Accounting Unit 3 Part 1 Prepaid Expenses

Accounting Unit 3 Part 1 Prepaid Expenses Youtube Link to the worksheet prepared in the video: drive.google open?id=0b5 i rehpohzvfvgedytoejlqukthis video series will discuss adjusting journal en. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. a “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet. prepaid expenses result from one party paying in advance for a service yet to be performed or an asset yet to.

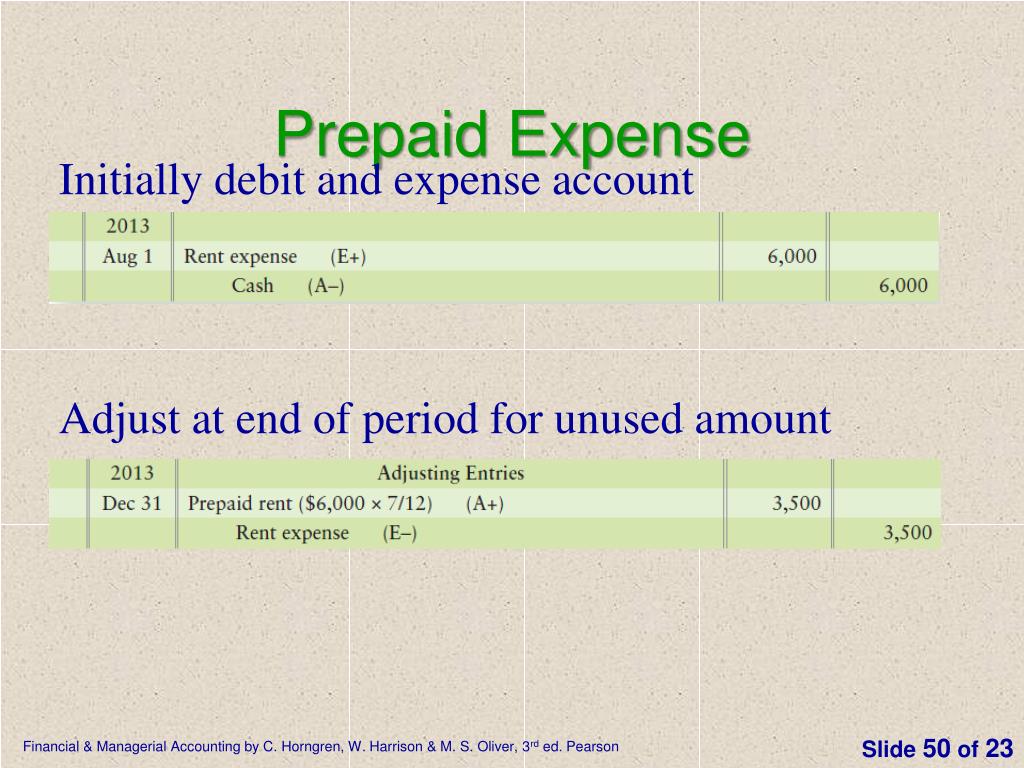

Unit 3 Vce Accounting Prepaid Expenses Youtube The correct insurance expenses for 2019 comprise 4 12th of $4,800 = $1,600. the balance, $3,200 (4,800 1,600), relates to 2020 and should be charged to that year's profit and loss account. although mr. john's trial balance does not disclose it, there is a current asset of $3,200 on 31 december 2019. This file goes through both the theory and practical aspects of recording a prepayment and the subsequent adjustment at balance day. there are 2 practical ex. Simplifying prepaid expenses adjustment entry with an example. question – on december 20th 2019 company a pays 1,20,000 (10,000 x 12 months) as rent in cash for next year i.e. for the period (jan’2020 to dec’2020). show all entries including the journal entry for prepaid expenses on these dates; december 20th 2019 (same day). On december 1, 20×1, entity a purchased a new insurance plan that covers one year period from december 1, 20×1 to november 30, 20×2. on the same day, $8,400 insurance premium for a year was prepaid. what are the journal entries to be prepared on december 1 and 31, 20×1? a38. prepaid expenses are recorded on the debit side as an asset account.

Accounting Equation Part 3 Treatment Of Prepaid Expenses And Simplifying prepaid expenses adjustment entry with an example. question – on december 20th 2019 company a pays 1,20,000 (10,000 x 12 months) as rent in cash for next year i.e. for the period (jan’2020 to dec’2020). show all entries including the journal entry for prepaid expenses on these dates; december 20th 2019 (same day). On december 1, 20×1, entity a purchased a new insurance plan that covers one year period from december 1, 20×1 to november 30, 20×2. on the same day, $8,400 insurance premium for a year was prepaid. what are the journal entries to be prepared on december 1 and 31, 20×1? a38. prepaid expenses are recorded on the debit side as an asset account. Refer to the first example of prepaid rent. the adjusting entry on january 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). the expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Definition of prepaid expenses. a prepaid expense is an expenditure paid for in one accounting period, but for which the underlying asset will not be consumed until a future period. when the asset is eventually consumed, it is charged to expense. if consumed over multiple periods, there may be a series of corresponding charges to expense.

What Is Prepaid Expenses On A Balance Sheet Quant Rl Refer to the first example of prepaid rent. the adjusting entry on january 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). the expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Definition of prepaid expenses. a prepaid expense is an expenditure paid for in one accounting period, but for which the underlying asset will not be consumed until a future period. when the asset is eventually consumed, it is charged to expense. if consumed over multiple periods, there may be a series of corresponding charges to expense.

Comments are closed.