Acct 2301 Final Review Video 9 Bank Reconciliation And Journal Entries

Acct 2301 Final Review Video 9 Bank Reconciliation And Journal Entries Acct 2301 final review video 9 bank reconciliation and journal entries. On december 15, 2016, sansa declared a $950,000 cash dividend payable on january 15, 2017. multiply % by shares issued times 100. corgi, inc. has the following stock issued as of december 2015: 6% preferred stock, $100 par, 10,000 shares issued and outstanding. common stock, $5 par, 50,000 shares issued and outstanding.

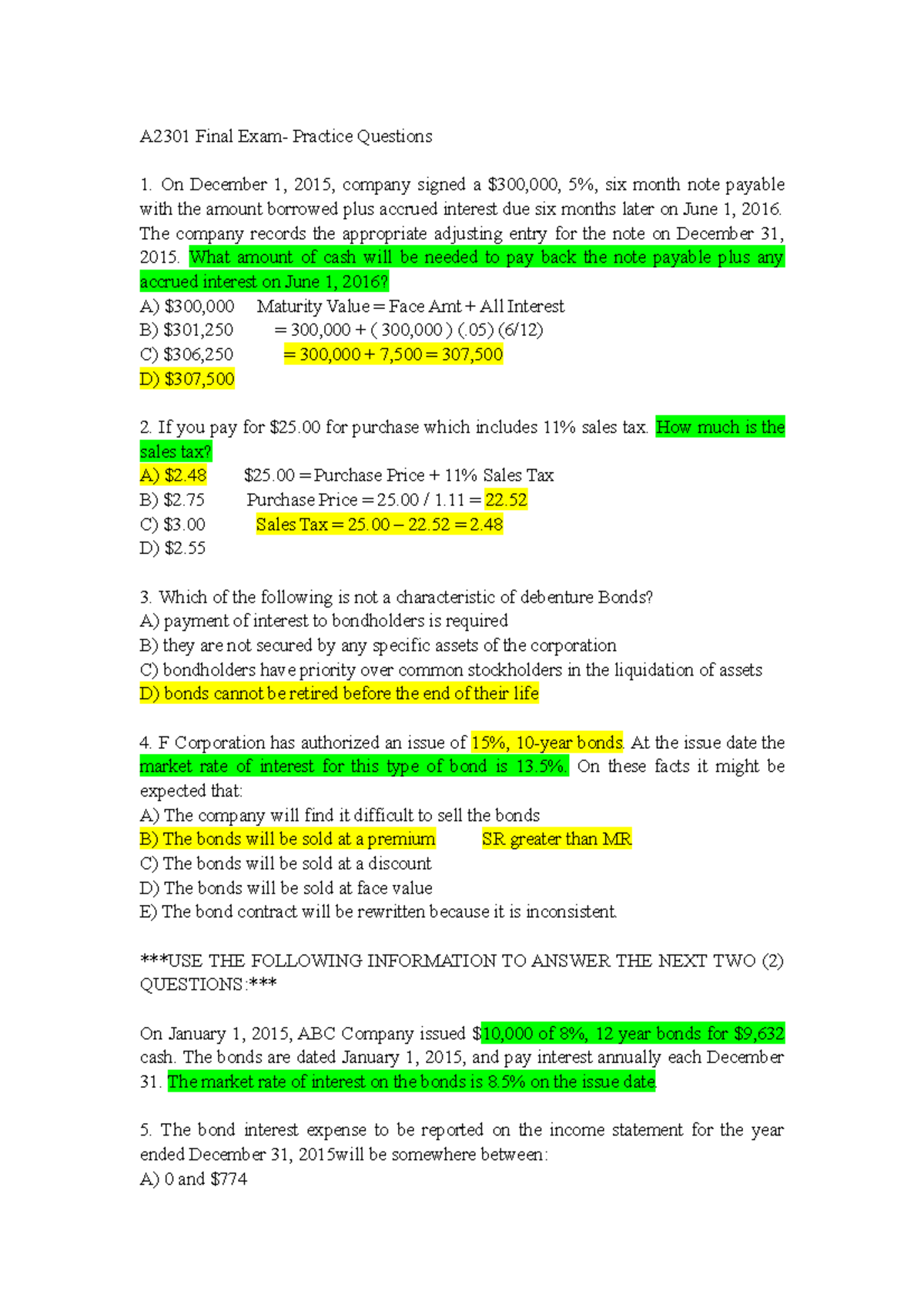

Acct 2301 Final Exam Review Questions And Answers A2301 Final Exam This video demonstrates how to prepare journal entries related to a bank reconciliation. Jansen packaging corporation began business in 2008 by issuing 40,000 shares of $5 oar common stock for $8 per share and 10,000 shares of 6%, $10 par preferred stock for par. at the end of the year, the common stock had a market value of $10. on its december 31, 2008 balance sheet, jansen packaging would report. Study with quizlet and memorize flashcards containing terms like issued 2000 shares of $.01 par value common stock to investors for cash at $20 per share, paid 3 months rent for the store at $1760 per month (recorded as prepaid expenses), purchased furniture and fixtures for the warehouse for 15,000, paying 3000 cash and the rest on account. the amount is due within 30 days. and more. In this video we do the journal entries required after the bank reconciliation is complete to record the items from the book side of the reconciliation. for.

Acct 2301 Exam 1 Review Acct 2301 Exam 1 Review Chapters 1 2 Know Study with quizlet and memorize flashcards containing terms like issued 2000 shares of $.01 par value common stock to investors for cash at $20 per share, paid 3 months rent for the store at $1760 per month (recorded as prepaid expenses), purchased furniture and fixtures for the warehouse for 15,000, paying 3000 cash and the rest on account. the amount is due within 30 days. and more. In this video we do the journal entries required after the bank reconciliation is complete to record the items from the book side of the reconciliation. for. Journal entries for the bank reconciliation process work as follows: 1. identify discrepancies. during bank reconciliation, you compare the cash balance on the company's records to the bank statement. any discrepancies must be identified, such as outstanding cheques, deposits in transit, bank fees, interest income, or recording errors. Bank reconciliation journal entries. the bank reconciliation journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting relating to bank reconciliation adjustments. in each case the bank reconciliation journal entries show the debit and credit account together.

Acct 2301 Final Exam Review Sheet Docx Final Exam Review Sheet Acct Journal entries for the bank reconciliation process work as follows: 1. identify discrepancies. during bank reconciliation, you compare the cash balance on the company's records to the bank statement. any discrepancies must be identified, such as outstanding cheques, deposits in transit, bank fees, interest income, or recording errors. Bank reconciliation journal entries. the bank reconciliation journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting relating to bank reconciliation adjustments. in each case the bank reconciliation journal entries show the debit and credit account together.

Comments are closed.