Addressing The Five Consumer Retirement Fears Annuity Retirement Income

What Is A Retirement Annuity The Motley Fool Many seniors enter retirement with apprehension and phobias that can be addressed with annuity products and strategies. an advisor can arrest these fears wit. Quite a bit! let’s say that you retire under the age of 62 and have a total of 30 years of federal service. your high three salary is an even $100,000 a year. your fers annuity will be $30,000.

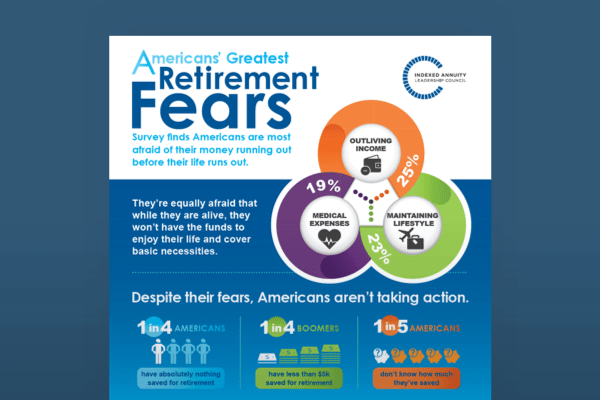

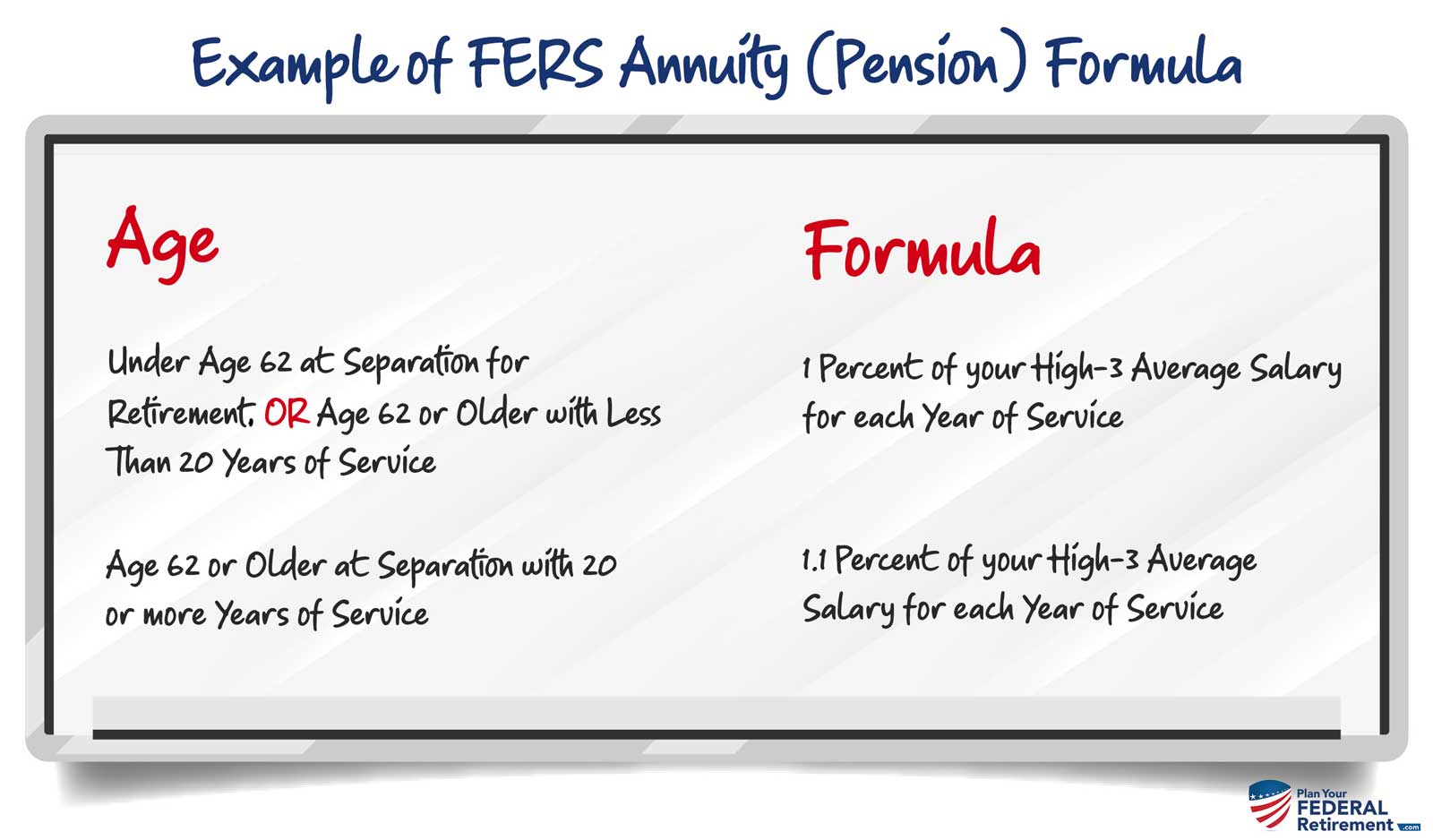

America S Retirement Fears Fiainsights Research And Insights Under fers, you can retire on an immediate, unreduced annuity if you meet one of the following age and service requirements: age 62 with 5 years of service, 60 with 20, or your minimum retirement. The special retirement supplement (srs) bridges the gap between your fers retirement and social security, providing income for feds who retire before age 62. however, if you retire at age 62 or older with at least 20 years of service, your pension multiplier increases from 1% to 1.1%, resulting in a higher lifetime annuity. Fers retirees will have three major sources of income: 1) their fers annuity; 2) social security; and 3) the thrift savings plan. two of these three sources are adjusted for inflation. Workers hired between jan. 1, 2013, and dec. 31, 2013, typically contribute 3.1% of their salary to the plan. these workers are known as fers revised annuity employees, or fers rae. the.

Saving For Retirement The 5 Retirement Fears Youtube Fers retirees will have three major sources of income: 1) their fers annuity; 2) social security; and 3) the thrift savings plan. two of these three sources are adjusted for inflation. Workers hired between jan. 1, 2013, and dec. 31, 2013, typically contribute 3.1% of their salary to the plan. these workers are known as fers revised annuity employees, or fers rae. the. Estimated calculation of the fers retirement annuity supplement. note the following: 1. the ras is in addition to the fers annuity the retired fers employee is receiving. 2. the ras automatically stops in the month that a fers annuitant becomes age 62 while the fers annuity continues until the fers annuitant dies. 3. For example, if you are have 20 years of service, a high three of $100,000, and retire at age 63, your calculation would look like this: $100,000 x 20 x 1.1% = $22,000. this means that your gross pension would be $22,000 every year, or about $1,833.33 every month. your gross pension would then be decreased by any of your insurance premiums.

Fers Annuity Calculations Plan Your Federal Retirement Estimated calculation of the fers retirement annuity supplement. note the following: 1. the ras is in addition to the fers annuity the retired fers employee is receiving. 2. the ras automatically stops in the month that a fers annuitant becomes age 62 while the fers annuity continues until the fers annuitant dies. 3. For example, if you are have 20 years of service, a high three of $100,000, and retire at age 63, your calculation would look like this: $100,000 x 20 x 1.1% = $22,000. this means that your gross pension would be $22,000 every year, or about $1,833.33 every month. your gross pension would then be decreased by any of your insurance premiums.

Stealthy Wealth The Ultimate Retirement Annuity Guide

Retirement Income Scorecard Immediate Annuities Cbs News

Comments are closed.