Acct 2301 Final Review Video 11 Double Declining Balance Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner Acct2301 is your complete online resource for learning introduction to financial accounting at ut arlington. the most understandable, logical content about financial accounting you'll find anywhere, online or off. about me. hey, i'm aaron. i made this site and recorded all these videos. 💥depreciation cheat sheet → accountingstuff shopin this video you'll learn how to use the double declining balance depreciation method in accoun.

Acct 2301 Final Review Q 2 Youtube This video explains the double declining balance depreciation method and illustrates how to calculate depreciation expense using the double declining balance. What is the double declining balance method for calculating depreciation for financial statements? an accelerated depreciation method that computes annual depreciation by multiplying the assets decreasing book value by a constant percentage, which is two times the straight line rate. In this video, i will teach you how to use the double declining balance method to calculate the depreciation expense for your assets. this method is faster a. Online, on demand acct 2301 exam review. looking for an exam review for acct 2301? you're in luck, i made videos covering that whole class! and you just found them. my name is aaron and i made this site, recorded 88 videos, and wrote 74 practice problems for acct 2301. you can watch them any time, anywhere.

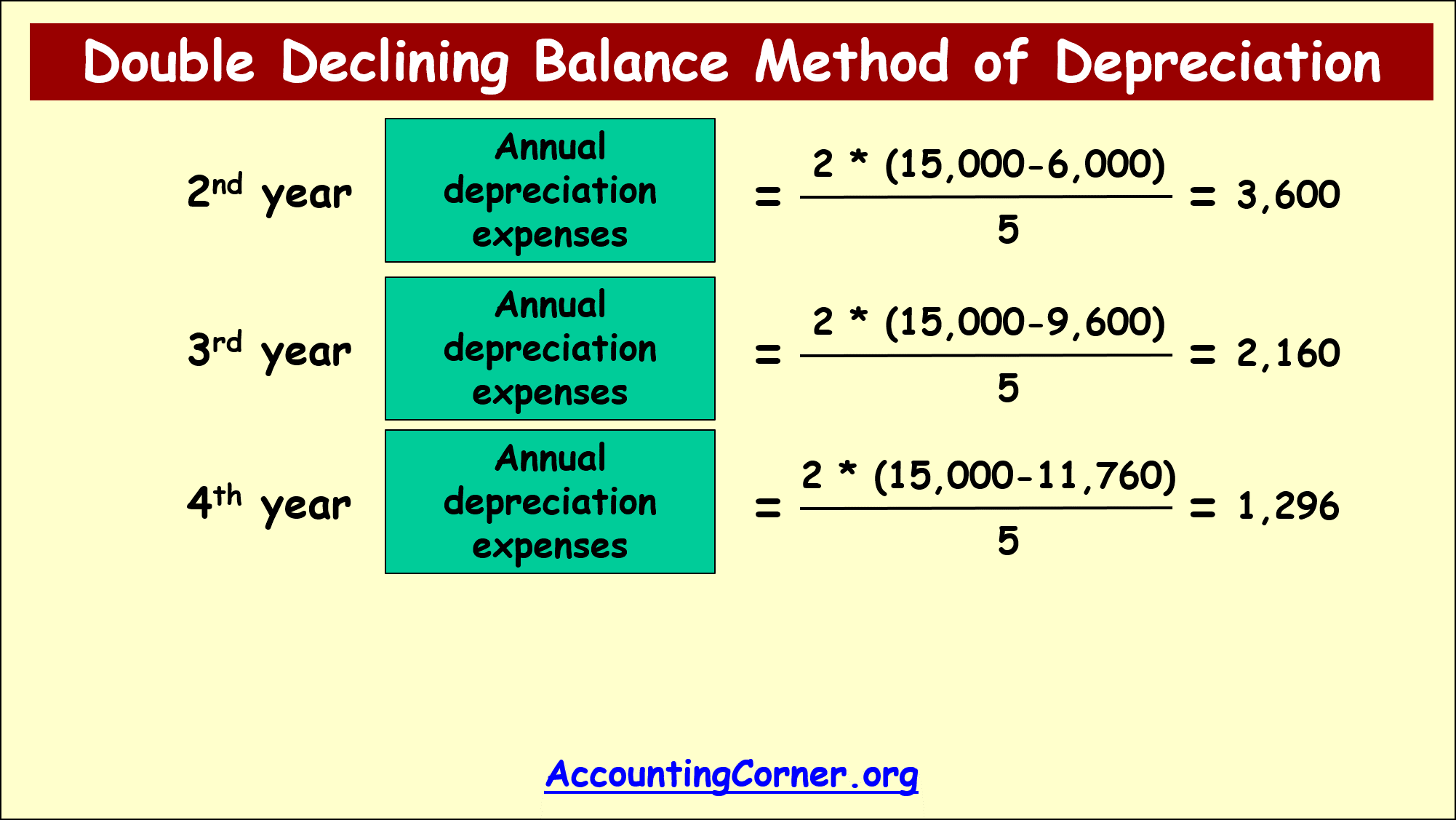

Double Declining Balance Method Of Depreciation Accounting Corner In this video, i will teach you how to use the double declining balance method to calculate the depreciation expense for your assets. this method is faster a. Online, on demand acct 2301 exam review. looking for an exam review for acct 2301? you're in luck, i made videos covering that whole class! and you just found them. my name is aaron and i made this site, recorded 88 videos, and wrote 74 practice problems for acct 2301. you can watch them any time, anywhere. The double declining balance method is a form of accelerated depreciation. in this approach, the asset is depreciated at double the rate as compared to straight line depreciation. hence, it’s called double declining balance depreciation. let us consider an example of an asset with a useful life of 10 years. How to calculate depreciation in ddb method. the steps to determine the annual depreciation expense under the double declining method are as follows. step 1 → calculate the straight line depreciation expense (purchase cost – salvage value) ÷ useful life assumption. step 2 → divide the annual depreciation under the straight line method by.

Acct 2301 Final Review 11 To 13 Youtube The double declining balance method is a form of accelerated depreciation. in this approach, the asset is depreciated at double the rate as compared to straight line depreciation. hence, it’s called double declining balance depreciation. let us consider an example of an asset with a useful life of 10 years. How to calculate depreciation in ddb method. the steps to determine the annual depreciation expense under the double declining method are as follows. step 1 → calculate the straight line depreciation expense (purchase cost – salvage value) ÷ useful life assumption. step 2 → divide the annual depreciation under the straight line method by.

Double Declining Balance Method Of Depreciation Accounting Corner

Acct 2301 Final Review Questions 1 Youtube

Comments are closed.