Accounts Payable Automation Best Practices Must Read Guide

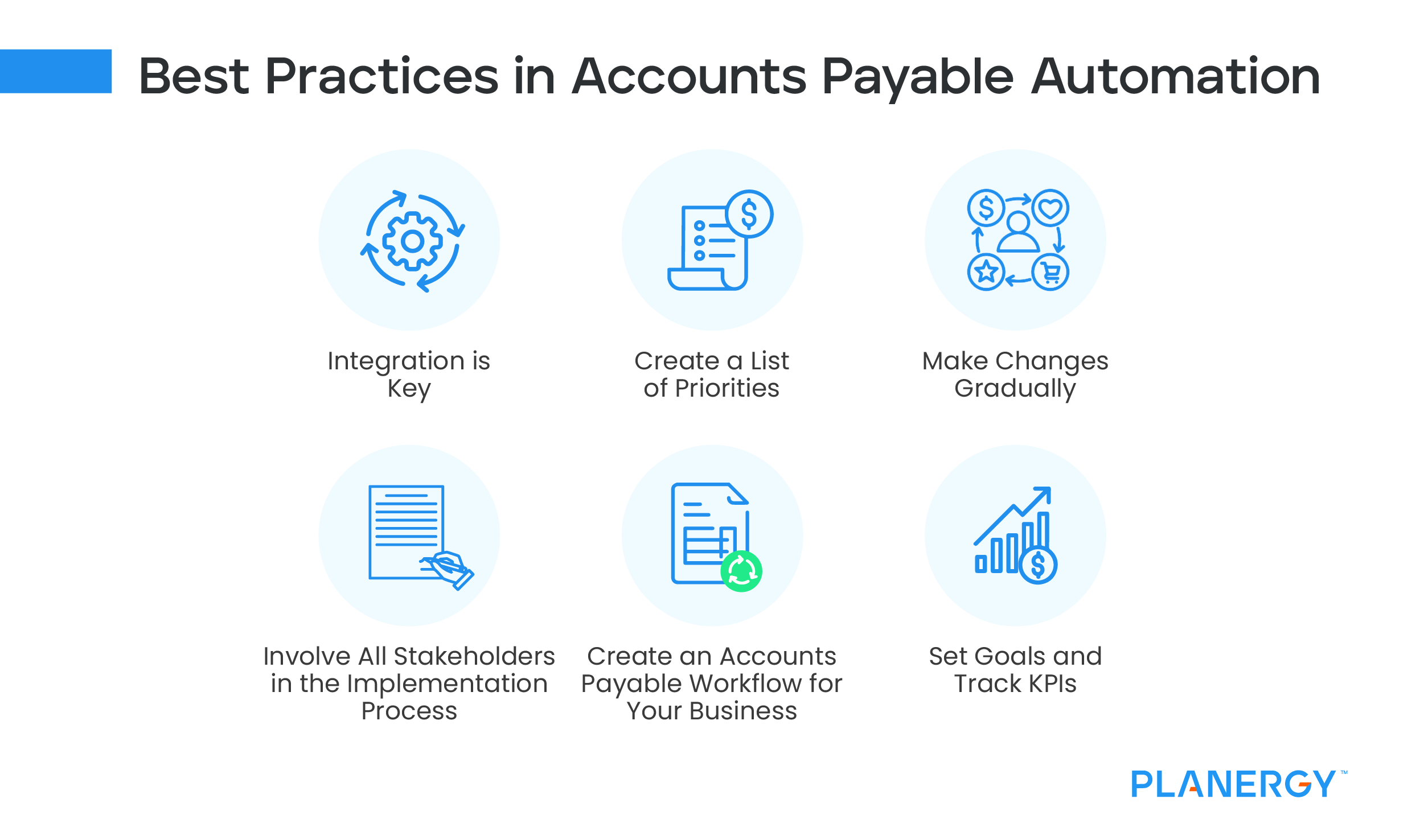

Best Practices In Accounts Payable Automation Planergy Software Best practices to adopt while implementing ap automation. to save you the trouble, we’ve compiled a curated list of the accounts payable automation best practices to implement along with your to ensure that it remains efficient and effective. they are as follows:–. 1. involve your staff. Ap automation can dramatically reduce days payable outstanding (dpo) —by an average of 5.55 days, according to the aberdeen group. but that reduction depends on when an invoice is entered into the system. if you are still receiving paper invoices, you’ll need to scan them promptly.

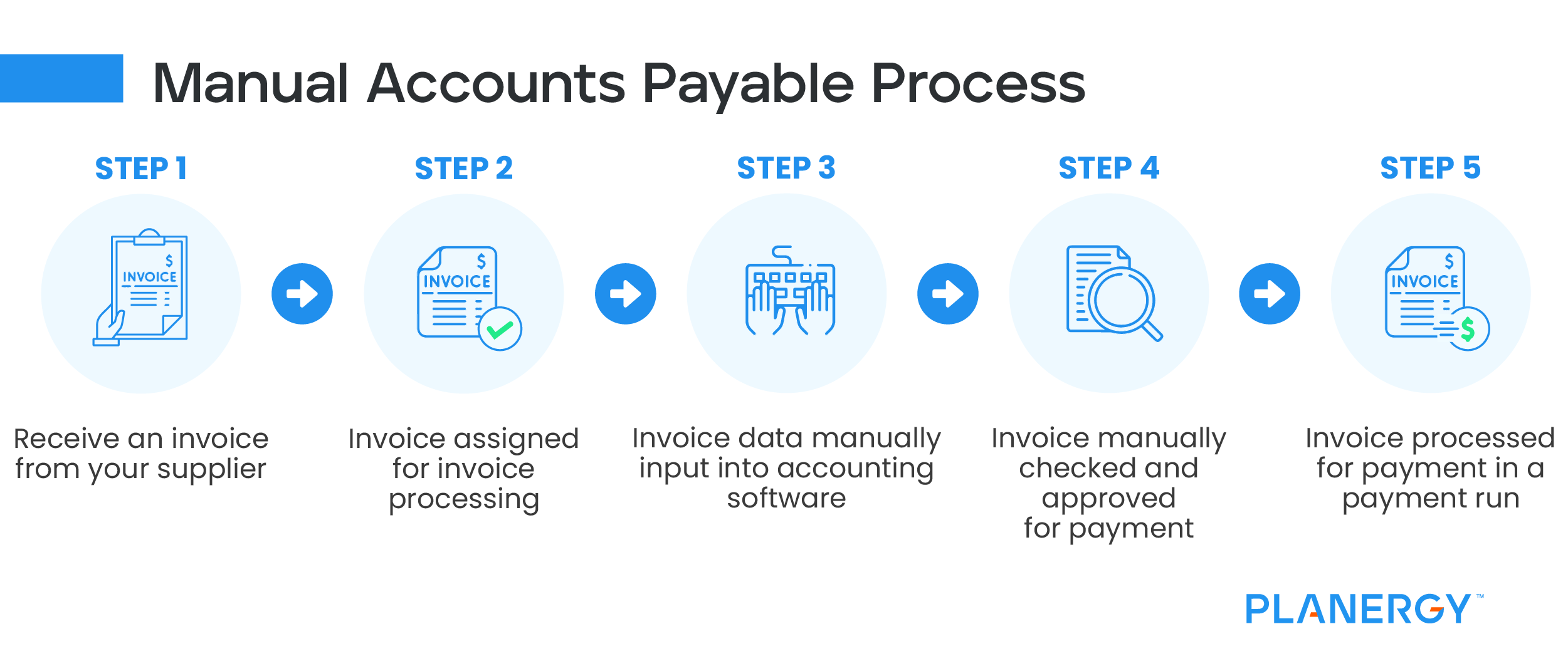

Best Practices For Accounts Payable Processes Planergy Software 5 key benefits of ap automation software. automating accounts payable processes adds value while freeing up your team to focus on managing exceptions. here are five specific benefits of ap automation: saved time: no more email tag or, worse, leaving paper invoices on someone’s desk for approval. A recent survey found that 98% of firms believe accounts payable automation could accelerate payments. rather than taking weeks or more to process an invoice, businesses can do so in a matter of hours, ensuring timely payment. enhanced compliance: compliance and audit readiness are priorities for any finance team, and ai makes achieving them. A guide to accounts payable automation. accounts payable (ap) in simple terms is described as the money owed to vendors or suppliers for goods or services purchased on credit. the process involves working with thousands of paperwork everyday relating to approvals and communication. in the recent survey of the institute of financial operations. We’ll now delve into proven strategies and techniques that can revolutionize your accounts payable operations. from harnessing cutting edge automation technologies to streamlining workflows and enhancing collaboration, we’ll uncover some best practices to elevate your accounts payable function to new heights of productivity and success.

Accounts Payable Automation Best Practices Must Read Guide A guide to accounts payable automation. accounts payable (ap) in simple terms is described as the money owed to vendors or suppliers for goods or services purchased on credit. the process involves working with thousands of paperwork everyday relating to approvals and communication. in the recent survey of the institute of financial operations. We’ll now delve into proven strategies and techniques that can revolutionize your accounts payable operations. from harnessing cutting edge automation technologies to streamlining workflows and enhancing collaboration, we’ll uncover some best practices to elevate your accounts payable function to new heights of productivity and success. 15. practice daily reconciliation of accounts. daily ap reconciliation isn't just an accounts payable best practice, it's a good habit. if you need to make an additional payment to a vendor and it’s not recorded, your books won’t match the bank's. this can impact cash flow and lead to errors down the road. 1. give someone the ap automation responsibility. put someone in charge of supervising all the behind the scenes aspects of the software. this person will manage the process of setting up the software during its implementation phase and will provide analytical reports on how to improve it.

Comments are closed.