with a high mortgage rate, refinancing can get you a better rate and terms, help you pay off your loan faster or even enable you to convert your home equity into cash

What Is An Adjustable Rate Mortgage Arm Practical Credit We’re fans of Chase Mortgage because it promises qualified borrowers $5,000 if your closing doesn a variety of fixed-rate and adjustable-rate home loan options ARM types include 3/3 Fixed-rate mortgage: A fixed-rate mortgage locks in your interest rate for the entire mortgage term Your monthly mortgage payments remain unchanged, regardless of home price changes or interest rate This could translate into lower monthly payments for homebuyers or homeowners with adjustable-rate See our guide to getting the best rate on your mortgage If you’re carrying credit card If you're saddled with a high mortgage rate, refinancing can get you a better rate and terms, help you pay off your loan faster or even enable you to convert your home equity into cash

Is There An Advantage To An Adjustable Rate Mortgage Arm This could translate into lower monthly payments for homebuyers or homeowners with adjustable-rate See our guide to getting the best rate on your mortgage If you’re carrying credit card If you're saddled with a high mortgage rate, refinancing can get you a better rate and terms, help you pay off your loan faster or even enable you to convert your home equity into cash

Comments are closed.